Canara Bank FD Interest Rates – Latest Fixed Deposit Rates

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Insights

- FD tenures can vary from 7 days to 10 years to meet multiple purposes.

- Senior citizens receive an additional 0.50 % interest on all deposits.

- Options for loans and partial withdrawals are available to provide immediate liquidity.

- The bank offers a range of FD schemes, including Regular, Tax-Saving, and Reinvestment plans.

- It is a trustworthy and safe investment supported by a public sector bank.

Canara Bank is one of the oldest and most trusted public sector banks in India. It supports customers in increasing their savings with a variety of Fixed Deposit (FD) options.

The bank serves more than 11.76 crore customers across India through its branch and ATM network. There are different time periods, reasonable FD Interest rates, and special concessions for senior citizens.

For example, investing ₹1 lakh in a one-year FD at 6.25% p.a. will yield ₹6,250 in interest at maturity, providing a stable and secure return on your investment.

This guide offers a clear summary of Canara Bank FD interest rates, schemes, features, and all that is required to make a well-informed choice.

Bonus Tip: Download the Canara Bank Mobile Banking app to get the latest FD rates, open Fixed Deposits right away, and manage your investments anytime from your phone.

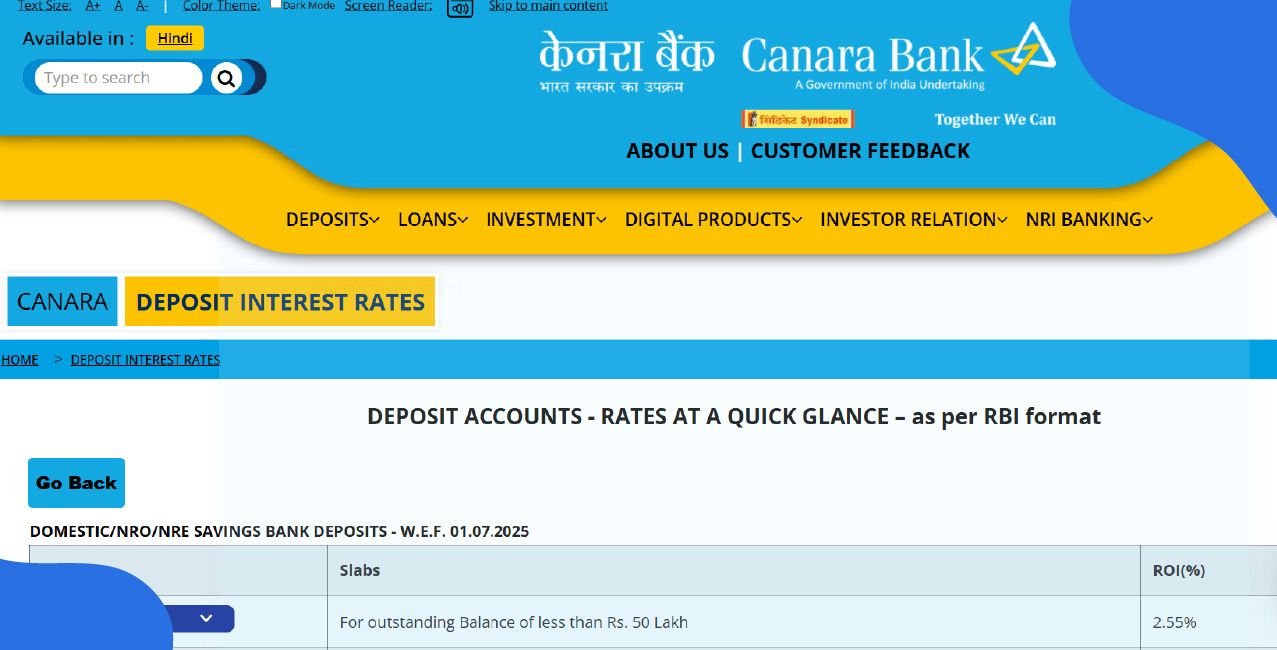

Canara Bank FD Interest Rates 2025

Canara Bank provides competitive FD rates of interest in 2025 with flexible tenures for both general customers as well as senior citizens.

Latest FD interest rates (domestic deposits < ₹3 crore)

Here are the latest Canara Bank FD interest rates for deposits below ₹3 crore in 2025:

These Canara Bank FD Interest rates make it a worthwhile and secure option for anyone wanting to increase their savings.

Types of Canara Bank Fixed Deposit Schemes

Canara Bank gives you a vast choice of FD schemes based on your savings goals:

Canara Bank FD ensures that every type of saver finds a scheme that suits their needs.

Features and Benefits of Canara Bank FD

Canara Bank Fixed Deposits delivers options for both short-term and long-term financial goals:

- Canara Bank FDs are safe and backed by a major public sector bank to give confidence to the investors.

