HDFC Bank SIP Calculator – Returns, Formula & Growth

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Insights

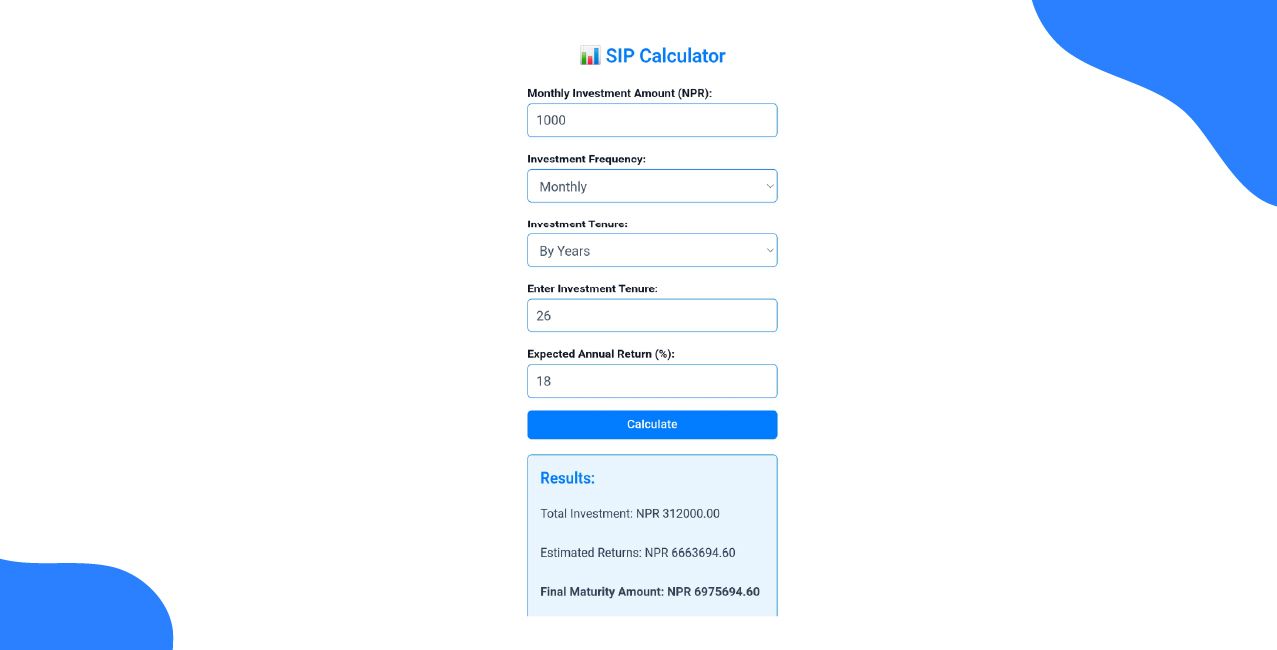

- Enter your monthly SIP amount, the return rate you expect, and your investment period. The HDFC Bank SIP calculator will then show you how much you could save.

- If you want to know how much to invest each month to reach your goal, enter your target amount in the HDFC Bank SIP calculator and the time you have to save.

- You can also use the calculator to see if your current SIP will help you reach your future goal.

The HDFC Bank SIP Calculator shows you exactly how much your money can grow with sip calculator hdfc growth, whether you want to check returns from the hdfc sip returns last 5 years or see your long-term gains for the next hdfc sip returns last 10 years.

How to Use the HDFC Bank SIP Calculator?

If you want to forget about complicated calculations. The interactive HDFC SIP calculator helps you see how your investments can grow, so you can make each SIP with HDFC a confident move toward your financial goals.

This digital tool helps you estimate how much your Systematic Investment Plan could be worth in the future. It works like a financial simulator for your HDFC SIP calculator investments. Just enter your monthly investment, expected rate of return, and time frame to view a clear growth chart.

If I invest ₹10,000 in an equity fund with an HDFC SIP expected 12% return for 15 years, the HDFC mutual fund hdfc calculator estimates I could build a corpus of over ₹50,00,000.

