Union Bank RTGS Form: Complete Guide to Fill & Submit

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- The Union Bank RTGS form enables secure and real-time transfers of ₹2,00,000 or more between banks through both online and offline methods.

- Customers can easily do a Union Bank RTGS form 2025 PDF download. Then they can fill out and submit the Union Bank RTGS form with accurate remitter and beneficiary details for smooth processing.

- With 24×7 online access, nominal charges, and flexible branch timings, Union Bank ensures fast, safe, and convenient high-value fund transfers.

- Union Bank RTGS enables instant transfers of ₹2,00,000 and above through secure real-time settlement.

- Customers can submit RTGS requests online anytime or offline during branch working hours. The RTGS form requires accurate remitter, beneficiary, account number, and IFSC details.

- Union Bank RTGS charges are ₹28.91 for transactions up to ₹5,00,000. The charge is ₹58.41 for transactions above ₹5,00,000. Customers can complete a Union Bank RTGS form 2025 PDF download for offline submission.

Bonus Tip: Always cross-verify beneficiary account details on the RTGS form with the cheque and bank records before submission to avoid rejection or delays.

Aditya, a software engineer from Bengaluru started his day with a cup of coffee. That is when he received a terrible phone call. It was his mother, who mentioned that his father had been admitted to the hospital due to a sudden illness. Aditya quickly downloaded the Union Bank RTGS form PDF in his office, and rushed to the bank. He filled up the necessary details and made a transfer of ₹2,50,000 to his mother for his father’s treatment.

The Union Bank RTGS form allows customers to make high-value fund transfers of ₹2,00,000 and above instantly through the Real-Time Gross Settlement system. It requires basic details such as the sender’s and beneficiary’s names, account numbers, and IFSC codes.

Union Bank RTGS form PDF is available both online and offline. This service ensures secure, efficient, and real-time settlement for smooth fund transfers across banks. You can easily do a Union Bank RTGS form PDF download to print and fill it to complete the process of RTGS.

Read More – PNB RTGS Form: Complete Guide to Fill & Submit

Aditya said. “I quickly carried out the Union Bank RTGS form PDF download. I filled out the RTGS form, and submitted it to Union Bank. I could easily carry out large fund transfers safely and efficiently with the Union Bank RTGS form PDF."

What is the Union Bank RTGS form?

The Union Bank RTGS form is an application used for transferring funds of ₹2,00,000 or more through the Real-Time Gross Settlement system. It requires details of both the sender and the beneficiary, including names, account numbers, bank names, and IFSC codes. This form, available at Union Bank branches, ensures secure, high-value fund transfers between banks in real time.

How To Download the Union Bank RTGS Form?

If you wish to make an offline RTGS transaction through Union Bank of India, you can easily do a Union Bank RTGS form PDF download in just a few simple steps.

Steps to Download the Union Bank RTGS Form

- Visit the official Union Bank of India website.

- Click on the download forms at the bottom of the page.

- Find the RTGS form and open it. Select the ‘Save’ option to download and store the form on your device.

Once you are done with Union Bank RTGS form 2025 PDF download, you can print the form. Fill in all required details like beneficiary information and transaction amount, and submit it at your nearest Union Bank branch. This is how you can complete the RTGS transaction.

