Canara Bank Personal Loan EMI Calculator: EMI & Interest Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- The Canara Bank Personal Loan EMI calculator estimates your monthly payment based on your loan amount, tenure, and Canara Bank personal loan rate of interest.

- A small change in the interest rate can make a big difference to your monthly EMI, particularly when the loan amount is high.

- When Canara Bank cuts its benchmark rates, the EMI on floating-rate personal loans can come down.

The Canara Bank personal loan EMI calculator is an online tool that helps people estimate their monthly loan repayment in advance. It shows the expected EMI by entering the loan amount, applicable interest rate, and repayment tenure. This helps in making monthly budget planning easier and more accurate.

How to Calculate Your EMI?

When rent, groceries, bills, and savings already take up a large part of your monthly income, it becomes very important to know your Canara Bank EMI in advance. It helps you understand how much you can comfortably repay each month!

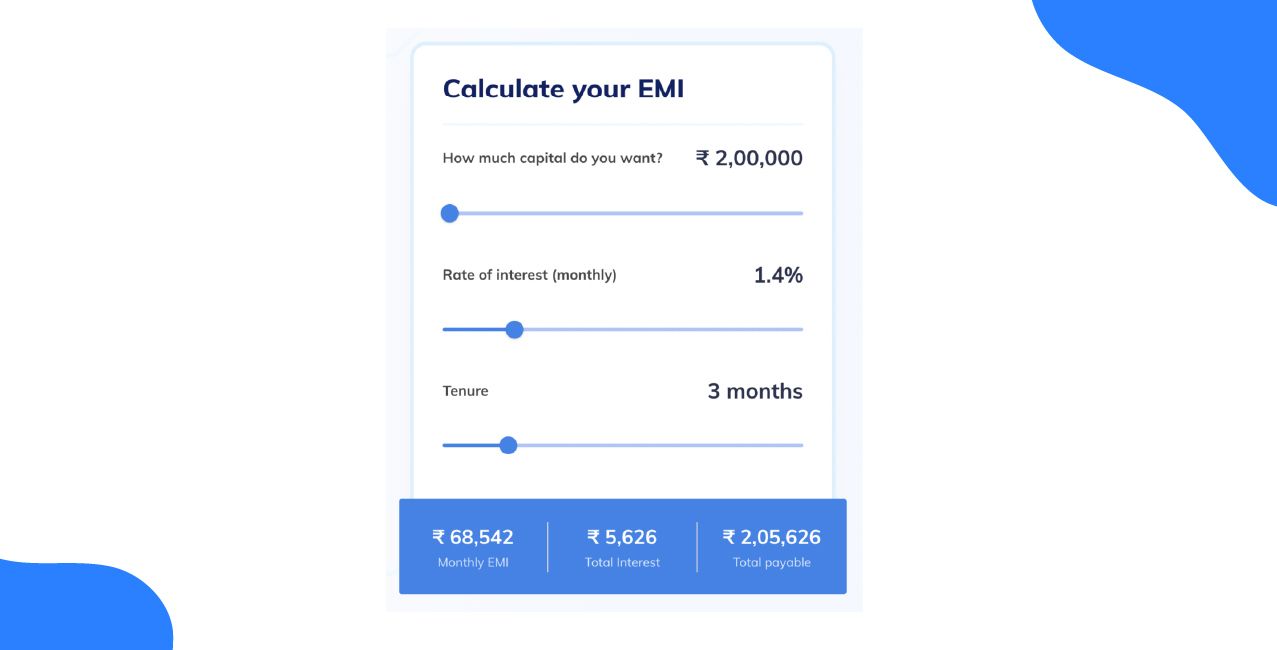

You only need to enter a few basic loan details in the Canara Bank personal loan EMI calculator to calculate your EMI easily:

- Enter the personal loan amount you want to borrow from Canara Bank.

- Select the loan tenure offered by Canara Bank (in months or years).

- Add the applicable Canara Bank personal loan rate of interest for salary account.

- The EMI amount is calculated based on these details.

If I plan to borrow ₹3,00,000 at an annual interest rate of 12% for 3 years, the Canara Bank personal loan emi calculator based on salary helps me find my monthly payment. This makes it easier for me to plan my monthly budget.

Bonus Tip: Canara Bank recently reduced its Repo Linked Lending Rate (RLLR) by 25 basis points. This means personal loan interest rates and EMIs are likely to become more affordable for borrowers as the cut takes effect.

Canara Bank Personal Loan EMI Examples

These real-life examples show how different borrowers use the Canara Bank personal loan EMI calculator to choose a loan amount and tenure.

Salaried Professional Managing Family Expenses

Karan is a 28 year old salaried employee working in a private firm. He needed funds for medical and household expenses and wanted a low EMI that would not disturb his fixed monthly budget.

This EMI allowed Karan to manage daily expenses smoothly. It also helped him understand the Canara Bank personal loan interest rate for 1 lakh properly.

Mid-Level Employee Planning Skill Upgrade

Shikha is a 35 year old IT professional who wanted to upgrade her skills through a certification course. She preferred a shorter tenure to reduce the overall interest cost.

This option worked well because her stable income supported a higher EMI, even with changes in the Canara Bank personal loan rate of interest.

Young Borrower Buying a Two-Wheeler

Aman is a 24 year old first job professional who wanted a scooter for daily commuting. He focused on keeping the EMI affordable while starting his career.

This planning helped Aman repay comfortably without affecting his savings and gave him clarity on the Canara Bank personal loan interest rate for 1 lakh.

