Natural Calamities: RBI Drafts New Relief Norms For Stressed Borrowers

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

India’s banking regulator wants a standard playbook for loan relief after floods, landslides and cyclones, with tighter eligibility and clear deadlines for lenders.

The Reserve Bank of India has circulated draft rules asking banks and other regulated entities to pre-build disaster relief steps into their credit policies, instead of waiting for case-by-case relaxations.

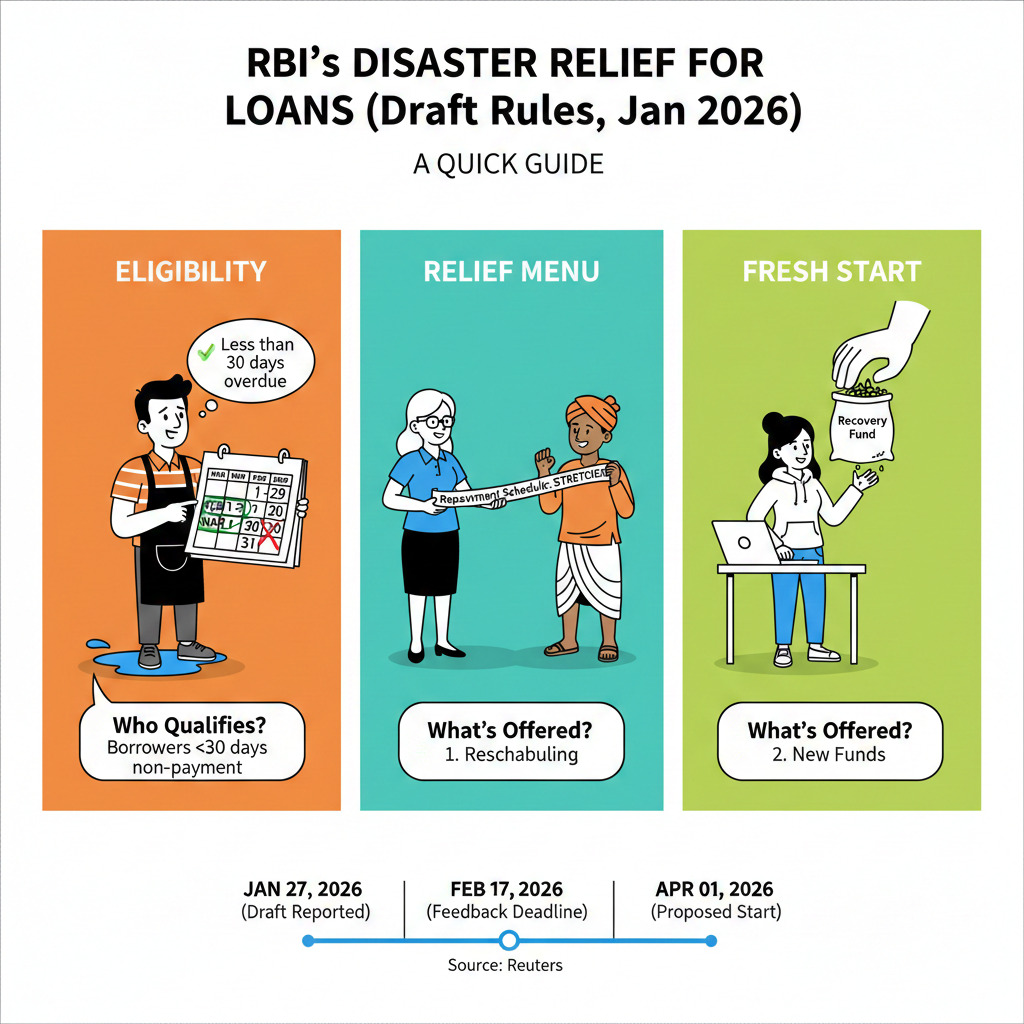

The draft, reported on January 27, 2026, keeps lenders in the driver’s seat on designing a resolution plan, but sets guardrails on who qualifies and what can be offered. Feedback is open till February 17, 2026, and the framework is proposed to start from April 01, 2026.

Relief timelines and consultation dates are a big part of this draft. If finalised, lenders will need internal processes ready before the monsoon cycle builds pressure on repayments in flood-prone districts.

What Is The Issue And Why It Is In Focus?

Natural calamities can wipe out cash flows overnight, especially for small businesses, farmers, and households in hill states and coastal belts. The draft tries to standardise how credit stress is handled in such events, so relief is quicker and more predictable across lenders.