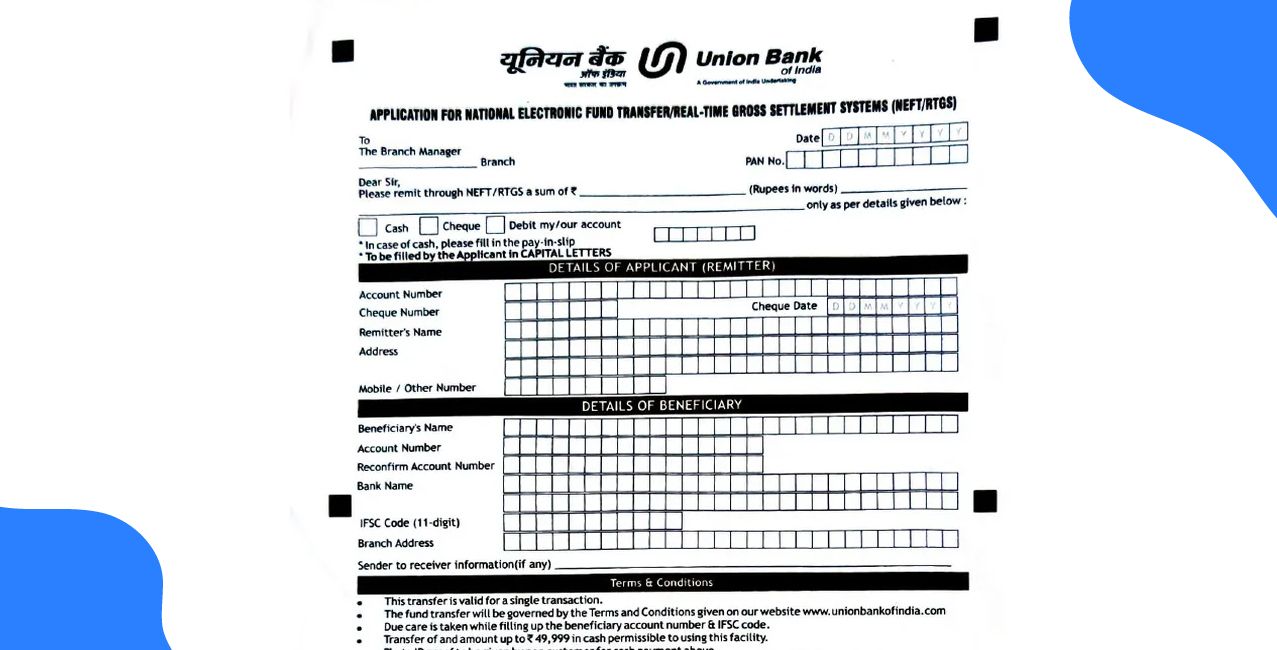

How To Fill the Union Bank RTGS Form?

To make a high-value transfer through Union Bank of India using RTGS, you must fill out the RTGS form carefully with all required details. Below is a simple step-by-step guide to help you complete it correctly.

Steps to Fill the Union Bank RTGS Form

Step 1: Fill in the remitter’s (sender’s) details

- Branch Name: Enter the name of the Union Bank branch where you are submitting the form.

- Date: Mention the date of filling the form.

- Remitter’s Name: Write your full name.

- Remitter’s Address: Enter your complete address.

- PAN Number: Provide your Permanent Account Number.

- Mobile Number: Write your registered mobile number.

- Account Type: Specify whether it is a Savings Bank (SB), Current (CD), or Cash Credit (CC) account.

- Customer ID: Mention your Customer ID, if applicable.

Step 2: Fill in the beneficiary’s (receiver’s) details

- Beneficiary’s Name: Write the full name of the person or organisation you are transferring funds to.

- Account Number: Enter the beneficiary’s correct account number.

- Type of Account: Specify if it is a Savings, Current, or other account type.

- Name of Bank: Mention the beneficiary’s bank name.

- Branch Name: Write the name of the beneficiary’s bank branch.

- IFSC Code: Enter the correct IFSC code of the beneficiary’s branch.

Step 3: Specify the amount and payment method

- Amount (in figures): Write the transaction amount in numbers (e.g., ₹1,00,000).

- Amount (in words): Write the same amount in verification words.

- Payment Method: Choose whether to debit your account directly or make a payment by cheque.

- If paying by cheque: Enter the cheque number and date. Write “For Self For RTGS” on the cheque and obtain a counter-signed receipt if required.

Step 4: Read, sign, and submit

- Read the Declaration: Go through the terms and conditions carefully.

- Sign: Sign the form in the authorised signature section to approve the transaction.

- Submit: Submit the form to your nearest Union Bank branch.

- Keep the Receipt: Collect the acknowledgement copy for your reference.

- Supporting Documents: Non-account holders may need to present valid photo ID proof.

