Mid Cap SIP Calculator – Estimate Returns & Growth Potential

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- A Mid Cap SIP calculator estimates the future value of monthly investments in mid cap mutual funds. It uses official SIP tools from AMCs like SBI and HDFC to help investors understand potential returns before investing.

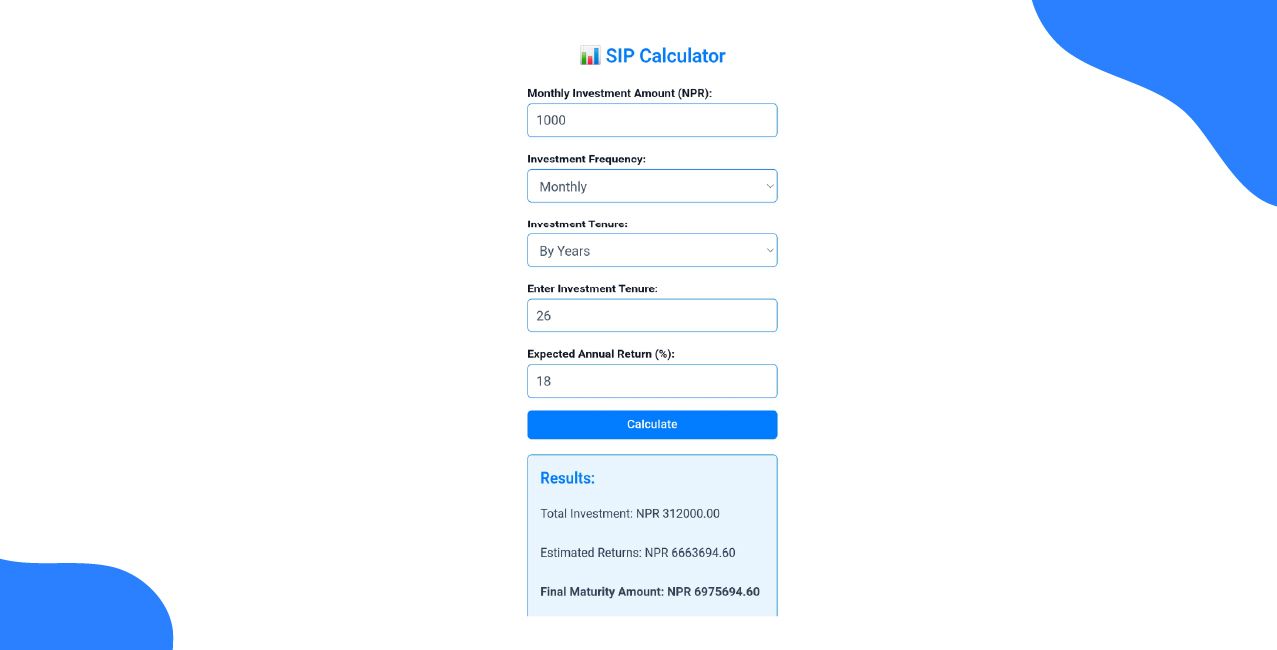

- The Mid Cap SIP calculator calculates expected savings by combining the expected rate of return, investment tenure, and the monthly SIP amount. It shows the total investment, estimated gains, and final corpus separately, similar to how a step up sip calculator highlights growth with increasing contributions.

- The Mid Cap calculator helps investors align their SIP amounts with plans such as retirement, home purchase, or higher education through expected numbers.

The Mid Cap SIP calculator helps estimate how monthly investments in mid-cap mutual funds can grow over time based on expected returns. The SBI SIP calculator and HDFC SIP calculator provide quick and official estimates. This helps investors check potential outcomes before investing or comparing SIP plans with a lumpsum calculator.

How to Use Mid Cap SIP Calculator?

Salary aati hai, expenses nikal jaate hain, aur future planning reh jaati hai. That’s where a Mid Cap SIP calculator helps you plan for your future!.

