HDFC Preferred Banking Benefits – Privileges, Eligibility & Features

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- You must maintain ₹2,00,000 or more relationship value to meet HDFC preferred banking eligibility.

- You receive fee waivers, priority service, and card-linked benefits that define HDFC Preferred Banking Benefits and charges.

- You can access airport lounges through eligible cards under HDFC Preferred Banking Benefits Lounge Access.

The rules for “Preferred” status just changed. With the new ₹50,00,000 Total Relationship Value (TRV) criteria introduced in late 2025, qualifying for HDFC’s elite tier is now more flexible than ever. Are you already eligible for these premium perks without even realising it?

HDFC Preferred Banking is a premium relationship banking program offered by HDFC Bank for customers who maintain higher balances. “Bank ka kaam fast ho” and “extra charges na lagen” are daily expectations, and this program is designed around them.

I maintain a ₹4,00,000 monthly savings balance or a ₹50,00,000 total relationship value, which includes 20% of my home loan. This status allows me to save over ₹13,000 annually through 50% locker discounts, fee-free debit cards, and complimentary lounge access. You experience smoother service and better cost control when your balances remain stable.

Bonus Tip: Do you know? HDFC Bank reported a 10.8% rise in profit, reaching ₹186.4 billion for the quarter ended September 30, 2025, highlighting strong financial stability.

Eligibility: Do you qualify for Preferred Banking

You qualify for Preferred Banking only if you meet one of the officially defined conditions:

If you do not meet any of these thresholds, your account remains under Classic Banking, which directly answers HDFC Preferred banking eligibility in practical terms. If balances drop, this becomes one of the HDFC preferred banking disadvantages, as your status may change.

Preferred Banking vs Classic Banking

You often hear HDFC preferred banking vs classic banking, but the difference is purely numerical and service-based.

This comparison shows that HDFC preferred banking vs classic banking is not lifestyle-based but balance-driven.

Debit Card Issued Under Preferred Banking

You are typically issued a Visa Platinum or Titanium Debit Card under Preferred Banking.

These limits explain why Preferred Banking works well for high-transaction customers.

Service benefits you receive daily

You receive priority support that reduces time spent on routine banking tasks.

These benefits matter most if you visit branches or need frequent service support. If your banking activity is low, this is one of the HDFC preferred banking disadvantages.

What You Actually Pay (and What You Don’t) Under HDFC Preferred Banking

Charges decide whether a premium banking program truly adds value or quietly increases costs, so it is important for you to look at the official fee structure in clear numbers rather than marketing claims.

These numbers explain HDFC preferred banking benefits and charges clearly, without assumptions or marketing language.

Cards and lounge access you actually get!

Your travel benefits depend on the card linked to your HDFC Preferred Banking relationship.

Lounge visits are card-based and subject to usage conditions under HDFC Preferred banking benefits lounge access. Access is not automatic and depends on the card issued.

Conclusion

You gain the most from HDFC Preferred Banking when you maintain stable balances and actively use banking services. The program saves time and reduces charges. Review your financial pattern carefully and upgrade only if it aligns with your long-term needs.

FAQs Related to Axis Bank Credit Card Benefits

Q1. How can you opt out of HDFC Preferred Banking?

You can opt out of HDFC Preferred Banking by visiting your HDFC Bank branch or contacting customer care. Once your relationship value falls below the required threshold or you request a downgrade, your account moves to the regular banking category.

Q2. What is HDFC Bank’s Preferred Banking programme?

HDFC Bank’s Preferred Banking programme is a premium relationship banking service for customers who maintain a higher balance. It offers priority service, dedicated relationship support, and selective fee benefits compared to regular banking.

Q3. Are there any advantages of HDFC Preferred Banking?

Yes, you get priority branch service, a dedicated relationship manager, and fee-related benefits on select services. Card-linked benefits such as airport lounge access may also apply, depending on the card issued.

Q4. Have there been updates to HDFC Preferred Banking eligibility?

HDFC Bank periodically reviews and updates eligibility based on relationship value requirements. You should always check the official Preferred Banking eligibility page, as higher balance thresholds may apply compared to earlier criteria.

Q5. Is HDFC Preferred Banking suitable for everyone?

HDFC Preferred Banking suits you only if you maintain stable, higher balances and use banking services regularly. If your balances fluctuate or usage is low, regular banking may be more practical.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

What is Retail Banking: Services Offered & Role in Personal Finance

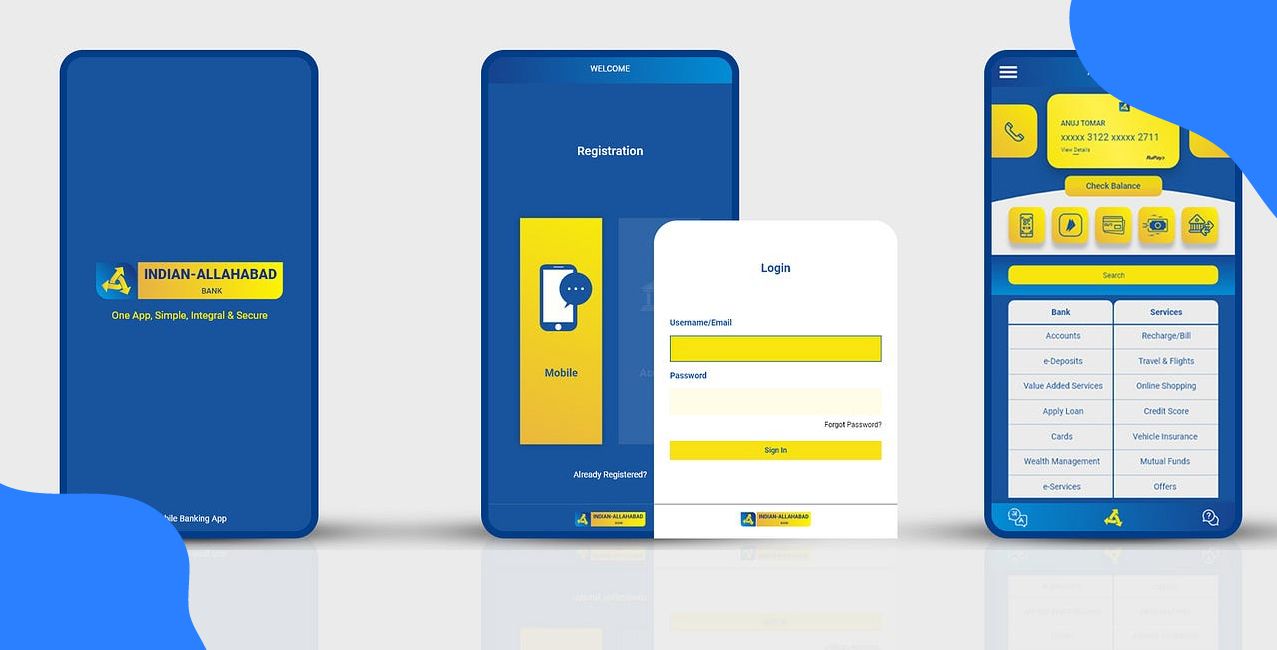

Indian Bank Mobile Banking: Features, App & Services

What is AEPS in Banking? The Thumb‑Powered Financial Revolution

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article