Once the form and cheque are submitted, the bank processes your RTGS request, and the funds are transferred securely to the beneficiary’s account in real time.

Required Documents For Union Bank RTGS Form

Before submitting the Union Bank RTGS form, it’s essential to have all the necessary documents ready to ensure a smooth and quick fund transfer process. These documents help the bank verify your transaction details accurately.

Required Documents

- A Completed RTGS Form: Make sure all fields are filled in correctly, including:

- Your name and account number

- Beneficiary’s name and account number

- Beneficiary bank name and branch

- Beneficiary bank’s IFSC code

- Transfer the amount written in both figures and words

- Your registered mobile number

- Cheque Leaf: Attach a cheque from your Union Bank account. Write the beneficiary’s details on the back of the cheque and include cheque details, such as cheque number and date, on the RTGS form.

Keep these documents ready to ensure that your Union Bank RTGS transaction is processed efficiently, securely, and without unnecessary delays.

Union Bank RTGS Charges

Union Bank of India levies nominal RTGS service charges for outward transactions based on the amount being transferred. These charges are the same for both individual and non-individual customers, with GST applicable at 18%.

Union Bank RTGS Charges

These RTGS charges by Union Bank ensure affordable and transparent pricing for high-value fund transfers. Online RTGS transactions are also encouraged for added convenience and speed.

Union Bank RTGS Timings

Union Bank of India offers flexible RTGS timings to meet the needs of both online and in-branch customers. While online RTGS is available round the clock, branch transactions follow specific working hours.

Union Bank RTGS Timings

With 24×7 online availability and convenient branch hours, Union Bank ensures smooth and secure high-value fund transfers for all customers.

Conclusion

The Union Bank RTGS form is an easy and reliable way to transfer large sums securely. With transparent charges, simple documentation, and 24×7 online access, it offers complete flexibility to customers. You can also download Union Bank RTGS form PDF and fill it to submit it offline.

Also Read – Indian Bank RTGS Form: Complete Guide to Fill & Submit

Whether used for personal or business purposes, RTGS ensures that funds reach the beneficiary instantly and safely, making it one of the most trusted payment methods in India.

FAQs

What is the minimum amount required for an RTGS transaction in Union Bank?

The minimum amount for RTGS in Union Bank is ₹2,00,000.

Can I download the Union Bank RTGS form online?

Yes, you can easily download the RTGS form from the official Union Bank of India website.

What are the Union Bank RTGS charges for transactions above ₹5,00,000?

For transactions above ₹5,00,000, the RTGS charge is ₹49.50 + GST, totalling ₹58.41 per transaction.

Are RTGS services in Union Bank available 24×7?

Yes, online RTGS transactions are available 24×7, including Sundays and holidays.

Do I need to submit a cheque with the RTGS form at Union Bank?

Yes, a cheque leaf from your account must be attached to verify and complete the RTGS transaction.

Is there a cut-off time for RTGS transfers in Indian banks?

Yes, most Indian banks require RTGS transfers to be initiated before the cut-off (usually around 4:30–5:00 PM on working days) to be processed the same day, otherwise they will be settled on the next working day.

Are large RTGS transactions in India automatically reported or monitored by banks?

Yes, banks are required to monitor and report high-value cash and suspicious transactions (including large RTGS transfers) under RBI’s AML/CFT guidelines, and transactions that appear unusual may be flagged for internal review or reported to the Financial Intelligence Unit (FIU-IND).

How can I increase the RTGS transfer limit in Union Bank of India?

You can request a higher RTGS limit by visiting your Union Bank of India branch or through internet banking, where the bank may allow a limit enhancement after verification and customer consent, as RTGS limits are bank-defined beyond the RBI minimum of ₹2,00,000.

Can I transfer money from State Bank of India (SBI) to Union Bank of India using RTGS?

Yes, RTGS allows high-value transfers (₹2,00,000 and above) between SBI and Union Bank of India in real time, provided both accounts are RTGS-enabled and the transfer is made within bank cut-off hours.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article

.png)