Union Bank Personal Loan EMI Calculator: EMI & Interest Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- The EMI calculator shows exact monthly outflow early, helping borrowers avoid budget shocks, over-borrowing, and uncomfortable EMIs before the loan commitment stage.

- Tenure comparison reveals how small EMI increases can save tens of thousands in interest, enabling a balance between comfort and cost.

- Loan planning becomes disciplined and rational when EMI calculators highlight affordability, total interest impact, and the consequences of borrowing extra money.

The Union Bank Personal Loan EMI Calculator helps you understand your monthly loan payment before applying. By changing the loan amount, interest rate, and tenure, you can clearly see how each option affects your budget. This helps avoid sudden money stress, prevents taking extra loans, and lets you choose an EMI that feels comfortable and affordable.

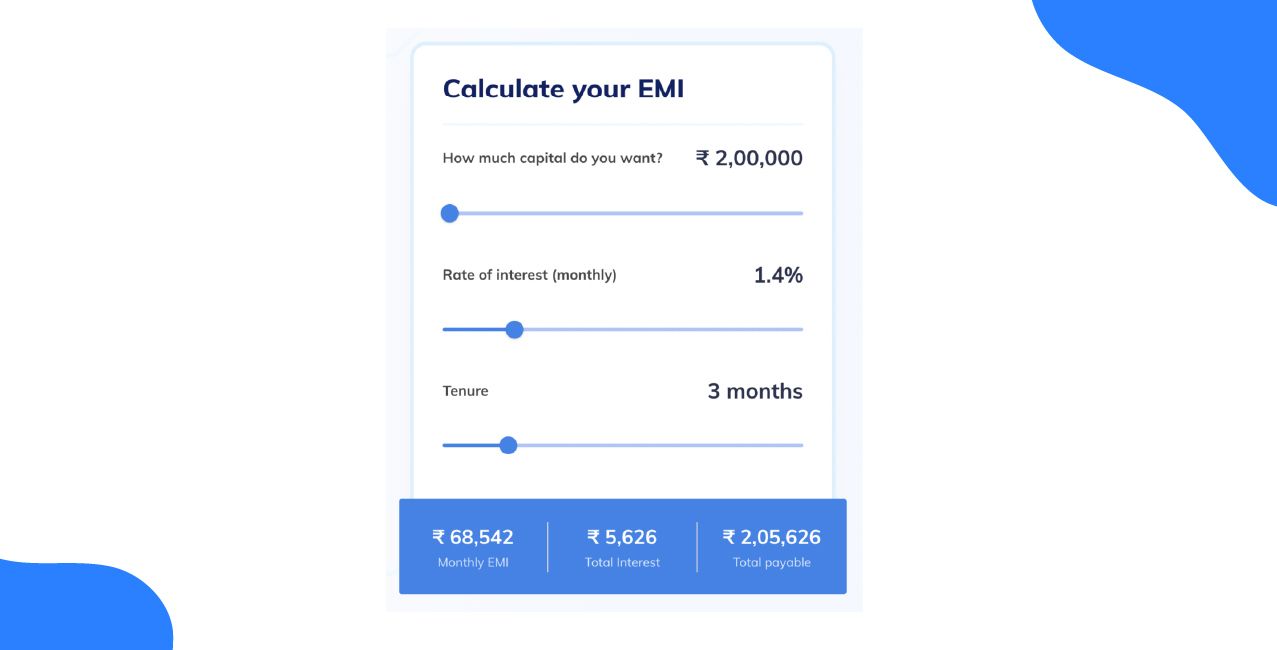

How to Calculate Your EMI

Want to know your monthly payment before taking a loan? An EMI calculator shows your EMI instantly using the loan amount, interest rate, and tenure, helping you change numbers and clearly see how they affect your budget.

EMI, or Equated Monthly Instalment, is the fixed amount you pay every month for a loan. It’s like dividing a big expense into equal parts, where early payments cover more interest and later ones repay more principal.

Suppose you take a ₹5,00,000 personal loan at 12% interest for 5 years. The EMI comes to around ₹11,122 per month. Early EMIs pay more interest, while later EMIs reduce the loan balance faster.

