Angel Broking Brokerage Calculator: Calculate Trading Brokerage Charges Easily

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- The calculator reveals hidden costs like brokerage, GST, STT, and exchange charges that can silently reduce trading profits.

- By checking charges in advance, traders can avoid low-reward trades and focus only on setups with meaningful net returns.

- It encourages disciplined trading by helping investors compare intraday, options, and delivery trades before committing capital.

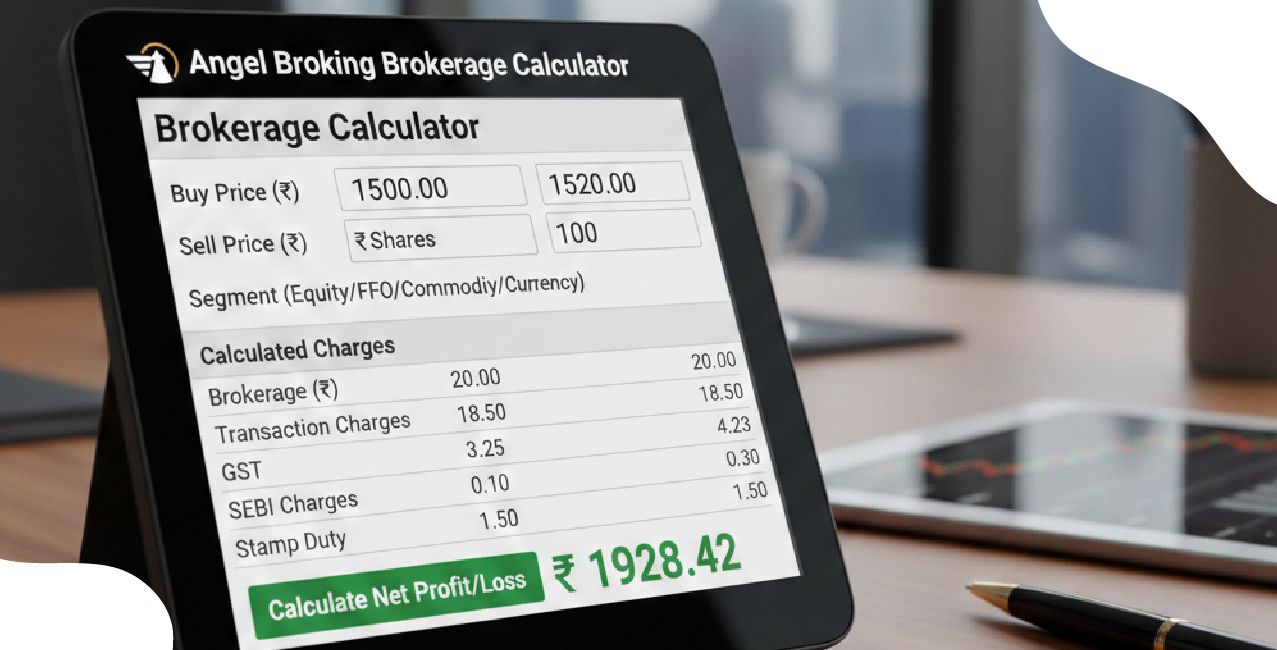

The Angel Broking Brokerage Calculator helps traders clearly understand the real cost of every trade before placing an order. By showing brokerage, taxes, and statutory charges upfront, it removes guesswork, prevents profit erosion, and supports smarter, more disciplined trading decisions across equity, intraday, and derivatives.

How to Use an Angel Broking Brokerage Calculator?

The Angel Broking Brokerage Calculator is an interactive tool that instantly shows your total trading charges and net profit or loss before you place a trade. By adjusting price, quantity, and segment, you can see costs update in real time.

The Angel Broking Brokerage Calculator helps you calculate brokerage, taxes, and other charges for a trade. Think of it like checking the final bill before ordering food. It prevents surprises and helps you make smarter decisions.

Suppose you buy 200 shares at ₹150 and sell at ₹155. Entering these details in the Angel Broking Brokerage Calculator shows brokerage, GST, STT, and exchange charges, revealing your exact net profit before placing the trade.

Benefits of Using Angel Broking Brokerage Calculator with Examples

Trading profits often look exciting on charts, but real profits are decided after charges. This is where the Angel Broking Brokerage Calculator quietly saves traders from unpleasant surprises. Here are three relatable stories that show how.

Example 1: The Beginner Who Thought ₹2,000 Was Guaranteed Profit

Rohit, a college student, placed his first intraday trade after watching a popular trading tutorial. He bought shares expecting a clean ₹2,000 profit. Before placing the order, he entered the details into the Angel Broking Brokerage Calculator, just out of curiosity.

The calculator told a different story.

Trade Breakdown (Before Placing the Order)

This table shows how charges quietly reduce profits even before the trade begins.

Rohit realised that ignoring charges would have cut his profit by almost one-third.

Example 2: The Options Trader Who Avoided a Bad Trade Just in Time

During a high-volatility expiry session, an options trader spotted what looked like a perfect setup. Just before placing the order, he ran the numbers through the Angel Broking Brokerage Calculator.

The results were eye-opening. Once brokerage, GST, and exchange charges were added, most of the expected profit disappeared, clearly showing why small option trades can be risky without checking costs first.

The table below breaks down how trading charges can quietly eat into an options trade’s profit, even when the setup looks perfect on the chart.

The trader skipped the trade, saving himself time and capital.

Example 3: Delivery Investor Choosing the Right Holding Period

A long-term investor featured in a market story was confused about frequent buying and selling. He used the Angel Broking Brokerage Calculator to compare short-term vs longer holding periods.

Delivery Trade Comparison

This comparison shows how the holding period directly affects trading costs.

The calculator nudged him toward fewer, more meaningful trades.

Conclusion

The Angel Broking Brokerage Calculator acts like a financial filter between excitement and execution. It forces traders to pause, evaluate costs, and trade with clarity instead of assumptions. Whether you are a beginner or an active trader, using the calculator regularly helps protect profits, reduce unnecessary trades, and build long-term trading discipline.

FAQs

Q1. Does the Angel Broking Brokerage Calculator show exact trading charges?

Yes, it provides a close estimate of all applicable brokerage and statutory charges before you place a trade.

Q2. What types of accounts and brokerage plans does Angel One offer?

Angel One provides full-service and discount-style trading accounts with flat or percentage-based brokerage, plus advisory, research, execution, and investment services across equity, derivatives, commodities, and currency segments.

Q3. Are Angel Broking intraday charges applied to both buy and sell orders?

Yes, Angel Broking charges ₹20 per executed order, so an intraday trade with one buy and one sell attracts ₹40 total brokerage.

Q4. Should my family switch from Angel One to another broker to save costs?

Yes, if trading costs and AMC matter, switching can make sense, but factor in DP transfer charges, effort, and whether they actively trade or mostly invest long term.

Q5. Why does Angel One get fewer questions here despite having many users?

Because most Angel One users are passive investors, while active traders, who ask more questions, tend to discuss platforms like Zerodha or Fyers more often.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Sharekhan Brokerage Calculator: Calculate Charges & Taxes

Shoonya Brokerage Calculator: Calculate Trading Brokerage Charges Easily

Fyers Brokerage Calculator: Calculate Trading Brokerage Charges Easily

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article