IndusInd Bank Personal Loan EMI Calculator: EMI & Interest Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key takeaways

- The Indusind Bank Personal Loan EMI calculator helps you to understand your monthly EMIs before applying for the loan.

- It is a simple and easy to use online tool that can be used by providing a few basic details of the loan.

- By choosing shorter repayment tenure, interest rate is less which helps to become debt free sooner.

Bonus tip:

Before applying for a personal loan, it is important to know that choosing higher tenure can lower the EMIs but on the other hand it will increase the interest rate. So, it is better to choose a shorter tenure to repay the loan amount to save yourself from the high interest rate.

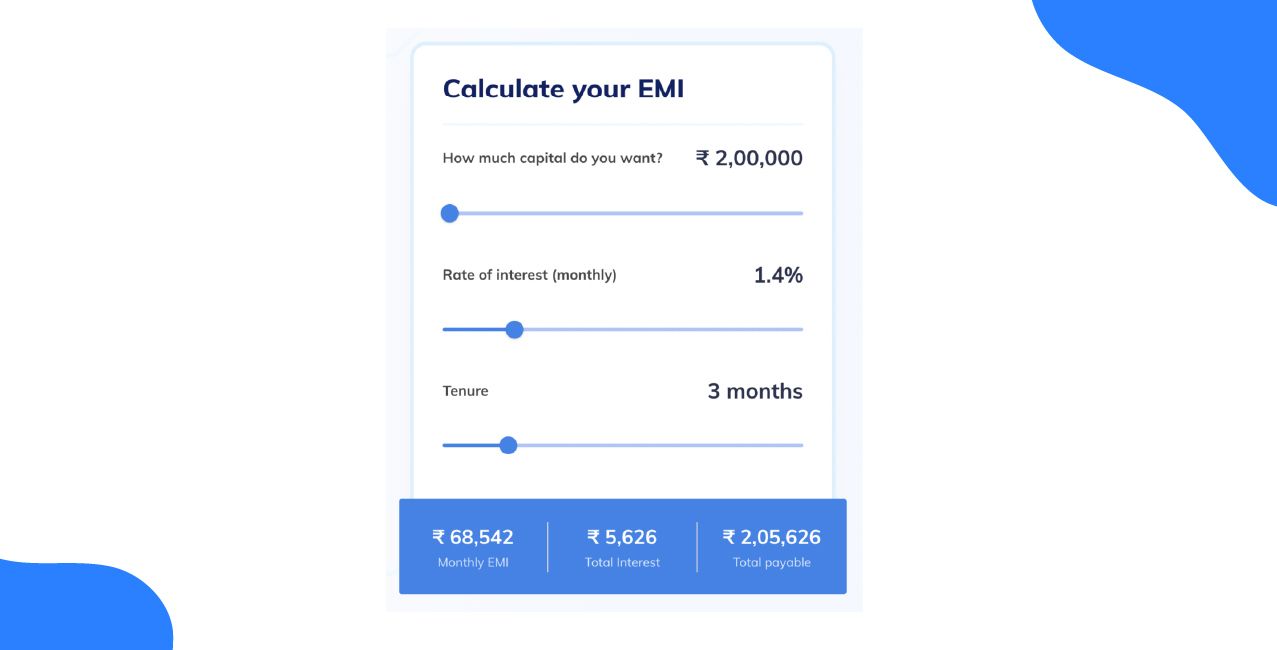

The Indusind Bank Personal Loan EMI calculator is an online interactive tool that helps you estimate the monthly loan repayment based on loan amount, interest rate, and tenure. This is also helpful to know your Indusind Bank Personal Loan eligibility before applying. The calculator requires a few basic details about the loan like the principal amount, rate of interest and the repayment tenure. It helps you plan your monthly budget confidently before applying for a personal loan.

If you enter a loan amount of ₹5,00,000, repayment tenure of 36 months, and interest rate of 12%. The calculator will instantly show your EMI, total interest payable, and overall repayment amount without any manual calculation and in just a few seconds.

How to use Indusind Bank Personal Loan EMI Calculator

Below is the step by step process of using IndusInd Bank Personal Loan EMI Calculator (https://www.indusind.bank.in/in/en/personal/calculators/personal-loan-emi-calculator.html)

STEP 1- Enter the desired loan amount or adjust the slider accordingly.

STEP 2- Then enter the repayment tenure by choosing monthly or yearly.

STEP 3- enter the interest rate or adjust the slider.

STEP 4- Enter “Apply Now” to get instant results and check your Indusind Bank Personal Loan eligibility.

By following the above mentioned steps you can easily use the EMI calculator to know your monthly EMIs.

Examples:

Few examples to understand the calculator more easily are :

Example1 - Abhinav is a job professional and planning a wedding l. He applied for a personal loan of 4 lakhs with an interest rate of 11.5% per annum for 36 months. He uses the calculator to know the monthly EMIs so that he can plan the wedding budget accordingly:

Abhinav ensures that the EMI stays under 30% of their ₹50,000 monthly salary which makes loan repayment easy without changing his lifestyle.