Examples Of Union Bank Personal Loan EMI Calculator

Example 1: A Salaried Professional Planning Smartly

Rohit, a salaried professional, needed ₹5,00,000 for a family expense. Before applying, he used the Union Bank Personal Loan EMI Calculator to avoid guesswork. By entering the loan amount, interest rate, and tenure, he instantly saw what the loan would really cost him every month.

Here’s what the calculator showed him clearly before he committed:

Seeing this breakdown gave Rohit confidence. The EMI fit comfortably in his salary, and he knew the exact interest cost upfront. The calculator helped him borrow calmly, not emotionally, and plan repayments without stress.

Example 2: Managing a Bigger Loan Without Stress

Priya was planning a major home renovation and needed ₹10,00,000. The amount felt large, so before applying, she used the Union Bank Personal Loan EMI Calculator to understand the real monthly impact. By adjusting the tenure to 5 years, she could see how spreading the loan made repayments easier.

This is what the EMI calculator showed her before taking the loan:

With clear numbers in front of her, Priya felt confident. The EMI fit her monthly budget, and there were no surprises. Using the EMI calculator helped her plan a big loan calmly and responsibly.

Example 2: Managing a Bigger Loan Without Stress

Priya was planning a major home renovation and needed ₹10,00,000. The amount felt large, so before applying, she used the Union Bank Personal Loan EMI Calculator to understand the real monthly impact. By adjusting the tenure to 5 years, she could see how spreading the loan made repayments easier.

This is what the EMI calculator showed her before taking the loan:

With clear numbers in front of her, Priya felt confident. The EMI fit her monthly budget, and there were no surprises. Using the EMI calculator helped her plan a big loan calmly and responsibly.

Benefits of Using the Union Bank Personal Loan EMI Calculator

1. How the EMI calculator saved me from a budget shock

When I first planned to take a ₹5,00,000 Union Bank personal loan, I casually assumed the EMI would be around ₹12,000. Before applying, I used the Union Bank Personal Loan EMI Calculator, and got a surprise.

At 12.5% interest for 5 years, the EMI showed ₹11,248 per month, but when I reduced the tenure to 3 years, the EMI jumped to ₹16,745.

That one calculation helped me realise I couldn’t afford the shorter tenure comfortably. Without the calculator, I would’ve locked myself into an EMI that strained my monthly expenses.

The EMI calculator shows the real monthly impact before you commit.

2. Choosing the right tenure saved me ₹48,000 in interest

I was comparing two options for a ₹8,00,000 loan:

- 5 years: EMI is ₹18,200

- 4 years: EMI is ₹20,500

Using the EMI calculator, I noticed something important:

- Total interest for 5 years: ₹2,92,000

- Total interest for 4 years: ₹2,44,000

That’s a ₹48,000 difference, just by choosing a shorter tenure. Because I could manage an extra ₹2,300 per month, I saved nearly ₹50,000 over the loan life. The calculator helps balance EMI comfort vs total interest cost.

3. It stopped me from over-borrowing ₹2,00,000

Initially, I thought of applying for ₹10,00,000, since Union Bank’s eligibility allowed it. Out of curiosity, I checked the EMI calculator first.

- ₹10,00,000 at the rate of 12% for 5 years: EMI will be ₹22,244

- ₹8,00,000 at the rate of 12% for 5 years: EMI will be ₹17,795

That ₹4,400 difference every month hit me hard. Over 60 months, that’s ₹2,64,000 extra outflow, for money I didn’t really need. I finally applied for ₹8,00,000, not ₹10,00,000.

EMI calculators prevent emotional borrowing and keep loans practical.

Conclusion

The Union Bank Personal Loan EMI Calculator makes loan planning simple and stress-free. Clear EMI, interest, and tenure details help you borrow smartly and stay in control of your finances with confidence. Whether you want lower monthly payments or lower total interest, the calculator gives clear answers, avoids surprises, and ensures your loan supports your needs without disturbing your monthly budget.

