Motilal Oswal SIP Calculator – Estimate Returns & Monthly Investment

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- The Motilal Oswal SIP Calculator helps you estimate long-term SIP returns without assuming a fixed Motilal Oswal SIP interest rate, as SIP outcomes depend on market performance and investment duration.

- It allows you to evaluate investment potential by reviewing estimates along with motilal oswal sip last 5 years return that helps you set realistic expectations before starting a SIP.

- The calculator simplifies SIP planning by showing total investment, estimated gains, and final corpus in advance, which helps you choose an amount that suits your monthly budget and long-term needs.

The Motilal Oswal SIP Calculator is an official online tool that helps you estimate the future value of monthly SIP investments. You can understand potential outcomes and also compare estimates with tools like Motilal Oswal SIP Calculator SBI, by adjusting investment amount and tenure.

It also helps you understand that there is no fixed Motilal Oswal SIP interest rate, as SIP returns are market-linked and depend on fund performance over time.

How to Use the Motilal Oswal SIP Calculator?

Investments boring ya confusing nahi honi chahiye! Let’s understand SIP planning in a way that actually makes sense.

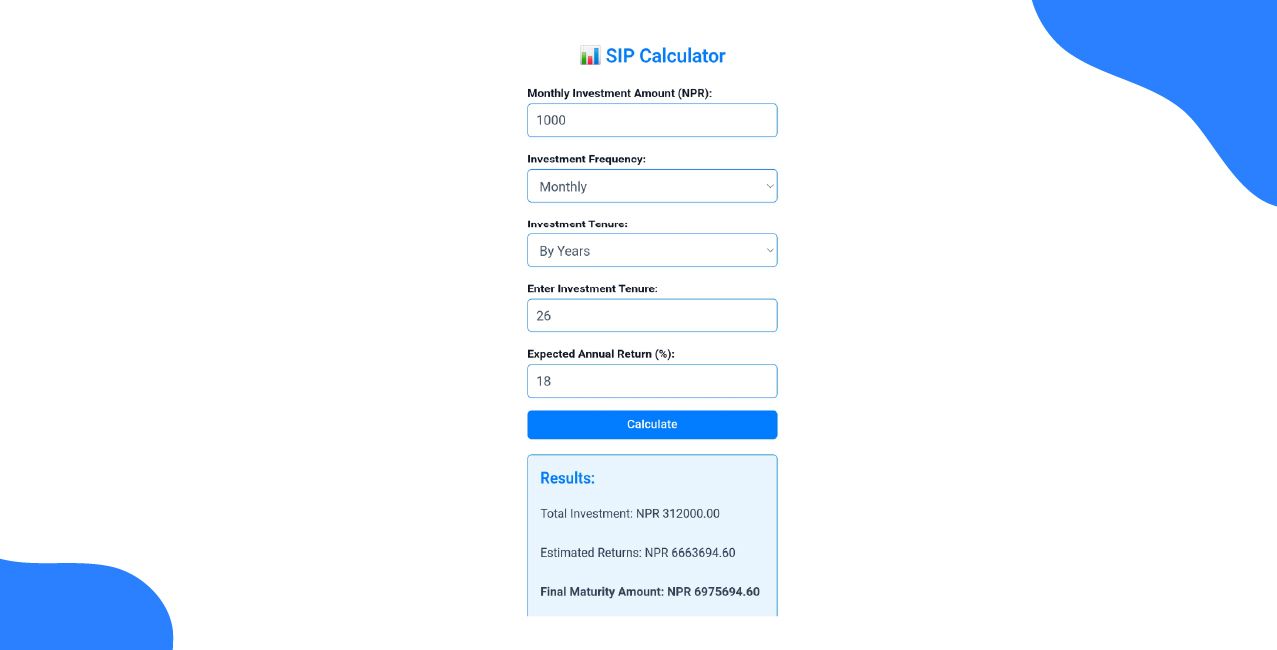

Start by opening the official SIP calculator on the Motilal Oswal Mutual Fund website. Enter a monthly SIP amount that fits comfortably within your income. Select an investment tenure based on your financial needs and choose an expected return only for estimation.

The calculator displays total investment, estimated returns, and final value once details are entered.

I enter ₹5,000 as a monthly SIP for 10 years in the calculator. It immediately shows the total investment and estimated corpus. This quick estimate helps me judge affordability and compare planning results with the Motilal Oswal SIP calculator SBI tools if needed.

Bonus Tip: SIP investments in India reached a record high of ₹3,34,000 crore in 2025, showing strong investor trust in systematic investing despite market volatility. This trend highlights why using a SIP calculator before investing is useful for planning your long-term financial goals.

SIP Investment Examples

These examples show how real people invest through SIPs in a way that fits their income and daily life.

Sneha, a 29 Year Old Startup HR Executive

Sneha works in a startup where salary hikes are uncertain. She wants to invest regularly without locking herself into a high monthly commitment. Her goal is to build a flexible wealth base for future career changes.

She uses the Motilal Oswal SIP Calculator to test different tenures and prefers SIP over one-time investing after comparing outcomes with Motilal Oswal SIP Calculator lumpsum estimates.

Rakesh, a 34 Year Old Small Business Owner

Rakesh runs a local retail store and earns an uneven monthly income. He wants to invest only what feels safe after business expenses. His focus is long-term growth without pressure during slow months.

He uses the Motilal Oswal SIP Calculator to keep SIP amounts realistic. He compares SIP planning with the Motilal Oswal SIP calculator one time investment options whenever surplus cash is available.

Meera, a 42 Year Old School Teacher

Meera wants to create a retirement support fund while managing household expenses. She prefers stability and long-term discipline rather than aggressive investing.

She uses the Motilal Oswal SIP Calculator to stay consistent and reviews the Motilal Oswal SIP last 5 years return data for market fluctuations.

These examples show that SIP investing can stay practical and manageable for different income levels.

Conclusion

The Motilal Oswal SIP Calculator acts as a practical planning tool rather than a return promise. It helps investors understand how time, consistency, and market-linked returns work together by showing total investment, estimated gains, and possible final value. This makes it easier to choose realistic SIP amounts, stay invested during market fluctuations, and align SIP planning with real financial needs.

FAQs Related to Motilal Oswal SIP Calculator

1. What is the Motilal Oswal SIP Calculator?

The Motilal Oswal SIP Calculator is an online tool that helps you estimate the future value of your monthly SIP investments. It calculates estimated returns based on the SIP amount, investment tenure, and expected market-linked returns.

2. Why should you use the Motilal Oswal SIP Calculator before investing?

You should use the Motilal Oswal SIP Calculator to check whether your investment goal is realistic. It also helps you decide if the SIP amount fits comfortably within your monthly budget.

3. Does the Motilal Oswal SIP Calculator support step-up SIP planning?

The calculator can be used to plan step-up SIPs by adjusting the SIP amount over different years. This helps you understand how increasing contributions may improve long-term returns.

4. What should you check before starting a SIP using the Motilal Oswal SIP Calculator?

You should check your financial needs, investment tenure, expected returns, and your ability to continue SIPs during market ups and downs.

5. Can the Motilal Oswal SIP Calculator be used for different mutual fund schemes?

Yes, the Motilal Oswal SIP Calculator can be used to estimate returns for different Motilal Oswal mutual fund schemes by adjusting expected returns. This makes it useful for comparing investment cases.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

ET Money SIP Calculator: Calculate SIP Returns Instantly

One Time SIP Calculator: Calculate Lump Sum SIP Returns

Aditya Birla SIP Calculator: Plan Investments the Smart Way

Recent Blogs

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article