Example 2- Rahul funds a business expansion with a loan amount of ₹8,00,000, interest rate 14% and for 48 months. He uses the EMI calculator to know the monthly EMIs.

The EMI calculator helped Rahul to decide whether increasing the tenure lowers EMI enough to match his financial budget.

Benefits of using Indusind Bank Personal Loan EMI calculator

In the table below, some benefits are mentioned for you to easily know why EMI calculators are used:

With the above mentioned benefits, you can plan your repayments in a more efficient way while maintaining financial stability.

Related Calculator:

If you are planning to buy a car, you can easily use Indusind car loan EMI calculator to estimate your monthly repayments.

Conclusion

Indusind Bank Personal Loan EMI Calculator is an interactive online tool that helps you to plan your financial budget by managing the loan repayments with clarity. It helps you to choose the right loan amount and repayment tenure by providing the EMI estimates. The calculator not only helps you with the future financial planning but it also helps to maintain a good credit score. This reduces the future stress of repaying the loan in the longer run.

FAQs

1-what are the benefits of a loan EMI calculator?

A loan EMI calculator helps you to reduce your repayment tenure by providing EMI estimates and also helps you maintain a good credit score.

2- How does an EMI calculator work for a personal loan?

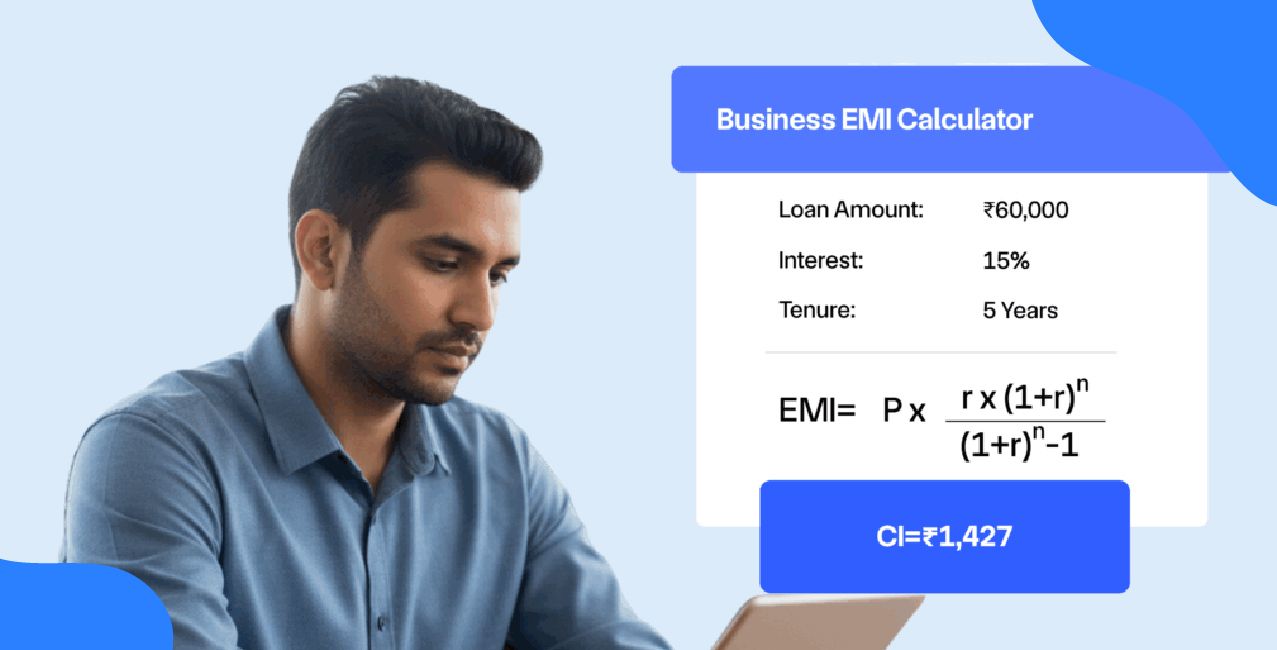

An EMI calculator works on three important pieces of information, loan amount, interest rate, and loan tenure, to give instant estimated EMIs for your personal loan.

3- Is the EMI calculator useful for comparing lenders?

Absolutely. You can enter different interest rates and tenures to compare EMIs across banks and choose the most cost-effective option.

4-How to use the EMI calculator?

You have to enter the principal amount, interest rate (annual), and tenure in months/years to use the EMI calculator for accurate results.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Personal Loan Prepayment EMI Calculator: Reduce EMI & Interest

LIC Personal Loan EMI Calculator: Calculate EMI Instantly

Kotak Personal Loan EMI Calculator: Check EMI & Loan Cost Easily

Recent Blogs

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article