Personal Loan Foreclosure EMI Calculator: Savings & Charges Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- The foreclosure charges on personal loans range from 2% to 5% of the outstanding principal that depends on the bank and tenure. If you overlook these charges, they can reduce the interest savings you expect from closing the loan early.

- Most banks allow personal loan foreclosure only after 12 EMIs are paid. Early closure is not allowed immediately.

- A Personal Loan Foreclosure EMI Calculator helps compare the interest saved with the foreclosure cost.

A personal loan foreclosure EMI calculator is an online tool that helps you find out how much money you need to pay if you want to close your personal loan before the end of its tenure. It shows the remaining loan amount, foreclosure charges, and helps you decide if early closure is financially beneficial.

IDFC Personal loan foreclosure calculator and loan foreclosure calculator SBI are commonly used for this purpose.

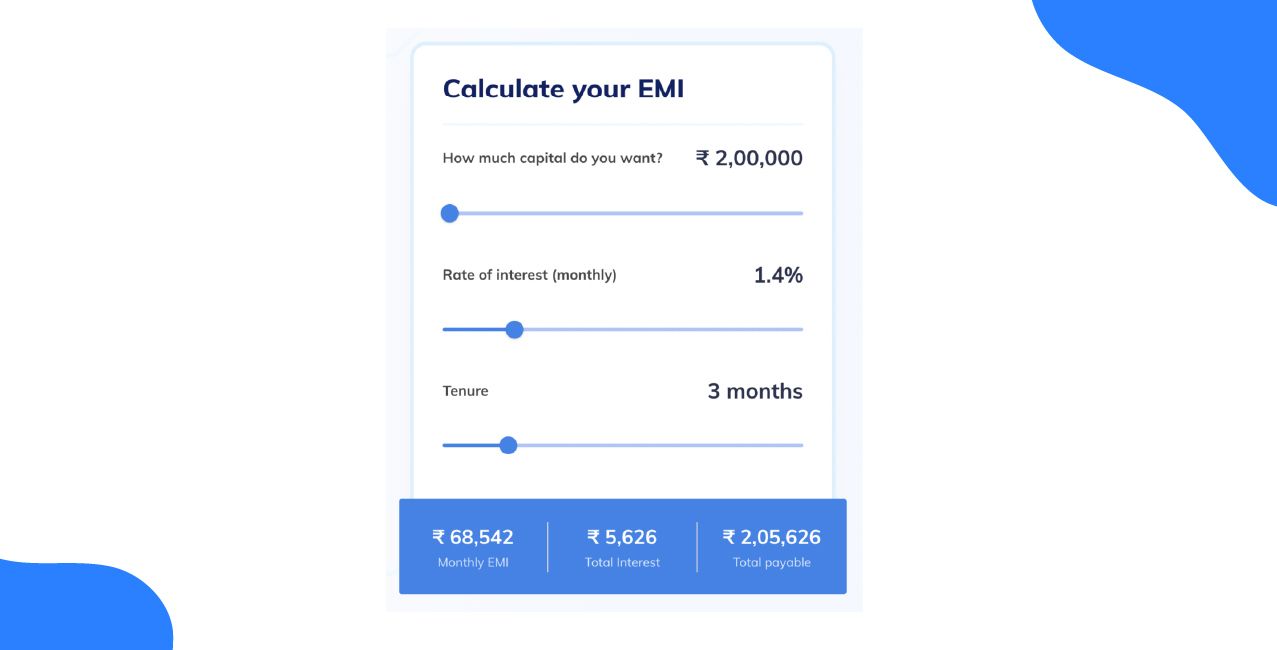

How to Calculate Your EMI?

Kabhi aisa laga hai ki salary aane ke baad loan turant close kar dena chahiye? A personal loan foreclosure emi calculator sbi helps you estimate how much principal is left, what charges apply, and how much interest you actually save before making that decision.