These cases explain that the right EMI planning helps manage expenses smoothly, whether you are salaried, mid-career, or just starting.

Benefits of Using Canara Bank Personal Loan EMI Calculator

The Canara Bank personal loan EMI calculator helps people understand their repayment responsibility before applying for a loan.

EMI Understanding Before Taking the Loan

When I first planned a loan of ₹1,50,000, the Canara Bank personal loan EMI calculator showed an EMI of around ₹4,900 to ₹5,000, depending on tenure and interest rate. This helped me choose a repayment period that fit comfortably within my monthly income.

Easy Comparison of Different Interest Rates

I compared EMIs for a ₹2,50,000 loan using different interest rates. At 11%, the EMI came to around ₹5,400, while at 14%, it increased to nearly ₹5,800 for the same tenure. This comparison clearly showed how even a small rate change impacts monthly outgo.

Monthly Budget planning

I used this calculator to see that ₹80,000 at 10.95% p.a. for 2 years would cost ₹3,700 per month before I upgraded my scooter. I saved that amount in advance.

The Canara Bank personal loan EMI calculator supports clear planning, easy comparison, and better budgeting.

Conclusion

The Canara Bank personal loan EMI calculator provides a clear estimate of monthly repayments based on the loan amount, interest rate, and tenure. It saves time, removes uncertainty, and helps people make informed financial decisions.

FAQs Related to Canara Bank Personal Loan EMI Calculator

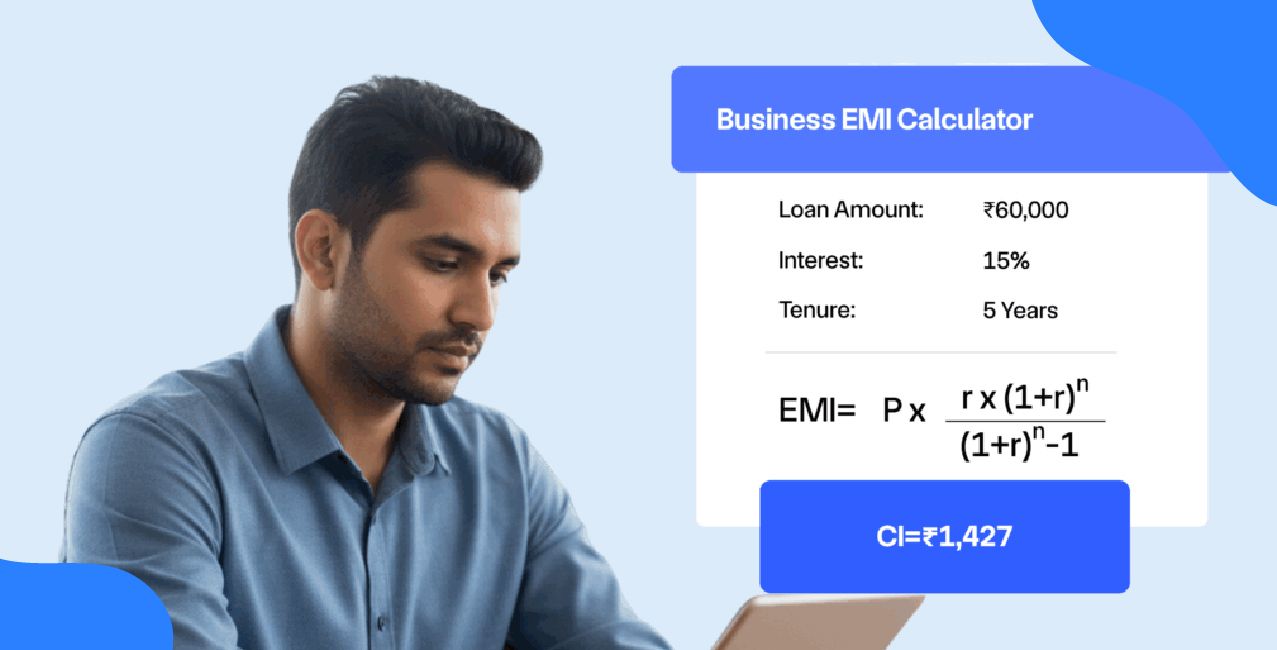

How does Canara Bank calculate EMI for a personal loan?

Canara Bank calculates EMI based on the loan amount, applicable interest rate, and chosen repayment tenure. The EMI remains fixed for the selected tenure and can be checked easily using the Canara Bank personal loan EMI calculator.

What is the Canara Bank personal loan EMI calculator?

The Canara Bank personal loan EMI calculator is an online tool available on the official Canara Bank website. It helps people estimate their monthly EMI before applying for a personal loan using bank-approved parameters.

How can I use the Canara Bank personal loan EMI calculator?

Enter the required loan amount, select the repayment tenure, and input the applicable interest rate to use the Canara Bank personal loan EMI calculator. The calculator shows the estimated monthly EMI.

Why should borrowers check the Canara Bank EMI calculator before applying?

People should check the Canara Bank EMI calculator to understand their monthly repayment in advance. This supports better budgeting and lowers the risk of selecting a loan that may become difficult to manage later.

Does the Canara Bank EMI calculator help in choosing the right tenure?

Yes, the Canara Bank EMI calculator allows borrowers to compare EMIs across different tenures. This helps in selecting a repayment period that aligns well with monthly income and financial commitments.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Personal Loan Prepayment EMI Calculator: Reduce EMI & Interest

LIC Personal Loan EMI Calculator: Calculate EMI Instantly

Kotak Personal Loan EMI Calculator: Check EMI & Loan Cost Easily

Recent Blogs

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article