Union Bank PPF Calculator – Step-by-Step Guide to PPF Interest & Returns

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- Union Bank PPF offers a reliable tax-efficient retirement instrument with a 15-year lock-in period.

- The Union Bank PPF calculator helps estimate maturity based on investment, interest rate, and tenure. It helps you plan your long-term savings properly with estimated maturity amounts.

- The Union Bank PPF Account interest rate is currently 7.10% per annum for FY 2025-26.

Bonus Tip: Make your PPF deposit before the 5th of the month to earn interest for that month. The PPF interest is calculated on the lowest balance between the 5th and the month-end.

Rohan was a coder in Mumbai’s Andheri. He was estimating long-term savings using the Union Bank PPF Calculator after his colleague teased him about a lack of PPF planning. He checked if there is any Union Bank PPF account opening online process. He input the investment amount and tenure into the PPF calculator Union Bank of India and began his journey of savings.

PPF (Public Provident Fund) is like a long-term Mumbai local train of savings. It is dependable, slow, but it gets you there with guaranteed returns. You invest yearly and let compounding do the heavy lifting. Currently, the Union Bank PPF account interest rate is 7.1% per annum for FY 2025-26.

Rohan said, “I deposited ₹75,000 annually into the Union Bank PPF calculator for 15 years at 7.1% per annum. I saw my corpus grow like my code commits, steadily and beautifully planned.”

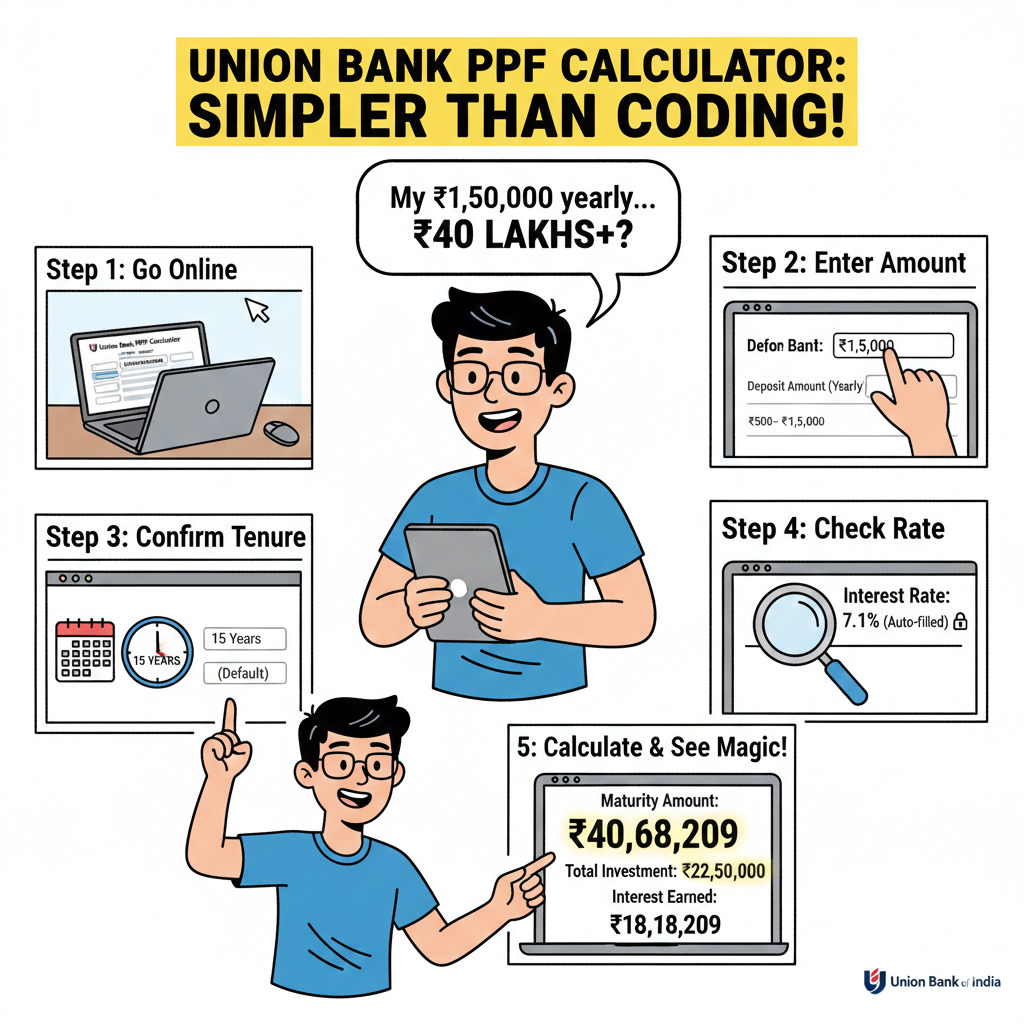

How to Use the Union Bank PPF Calculator?

Ever wondered if your yearly ₹1,50,000 limit could hit more than ₹40,00,000? Here’s how Rohan used the Union Bank PPF Calculator:

Rohan concluded that using a Union Bank PPF Calculator is simpler than deciphering bug logs before weekend hackathons.