- You can open an FD with a small amount to make it accessible even for first-time savers.

- Flexible tenures allow you to invest for short or long periods, from 7 days up to 10 years.

- Senior citizens earn slightly higher interest rates, giving them extra returns on their savings.

- You can borrow against your FD for up to 90% of the amount without breaking it, adding liquidity.

- Some FD types allow partial withdrawals, helping in case of urgent financial needs.

- Interest payouts can be customized monthly, quarterly, or cumulative to plan your income.

- Your deposits are insured by DICGC up to ₹5,00,000 to ensure the safety of your investment.

- Special schemes like green deposits or 444-day FDs offer higher returns or social benefits.

It mixes safety, flexibility, and regular returns to provide an assuring choice for investments.

Comparison of Canara Bank FD Interest Rates with Other Banks

The following is a brief comparison between Canara Bank's FD Interest rates and some of the big players among the Indian public sector banks:

Canara Bank FD Interest Rates are competitive, equal to or similar to the larger banks. These tiny variances in the rate of interest could make substantial differences for larger maturities.

Eligibility Criteria & Required Documents for Canara Bank FD Interest Rates

Who can open a Canara Bank FD?

- Resident Indians

- Hindu Undivided Families

- Companies, firms, and societies

- Trusts and associations

- Non-resident Indians (NRO/NRE deposits)

Documents you need:

- Identity proof (Aadhaar, PAN, passport, etc.)

- Address proof (utility bill, Aadhaar, voter ID, etc.)

- Passport-size photographs

- PAN card (mandatory for tax purposes)

- Additional documents for NRIs (passport, visa, etc.)

Tax Implications on Canara Bank FD

It’s important how your FD earnings are treated when it comes to taxes.

- Interest earned on regular FDs is taxable according to your income tax slab.

- Banks deduct TDS if annual interest exceeds ₹40,000 (₹50,000 for senior citizens).

- Five-year tax-saving FDs qualify for deductions under Section 80C for up to ₹1.5 lakh per year.

- Only individuals and HUFs can claim tax benefits on tax-saving FDs.

- Loans cannot be taken against tax-saving FDs.

- Only the first holder is eligible for the tax deduction in joint accounts.

- NRIs: Interest on NRO FDs is taxable, while NRE FDs remain tax-free.

- You can file Form 15G/15H to avoid TDS if your income is under the tax limit.

Understanding the tax rules helps you plan your FDs wisely and get the maximum benefit from your investment.

Canara Bank FD Premature Withdrawal & Closure Rules

Canara Bank allows premature withdrawal of most FDs. There is a 1% penalty on the applicable interest rate.

For example, if your FD had a contracted rate of 6.5% but you break it early, you may get only 5.5% (depending on the actual tenure completed).

- No interest is earned if the FD is withdrawn within 7 days of opening.

- Special schemes and tax-saving FDs do not allow premature withdrawal.

- Non-callable deposits cannot be broken before maturity.

- For very large deposits, the bank may waive penalties under special conditions.

How to Invest in Canara Bank FD

Online Option:

- Log in to Canara Bank net banking.

- Choose “Open Fixed Deposit” and fill in your details.

- Enter the deposit amount, tenure, and nominee info.

- Confirm. Your FD is ready to earn interest.

In-Branch Option:

- Visit your nearest Canara Bank branch.

- Request an FD application form and complete it.

- Provide your account details and submit the form.

- Bank staff will process it, and your FD starts immediately.

You can easily manage and track your FD online once it has been created.

Conclusion

Canara Bank Fixed Deposits help you grow your savings safely while earning consistent returns. You can choose a scheme that fits your financial goals with flexible tenures, competitive interest rates, and special benefits for senior citizens and NRIs.

Open your FD today online or at your nearest Canara Bank branch and enjoy the security and peace of mind that comes with guaranteed returns.

FAQs on Canara Bank FD Interest Rates

Can I open an FD without having a savings account in Canara Bank?

No, you need to have a savings or current account with Canara Bank to open an FD.

Can NRIs repatriate interest from NRO FDs easily?

Yes, NRIs can repatriate interest earned from NRO FDs up to $1 million per financial year, following RBI rules.

Can I link an FD to an SIP or investment plan?

Some Canara Bank schemes allow your FD interest to be automatically reinvested into other products like recurring deposits or mutual funds

What is the minimum deposit amount for opening a Fixed Deposit?

The minimum deposit amount for opening a Canara Bank FD is ₹1,000.

Can I change my nominee later?

Yes. You can update or change your nominee at any time during the FD tenure.

Other Related Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Punjab National Bank Gold Loan Interest Rate – Charges, Eligibility & Complete Guide

ICICI Bank RD Interest Rates – Updated Guide

SBI Gold Loan Interest Rate: Latest Rates & Loan Details

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article