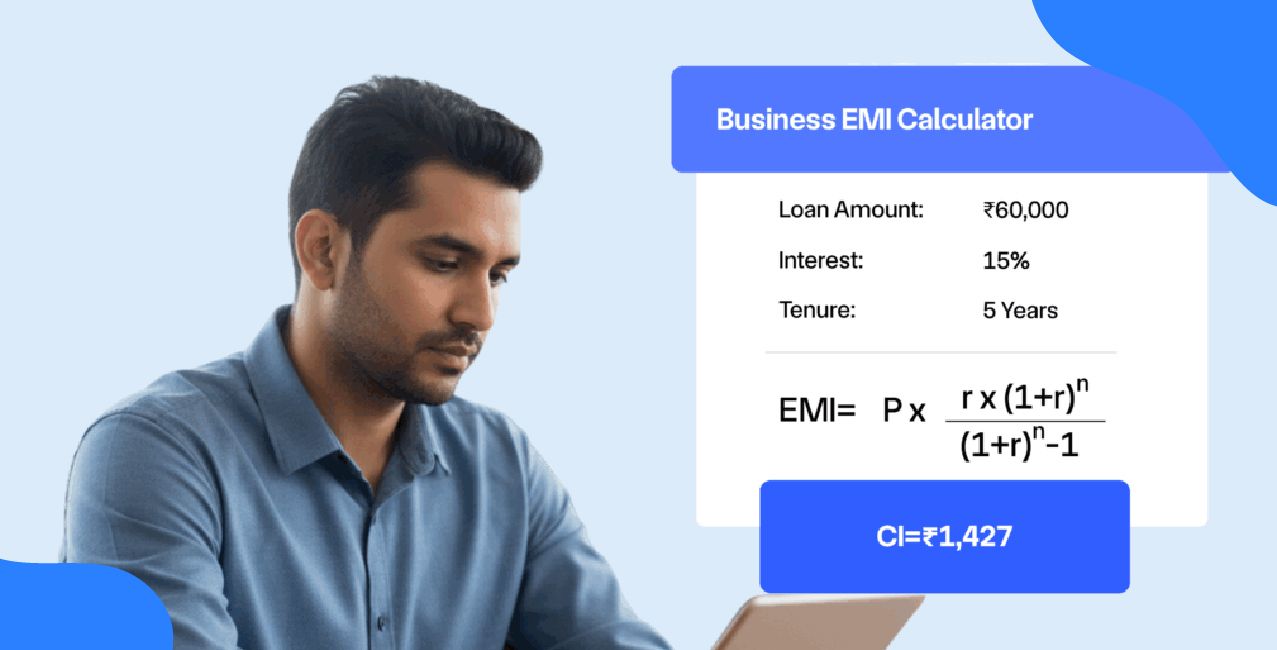

Banks calculate EMI using a standard formula mentioned on their official portals. These are the components of EMI:

You can use these details step by step to check your EMI:

I take a ₹5,00,000 personal loan for 48 months. I checked the foreclosure calculator after paying 24 EMIs. The outstanding principal is ₹2,85,000. The bank charges a 3% foreclosure fee. I pay ₹8,550 extra but save nearly ₹38,000 in interest.

Bonus Tip: Do you know? From January 1, 2026, banks cannot charge prepayment or foreclosure fees on floating-rate personal loans for non-business use, as per the RBI.

Personal Loan Foreclosure EMI Examples

Here are 3 simple situations where people used a personal loan foreclosure EMI calculator to make better financial decisions:

SBI Personal Loan Foreclosure Decision

Rahul is a 32 year old IT professional living in Pune. He took a personal loan to manage relocation expenses when he changed jobs. After 1 year, he received a performance bonus and thought of closing the loan early. He checked the loan foreclosure calculator SBI:

Rahul realised he would still save around ₹24,000 in interest even after paying charges, after using the calculator.

ICICI Bank Foreclosure Planning

Neha is a freelance graphic designer from Delhi. Her income is irregular, so she prefers reducing fixed liabilities. She took a personal loan for a home workstation. She checked how to calculate the EMI for her personal loan after 24 EMIs. She also reviewed the personal loan foreclosure calculator ICICI and the applicable foreclosure charges on the bank’s official page before closing the loan.

The calculator showed that her interest savings were higher than the charges.

IDFC First Bank Early Closure

Amit is a small business owner from Indore. He took a personal loan to expand inventory during the festive season. Sales improved faster than expected. He checked the IDFC personal loan foreclosure calculator before making a lump-sum payment.

Amit saved nearly ₹31,000 in interest and reduced financial pressure on his business by calculating early.

These examples show how checking the foreclosure amount in advance decides the right time to close a personal loan.

Benefits of Using Personal Loan Foreclosure EMI Calculator

These three real situations taught me why using a calculator before foreclosure matters.

It Helped Me Avoid a ₹12,000 Mistake

I once planned to close my loan immediately after receiving a bonus. I saw that foreclosure charges were higher than interest savings at that stage when I used the Personal Loan Foreclosure EMI Calculator.

I waited six more months and saved money instead of losing it because of the calculator

It Helped Me Choose the Right Bank

I compared my existing loan with the personal loan foreclosure EMI calculator SBI and another bank’s calculator before transferring my loan.

This comparison helped me stick with the better option and avoid unnecessary charges.

It Improved My Monthly Cash Flow Planning

I reduced my fixed EMIs by ₹8,200 per month after using a personal loan Foreclosure EMI calculator. This helped me allocate more money toward savings and emergency funds.

That decision made my finances more stable and predictable.

Conclusion

When you plan to close your personal loan early, you should not rely on assumptions. A personal loan foreclosure EMI calculator helps you clearly see how much interest you can save, what charges you need to pay, and how your monthly income will change.

FAQs Related to Personal Loan Foreclosure EMI Calculator

1. How does a personal loan foreclosure EMI calculator work?

A personal loan foreclosure EMI calculator works by using your loan amount, interest rate, tenure, and the number of EMIs already paid. Based on these inputs, it shows your outstanding principal, applicable foreclosure charges, and the total amount you need to pay to close the loan early.

2. What is a personal loan foreclosure EMI calculator?

A personal loan foreclosure EMI calculator is an online tool that helps you estimate the cost of closing your personal loan before the tenure ends. It gives clarity on the remaining loan balance, foreclosure fees, and possible interest savings using bank-approved methods.

3. How can you use a personal loan foreclosure EMI calculator easily?

You can use the calculator by entering your original loan amount, interest rate, total tenure, and the number of EMIs you have already paid. The calculator instantly shows the outstanding principal and the final foreclosure amount, helping you make a quick and informed decision.

4. Why should you check a personal loan foreclosure EMI calculator before closing your loan?

It allows you to see whether the interest you save is higher than the foreclosure charges. This ensures that early closure actually benefits your cash flow instead of increasing your cost.

5. Does foreclosing a personal loan early affect your financial planning?

Yes, foreclosing a personal loan early can positively impact your financial planning if done at the right time. You can improve cash flow, increase savings, and lower long-term interest outgo by reducing monthly EMIs, provided the foreclosure charges are reasonable.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Personal Loan Prepayment EMI Calculator: Reduce EMI & Interest

LIC Personal Loan EMI Calculator: Calculate EMI Instantly

Kotak Personal Loan EMI Calculator: Check EMI & Loan Cost Easily

Recent Blogs

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article