Union Bank PPF Investment Examples

Rohan binged YouTube and saw real-world breakdowns of PPF planning (since Mumbai rains can’t dampen financial planning). Here’s a table inspired by realistic examples:

Rohan saw realistic scenarios for new IT joiners who can start by investing just ₹500 per month. These examples mimic real scenario templates covered in detailed YouTube walkthroughs and blogs. They point out how compounding at 7.1% per annum changes the game. Rohan joked, “Yeh Union Bank PPF Calculator bhi GitHub ki merge request jaisa hai. It shows you what happens before you commit!” It helped him finalize his PPF planning before his next sprint release.

Conclusion

Planning long-term savings doesn’t need to be like debugging production issues at 2 AM. The Union Bank PPF Calculator gives clear estimates of where your money heads over 15 years. PPF remains a favorite for disciplined savers who prefer a “no surprises, just returns” journey.

You can’t currently do a Union Bank PPF Account opening online directly with Union Bank. But you can plan using online tools and then walk into a branch. With the 7.1% interest rate fixed by the government (unchanged over quarters), Rohan finally felt secure about layered financial planning.

FAQs Related to Union Bank PPF Calculator

Is there a way to open a Union Bank PPF account online?

Most authoritative info says Union Bank does not yet allow pure online opening; you must visit a branch even if you prepare online.

What happens if I miss depositing before the 5th of a month?

Interest for that month might not be counted.

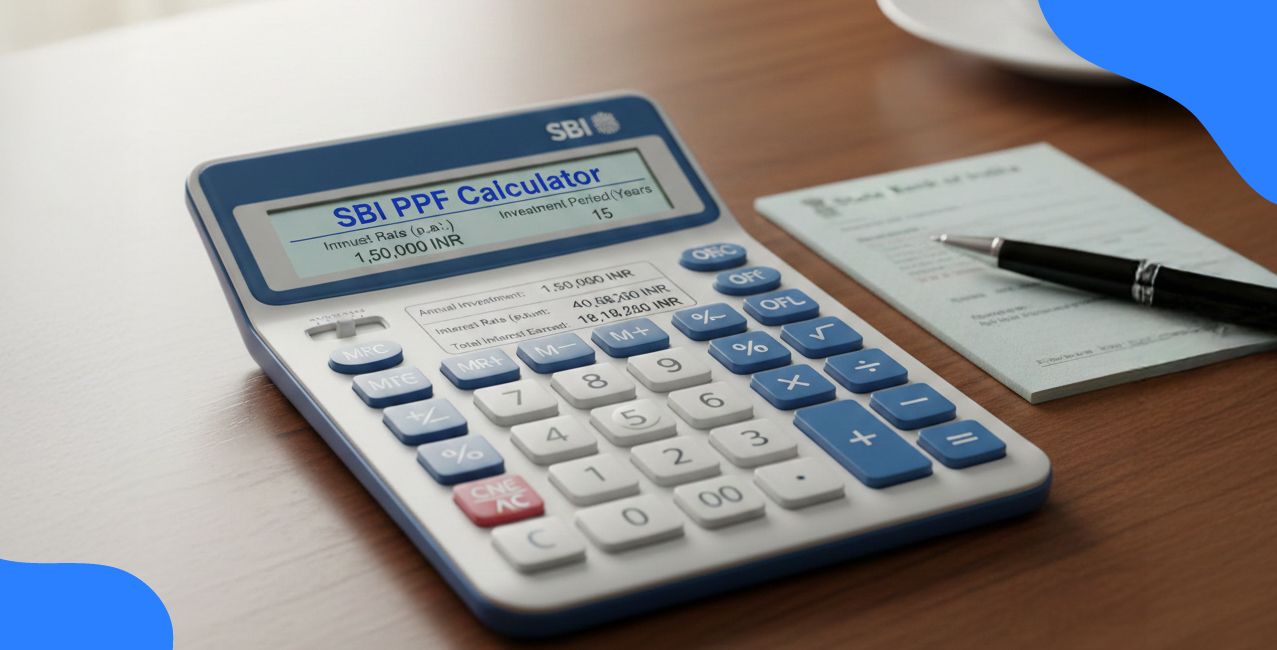

Can I use the SBI PPF calculator for Union Bank?

Yes, Union Bank PPF Calculator SBI, or any generic PPF calculator uses the same PPF rules and interest (7.1%) because the scheme is government-mandated.

How much does interest differ between banks?

There’s no difference: Union Bank, SBI, or others all follow the central PPF rate. Hence, calculators like SBI’s or Bank of Baroda’s will give similar results.

What is the Union Bank PPF interest rate calculator?

It’s simply an online math tool to compute estimated PPF maturity based on deposit, tenure, and the government-set interest rate of 7.1% per annum.

Can a PPF account be transferred from one bank to another without hassle?

Yes, many users report that transferring your PPF from one bank to another is possible and straightforward by submitting a transfer request and statement to your current bank, then completing formalities at the new bank.

Does choosing a specific bank give extra PPF benefits?

No, and that’s actually a plus. PPF is a government scheme, so interest rates and rules remain identical across all banks.

Is opening a PPF account in the Union Bank of India safe?

Yes, since PPF is a Government of India-backed scheme, holding your PPF with Union Bank of India is considered safe with no risk of loss.

Does a PPF account’s 15-year maturity date change if I deposit multiple times during the year?

No, PPF maturity is always 15 years from the end of the financial year in which you first deposit, regardless of how many deposits you make during the year. The tenure does not reset with each deposit.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Axis Bank PPF Calculator – Calculate Returns & Maturity Value

SBI PPF Calculator – Complete Guide to Interest & Maturity Returns

Bank of India PPF Calculator : Returns, Interest and Examples.

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article