RBI Revises Kisan Credit Card Draft Norms For Wider Farm Loan Access

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

India’s central bank has floated draft changes to the Kisan Credit Card framework, pushing higher flexibility, longer tenure, and wider eligible uses for farm credit.

Draft directions to refresh the Kisan Credit Card (KCC) scheme are now open for public feedback till March 6, 2026, according to multiple reports. The proposals aim to widen loan support for farmers by aligning limits with crop costs, standardising crop cycles, and extending the product’s overall tenure.

One reported highlight is a possible waiver of collateral and margin for agricultural and allied loans up to ₹2,00,000 per borrower, alongside a small-ticket flexible limit for marginal farmers. The draft also expands what farmers can fund, including soil testing and real-time weather inputs.

What Is Being Flagged In The Draft KCC Changes

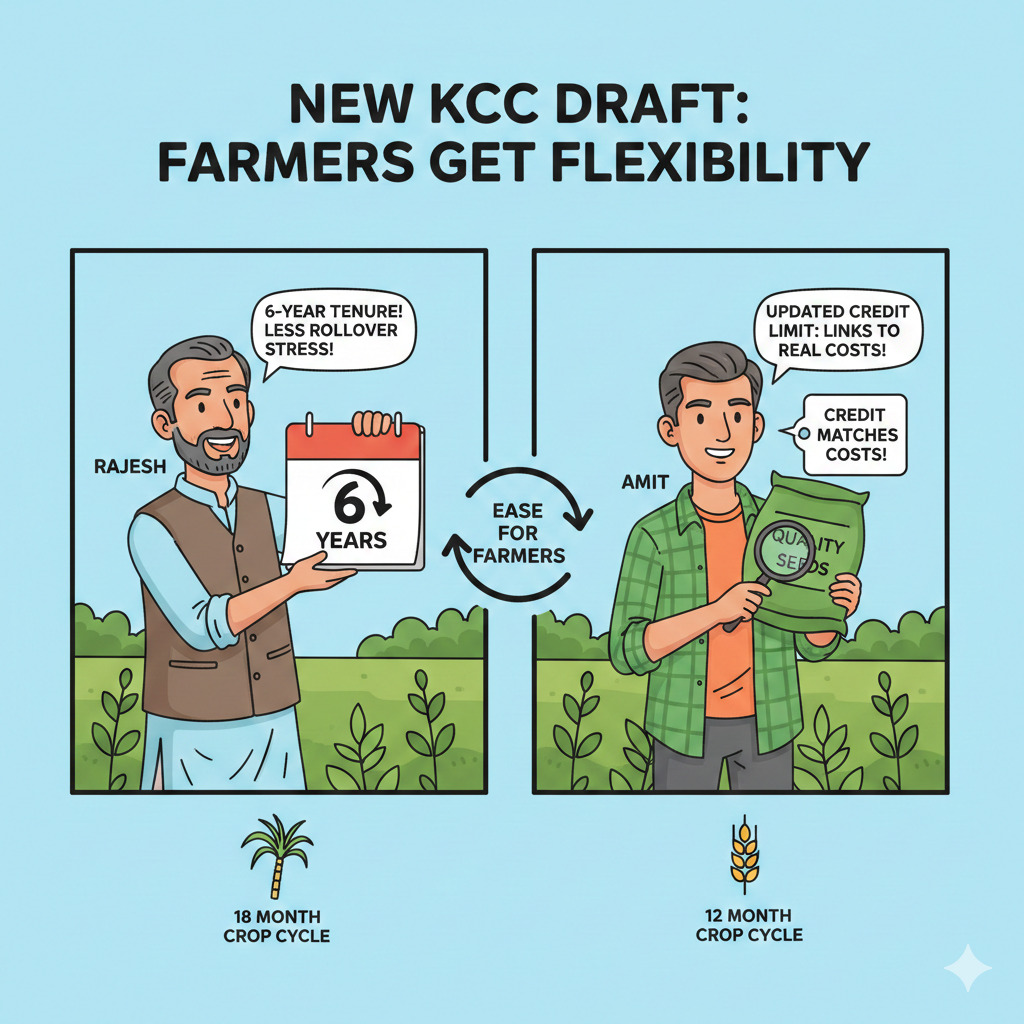

The draft centres on two everyday constraints for farmers: credit limits that do not always match actual input costs, and repayment timelines that feel misaligned to crop cycles. Reports say the draft proposes that drawing limits under KCC be linked to crop-wise scale of finance, so limits track cultivation economics more closely.

It also standardises crop seasons by duration: 12 months for short-duration crops and 18 months for long-duration crops. To match those cycles, the KCC tenure is proposed to be extended to 6 years, which could ease rollover pressure for longer-duration cultivation and allied activities.

Before the details, here is a quick snapshot of the headline proposals.

These proposals are being positioned as a practical shift in how farm credit is sized, timed, and used, rather than a cosmetic tweak.

What The Draft Changes Actually Do?

The draft broadens the “what can be funded” side of KCC in a way that reflects current farming practices. Reports highlight that technology-linked inputs such as soil testing and real-time weather forecasts are part of the eligible expense basket, along with organic or good agricultural practices (GAP) certification.

Another key reported feature is on smaller-ticket credit access. NewsOnAir reported a waiver of collateral and margin requirements for agricultural and allied loans up to ₹2,00,000 per borrower. The same report mentioned a flexible credit band of ₹10,000 to ₹50,000 for marginal farmers holding up to 1 hectare.