FAQs

1. Can an EMI calculator really help me decide my loan amount?

Yes, it shows the real monthly impact instantly, helping you borrow only what fits comfortably within your budget.

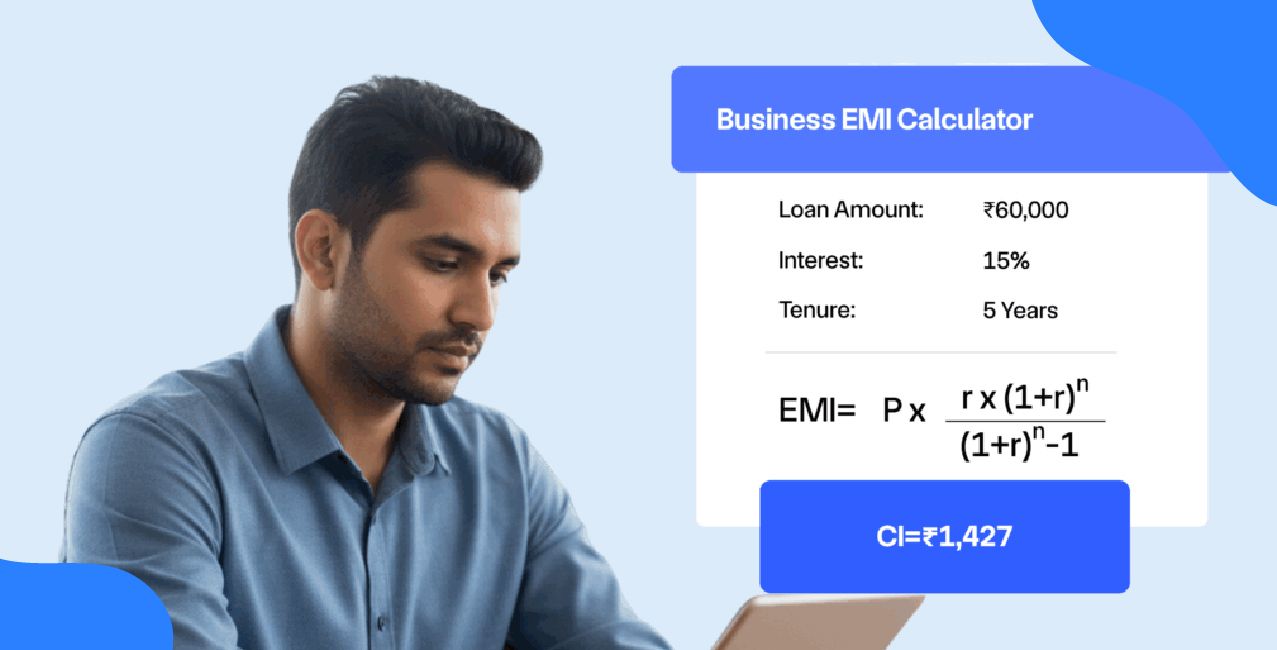

2. How is EMI calculated on a personal loan by banks?

Banks calculate EMI on a reducing balance method, where interest is charged only on the outstanding loan amount as it reduces with each EMI, not on the original loan amount.

3. How should you calculate the EMI for a personal loan?

You can calculate EMI using the reducing balance method, where monthly payments are fixed, and interest is charged only on the remaining loan amount after each repayment.

4. What happens if I miss an EMI even after paying extra earlier?

An unpaid EMI is treated as a default, attracts late fees, and can harm your CIBIL score, as banks track payment timing, not excess amounts paid earlier.

5. Are these charges normal after a ₹1 crore Union Bank home loan disbursement?

Yes, banks usually apply standard charges like processing fees, insurance, legal, valuation, and GST, but you should always cross-check the sanction letter to confirm nothing extra has been added.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Personal Loan Prepayment EMI Calculator: Reduce EMI & Interest

LIC Personal Loan EMI Calculator: Calculate EMI Instantly

Kotak Personal Loan EMI Calculator: Check EMI & Loan Cost Easily

Recent Blogs

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article