Open an official Mid Cap SIP Calculator, such as the SEBI SIP Calculator or platforms providing the Motilal Oswal Mid Cap SIP Calculator. Enter the following details:

After entering the values, the mid cap SIP calculator hdfc and similar tools show:

- Total invested amount

- Estimated maturity amount

- Expected gains

This helps you adjust your monthly amount before committing money or pairing it with a step up sip calculator for better planning.

I use an official SIP calculator by entering ₹3,000 as the monthly investment for 7 years at an expected 12% return. The calculator shows the total invested amount and the estimated returns, which helps me decide my actual budget.

SIP Investment Examples

These examples show how different people invest through SIPs based on their income and personal goals.

Aarav, a 27 Year Old Freelance UI Designer

Aarav works as a freelance UI designer and earns through project-based assignments. His income changes every month, so he avoids committing to high investments. His goal is to build emergency funds that can support him during low-income months without breaking discipline.

Aarav uses the Mid Cap SIP calculator to test long-term impact. He prefers the SBI SIP calculator and occasionally compares with a lumpsum calculator when he receives bonus income.

Kavya, a 25 year old Government Exam Aspirant

Kavya is preparing for competitive government exams and currently depends on savings and part-time tuition income. She wants to invest carefully while keeping enough liquidity for exam-related expenses. She aims to create a backup fund in case her preparation phase extends.

Kavya uses the Mid Cap SIP calculator to ensure her SIP stays affordable. She compares estimates using official tools like HDFC Mid Cap SIP calculator mutual fund platforms before committing.

Amit, a 40 Year Old Self-Employed Consultant

Amit runs his own consulting business and wants to create a retirement buffer. He does not have a fixed income every month, but when money comes in regularly, he increases his investments. He is happy to invest for a longer period.

Amit uses the mid cap SIP calculator to test different SIP amounts. He depends on HDFC tools and combines SIP planning with a step up sip calculator to increase investments when income improves.

Each case shows how SIP calculators help people invest comfortably and stay on track over time.

Bonus Tip: Mid-cap mutual funds continued to attract strong investor inflows in 2025 despite market volatility, which shows growing confidence in long-term SIP investing. This makes using a mid cap SIP calculator even more relevant for disciplined planning.

Conclusion

The Mid Cap SIP calculator is a planning tool that helps you achieve your investment goals. It is simple to use, based on official data, and allows you to adjust investment amounts before committing money.

FAQs Related to Mid Cap SIP Calculator

1. What is a Mid Cap SIP Calculator?

A Mid Cap SIP Calculator is an online tool that helps estimate the future value of monthly investments made in mid-cap mutual funds. It shows how your SIP may grow over time based on the investment amount, tenure, and expected return.

2. Why should you use a Mid Cap SIP Calculator before investing?

You should use a Mid Cap SIP Calculator to understand the potential returns of mid-cap funds and check whether your SIP amount matches your financial goal and monthly budget.

3. Can a Mid Cap SIP Calculator show step-up SIP benefits?

Yes, a Mid Cap SIP Calculator can be used along with step-up options to show how increasing your SIP amount every year may improve the final corpus. This is particularly for long-term mid-cap investments.

4. What factors should you check in a Mid Cap SIP Calculator before starting a SIP?

You should check the expected return, investment tenure, monthly SIP amount, and your ability to stay invested during market volatility common in mid-cap funds.

5. How does a mid cap SIP calculator help in managing investment risk?

A mid cap SIP calculator helps you plan for market volatility by showing long-term projections for mid-cap funds. It helps you balance risk and return more effectively by testing different tenures and SIP amounts.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

ET Money SIP Calculator: Calculate SIP Returns Instantly

One Time SIP Calculator: Calculate Lump Sum SIP Returns

Aditya Birla SIP Calculator: Plan Investments the Smart Way

Recent Blogs

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article