Personal Loan Part Payment EMI Calculator: EMI Reduction Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- A personal loan part payment EMI calculator helps borrowers understand how a part payment affects their loan. It shows whether the EMI will reduce or the loan tenure will shorten, which makes it easier to plan repayments and close debt faster.

- RBI guidelines allow individual borrowers to make part payments on floating-rate personal loans without paying any prepayment penalty. This makes part payment a practical option when extra funds are available and loan interest feels expensive compared to other uses of money.

- Borrowers can compare different outcomes, and take better control of their money by using a personal loan part payment EMI calculator in advance.

What is the Personal Loan Part Payment EMI Calculator?

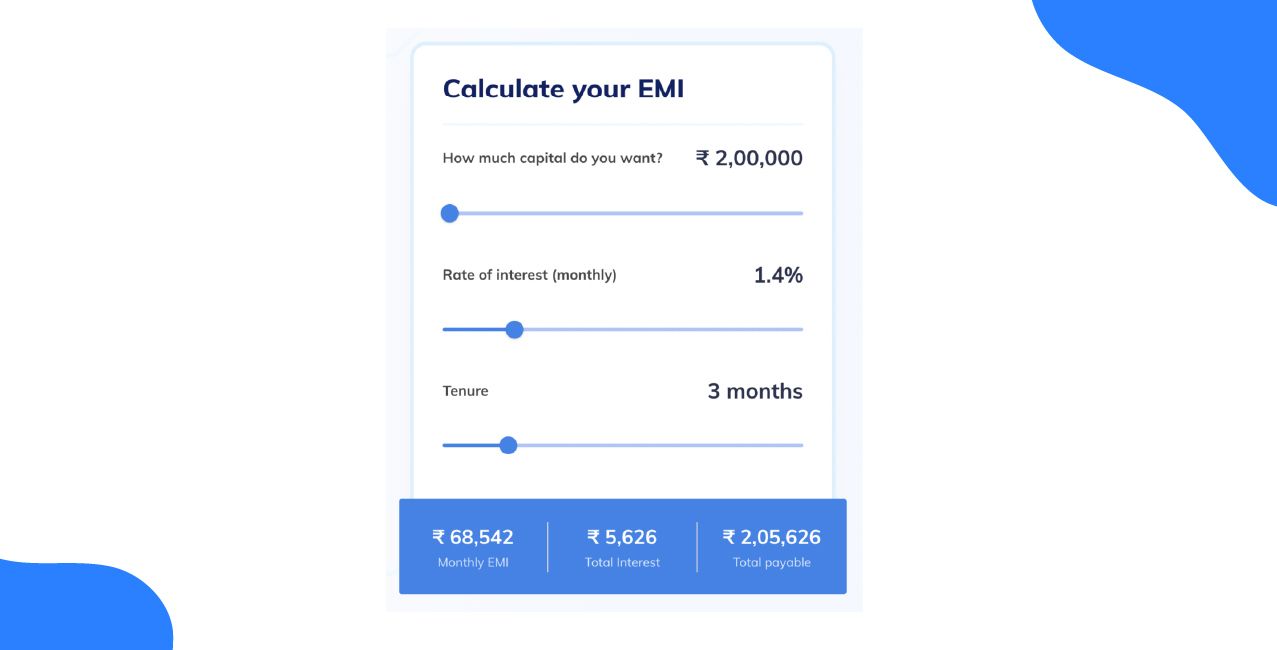

A Personal Loan Part Payment EMI Calculator is an online tool that helps you understand how your loan changes when you repay a portion of the principal before time. It shows the impact on EMI amount, remaining tenure, and total interest savings, similar to tools like Bajaj personal loan part payment calculator.

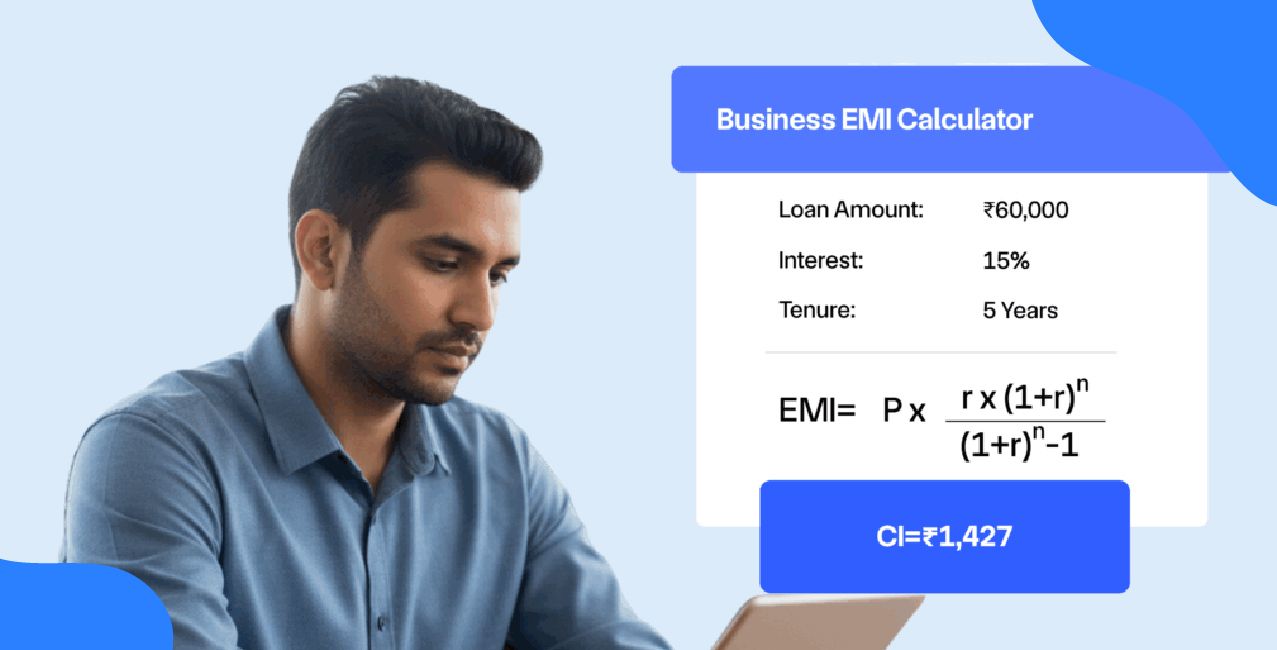

How to Calculate Your EMI?