Bonus Tip: Use the sliders to change any of the variables. If you raise the interest rate or loan amount, your EMI will go up. If you make the tenure longer, your EMI will go down. Set the values to match what you need.

SIP Investment Examples

Still guessing how to build wealth with SIPs? These real examples show you exactly how disciplined saving can turn into serious money.

Example 1: The Young Professional’s Wealth-Building Start

Ever watched a video like “My ₹5,000 SIP Strategy” and wondered how much you actually need to invest to hit ₹1 Crore? That’s exactly what happened to a 25-year-old IT professional looking to build long-term wealth.

She plugged her numbers into the HDFC SIP calculator online. With a ₹10,000 monthly SIP, a 12% annual return, and 25 years on her side, the calculator showed she could reach ₹1.87 Crores.

That one calculation made compounding feel real and achievable. She started her SIP right away, just like many first-time investors do after seeing the numbers for themselves.

Example 2: The Mid-Career Parent's Education Planning

A 40-year-old parent read an article about planning for children's education. With 12 years left before college, he wanted to find out how much he should invest each month to build a ₹50 lakh fund.

He used the calculator by entering his goal of ₹50,00,000, a 12-year timeframe, and a conservative 10% expected return from a balanced fund. The HDFC SIP calculator showed he would need to invest ₹18,500 each month.

The calculator turned a stressful guessing game into a clear monthly goal. If he knows the exact amount, this will help him adjust his budget with confidence, which financial planners often recommend.

Example 3: The Pre-Retiree's Corpus Gap Analysis

A 50-year-old, with 10 years left before retirement, saw a news story about people not saving enough for retirement. He already had some savings but was concerned it might fall short.

He realised he needed ₹1 Crore more to reach his goal. To check if he could make up the difference, he used the HDFC SIP calculator. By entering a monthly SIP of ₹40,000 for 10 years at an 11% return, the calculator showed he could reach about ₹86,00,000, which almost closed the gap.

The calculator gave him a clear picture of his situation and a plan to catch up. Instead of feeling anxious, he now had a practical solution and felt motivated to increase his SIP contribution. This is a good example of how calculators can help with pre-retirement planning.

Conclusion

The HDFC SIP Calculator offers more than just numbers. It helps build financial confidence and turns saving from a vague task into a clear, empowering path toward your biggest life goals.

FAQs

Is the SIP plan in HDFC BAF Good?

If you want steady growth without taking big risks, this fund could work for you. It balances stocks and bonds and uses rupee cost averaging, so you don’t have to time the market. But don’t just look at the 18.5% returns from the last three years. Check if you’re comfortable with the risk and the higher expense ratio that comes with hybrid funds.

How accurate are the estimated returns for the Stocks SIP?

SIP return estimates are not exact. They are based on past averages and do not guarantee future results. Actual returns can change depending on the market, the fund you choose, and how long you invest. Methods like XIRR help give a more accurate estimate by considering when each payment is made. This makes them a useful planning tool, but not a guarantee.

What are some good SIP options with HDFC Bank?

HDFC Bank offers a range of SIP options to suit different risk levels. Popular choices include the HDFC Balanced Advantage Fund, HDFC Flexi Cap Fund, HDFC Mid-Cap Opportunities, and the HDFC ELSS Tax Saver Fund for tax benefits.

How can an SIP return calculator help you?

An SIP return calculator lets you see how your investments might grow over time. It helps you plan for specific goals, compare different investment options, and understand how compounding and rupee cost averaging work. This tool saves you from doing complicated calculations yourself.

What does a “Pause” in SIP refer to?

The Pause feature in a SIP allows investors to temporarily stop their SIP payments for up to three months. They can cancel the pause and restart their investments at any time.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

ET Money SIP Calculator: Calculate SIP Returns Instantly

One Time SIP Calculator: Calculate Lump Sum SIP Returns

Aditya Birla SIP Calculator: Plan Investments the Smart Way

Recent Blogs

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article