This is where the draft becomes especially relevant for last-mile credit. A small flexible band can work like working capital for input purchases and emergency spends, while a collateral-free cap supports borrowers who struggle to provide security.

Here is the granular, farmer-facing set of numbers being tracked by news reports.

What Happened Earlier And Why This Is Coming Now

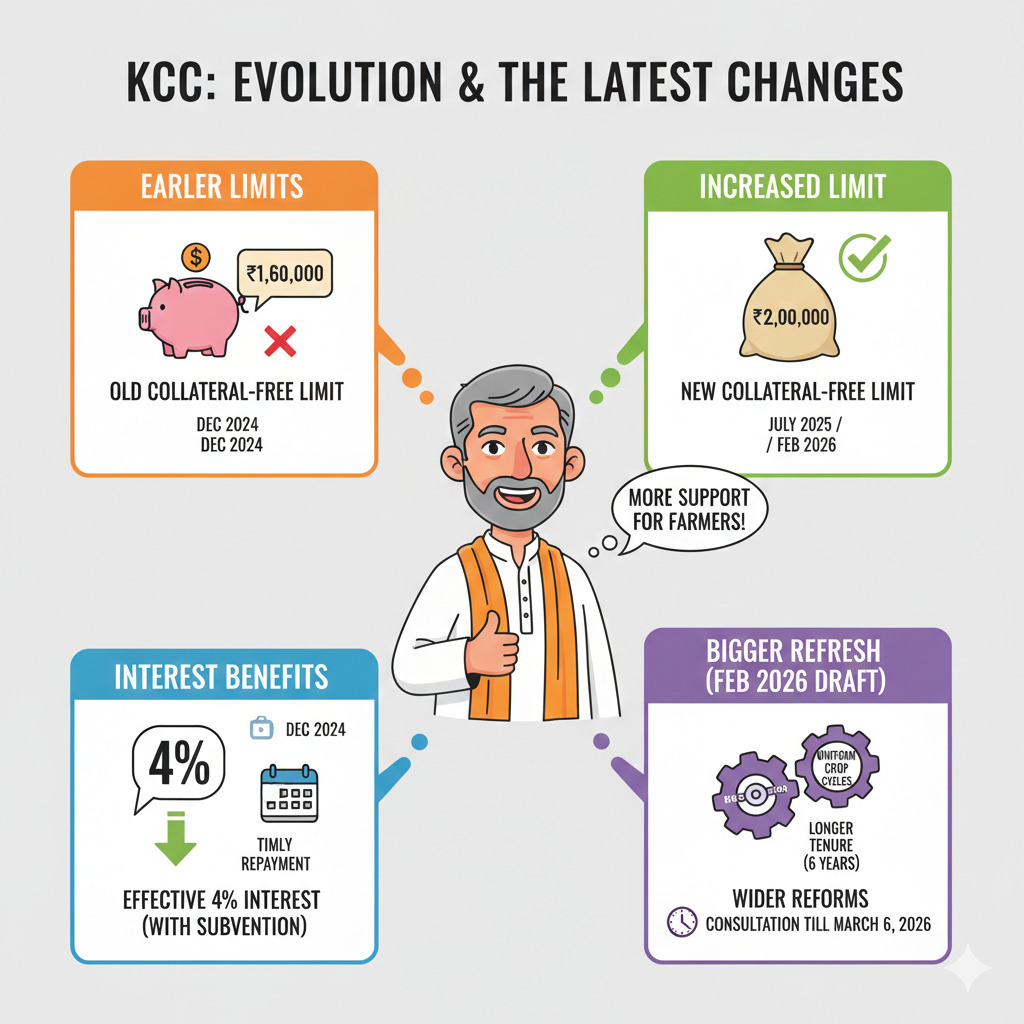

This is not the first time collateral-free thresholds in farm lending have come up. Reuters reported on December 6, 2024 that the collateral-free agriculture loan limit was raised from ₹1,60,000 to ₹2,00,000, citing inflation and higher input costs. That older move is now showing up again in current reporting as the draft discusses waivers up to ₹2,00,000.

On the scheme side, LoansJagat, in a guide dated July 29, 2025, highlighted that KCC’s effective interest can go down to 4% for timely repayment, under the commonly reported interest subvention and incentive structure. It also notes that loans up to ₹2,00,000 are typically treated as collateral-free, while higher amounts may require security based on bank policy.

Mainstream business dailies have framed the February 2026 draft as a wider refresh that includes uniform crop cycles and a longer tenure, while keeping the consultation window open till March 6, 2026.

What Stakeholders Are Saying?

In public-facing coverage, the draft is being described as an attempt to broaden KCC coverage and streamline operations. Farmer-side expectations, as reflected in explainers, are focused on easier access to credit without heavy security requirements, and loan uses that match present-day farming choices like soil health and weather-led decision-making.

Banking and market-focused outlets have also highlighted the operational shift towards cost-aligned limits and standardised crop durations.

Conclusion

If the draft is finalised largely along reported lines, KCC could become more usable through 6-year tenure, 12 to 18-month crop cycles, and wider eligible spends. The consultation window till March 6, 2026 will decide what stays, what gets tightened, and what gets expanded.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Home Loan Interest Rates 2025 Deliver Major EMI Relief, Will Borrowers See More Gains In 2026?

Will the Indian Rupee Stabilise in 2026 After a Volatile 2025?

RBI Draft Rules Target Surprise Costs in Overseas Payments

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article