EMI kam karni hai ya loan jaldi khatam karna hai? The Personal Loan Part Payment EMI calculator connects daily income planning with smarter repayment decisions and works in a similar way to a home loan prepayment calculator reduce EMI.

Here are simple steps to calculate EMI after Part Payment:

- Start by entering your original loan amount in the calculator.

- Select the interest rate charged by your bank.

- Choose the original loan tenure in months or years.

- Add the part payment amount you plan to pay in advance.

- Select whether you want EMI reduction or tenure reduction.

- The calculator shows the revised EMI, remaining tenure, and interest savings.

I entered the loan amount of ₹6,00,000, interest 13%, and tenure 4 years. After a ₹1,20,000 part payment, the calculator shows EMI drop or tenure cut instantly.

Bonus Tip: In 2025, the RBI clarified that banks and NBFCs cannot charge prepayment or foreclosure penalties on floating-rate loans for individual borrowers. This makes personal loan part payment more beneficial, as you can reduce interest without extra charges.

Personal Loan Part Payment EMI Examples

These cases show how part payment changes a loan in real life, and how a Personal Loan Part Payment EMI Calculator can help you with the calculations:

Shivang Used a Bonus to Reduce Interest

Shivang took a personal loan for wedding expenses. After completing one year of regular EMIs, he received a bonus and decided to reduce his loan burden.

Shivang chose a tenure reduction, so his EMI stayed the same. The loan closed almost 10 months earlier, and the interest was reduced by around ₹36,120.

Divya Wanted EMI Relief

Divya was managing rent and household expenses along with a personal loan. She wanted to reduce her monthly EMI instead of shortening the loan tenure.

Divya selected EMI reduction, so the tenure stayed the same. Her EMI dropped by ₹2,900, giving her immediate monthly comfort.

Amber Planned Faster Closure

Amber had a stable income and occasional bonuses. He wanted to close his loan early without increasing EMI pressure.

Amber chose tenure reduction. His loan closed 9 months earlier, and he saved about ₹18,000 in interest.

These examples show that one smart part payment can make a loan feel lighter and easier to manage.

Benefits I Personally Experienced Using a Part Payment Calculator

Here are 3 moments that helped me understand the value of the Personal Loan Part Payment EMI Calculator.

When I Realised How Much Interest I Was Actually Paying

I had a personal loan of ₹6,00,000 running quietly in the background. After checking the calculator, I decided to pay part of ₹1,00,000 early. The result surprised me. The total interest came down by almost ₹40,000, and that saving felt real.

When My EMI Finally Felt Manageable

My EMI was ₹15,800, and every month it pinched my budget. I tested a ₹75,000 part payment on the calculator and saw the EMI drop to ₹13,200. That ₹2,600 difference gave me breathing space without extending the loan tenure.

When Numbers Replaced Overthinking

I compared different outcomes using the personal loan prepayment calculator and the personal loan prepayment calculator SBI. These numbers removed fear and confusion.

The Personal Loan Part Payment EMI calculator did not just show numbers. It helped me make decisions.

Conclusion

A personal loan part payment EMI calculator makes loan repayment simpler and more transparent. It helps you see how small early payments can reduce EMIs, shorten loan tenure, and save interest. You can manage your loan in a more planned way by checking the numbers in advance.

FAQs Related to Personal Loan Part Payment EMI Calculator

1. Should you part-pay your loan or invest the money instead? Is there a calculator for this?

You can use a personal loan or home loan part payment EMI calculator to first check how much interest you save by reducing the loan. Then, compare that saving with expected mutual fund returns using official AMC calculators. If loan interest is higher than realistic investment returns, a part payment usually makes more sense.

2. How does the SBI home loan part payment actually work in real life?

SBI allows lump sum part payment through the YONO app or branch, based on account setup. Only the EMI amount is considered for part payment, not insurance deductions. After payment, confirmation reflects in the loan account statement, and revised EMI or tenure details are updated within a few working days.

3. If you make a part payment on a personal loan, will your EMI reduce?

Yes, EMI can be reduced if you choose the EMI reduction option while keeping the tenure the same. Some banks also reduce tenure instead, so the outcome depends on the option selected during part payment. A part payment EMI calculator shows both results before you decide.

4. In ICICI personal loans, is EMI reduction better or tenure reduction?

Tenure reduction usually saves more interest overall, while EMI reduction improves monthly cash flow. If the monthly budget feels tight, EMI reduction helps. If long-term savings matter more, tenure reduction is generally the better option.

5. Is there a minimum or maximum limit on personal loan part payment?

Yes, most banks set limits on part payment amounts and frequency. Typically, part payment must be above a minimum amount and may be capped as a percentage of outstanding principal. These limits vary by lender and are clearly mentioned on official bank loan policy pages.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Personal Loan Prepayment EMI Calculator: Reduce EMI & Interest

LIC Personal Loan EMI Calculator: Calculate EMI Instantly

Kotak Personal Loan EMI Calculator: Check EMI & Loan Cost Easily

Recent Blogs

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article