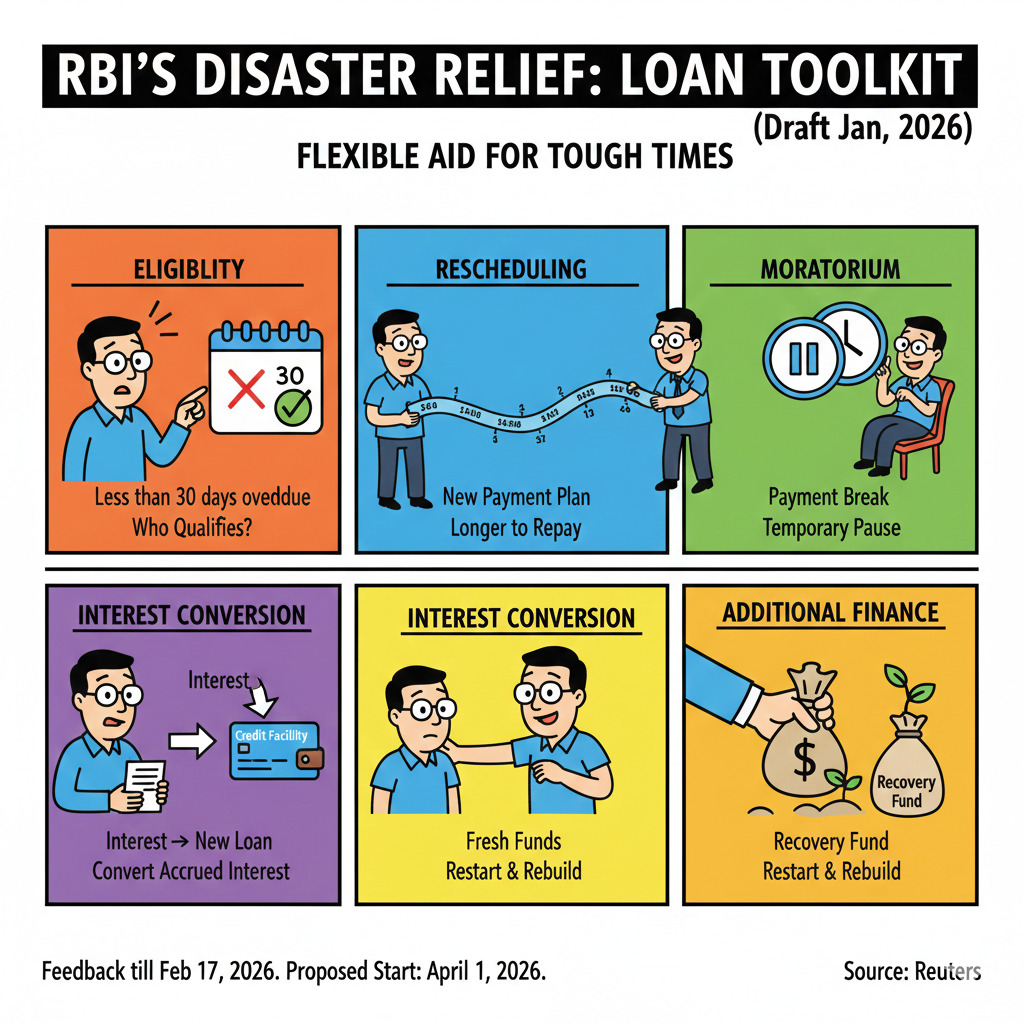

The rules also tighten who can get support: only borrowers who have not defaulted for more than 30 days qualify, as per the draft coverage.

Reuters flagged recent losses in agricultural states like Punjab and Assam due to flooding, and damage in Uttarakhand and Jammu and Kashmir from flash floods and landslides, as a backdrop to the move.

What The Draft Allows Banks To Offer?

The central design is a “principle-based” approach where regulated entities get discretion to craft and implement a resolution plan, based on viability assessment.

The draft’s relief toolkit, as reported across outlets, includes changing the repayment schedule, giving payment breaks, and even extending fresh funds where the borrower can recover.

Here is how the core eligibility and relief menu looks in plain terms.

This framework is aimed at avoiding panic downgrades and knee-jerk collection action right after a disaster, while still keeping lending discipline intact.

Previous Developments

The draft is landing as India’s climate and disaster risk profile stays elevated. Germanwatch’s Climate Risk Index 2025, released on February 12, 2025, places India at rank 6 for the long-term period 1993–2022, with 400+ extreme weather events, 80,000+ deaths and $180 billion in losses cited widely in coverage.

In the same climate-risk thread, Reuters reported on January 29, 2026 that the central bank has deferred its plan to mandate climate risk disclosures by banks, according to sources. The proposed disclosure regime was earlier aimed at getting banks to report climate-linked risks in loan books, but was paused amid cost concerns and gaps in corporate disclosure requirements.

There is also the financial-stability angle. Liquidity conditions have been tight at points this month, and bond-market support has been in focus. LoansJagat reported that Economic Times (dated January 17, 2026) said the central bank had already bought ₹2.54 trillion of bonds since December through open market and secondary market purchases.

Reuters too has tracked large bond purchases and liquidity injections in recent weeks, tying them to system liquidity and yields.

Put together, policymakers are trying to keep credit moving, while preparing for repeated climate shocks that hit repayment cycles.

Statements By Stakeholders

Reuters quoted the draft as envisaging a “principle-based” resolution regime with “complete discretion” for regulated entities on designing and implementing the resolution plan. Business Standard also highlighted that only Standard exposures with up to 30 days default on the event date are eligible, signalling a tighter filter than blanket relaxations.

PTI coverage said lenders will be required to factor disaster impact while framing credit policies, so the playbook is ready before the next event hits.

Conclusion

The draft relief framework is a push for faster, more uniform disaster support, with lenders getting flexibility but borrowers facing a firm eligibility bar. The feedback window till February 17, 2026 will decide how workable the guardrails feel on the ground.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Home Loan Interest Rates 2025 Deliver Major EMI Relief, Will Borrowers See More Gains In 2026?

Will the Indian Rupee Stabilise in 2026 After a Volatile 2025?

RBI Draft Rules Target Surprise Costs in Overseas Payments

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article