HDFC Bank Mobile Banking – Features, App & Services Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- HDFC Bank Mobile Banking lets you manage your money easily with secure access to all essential banking services.

- Using HDFC Bank Mobile Banking you can check balances, pay bills, transfer funds, and invest anytime without visiting a branch.

- The HDFC Bank Mobile Banking app is simple to register, safe to use, and ideal for both personal and business banking needs.

Skip this if waiting in bank lines doesn’t bother you. With HDFC’s mobile app, everyday banking becomes quick, secure, and completely digital.

HDFC Bank Mobile Banking offers a convenient way to manage your finances anytime, anywhere. It allows users to check balances, transfer money, pay bills, and invest securely through their mobile phones.

I am a marketing professional, who uses HDFC Bank Mobile Banking to handle my daily transactions without visiting a branch. I check my salary credit (₹67,000), pay electricity bills (₹5,000), and transfer funds instantly using IMPS. Even when travelling, I can monitor my spending and manage my savings directly from the app.

The app’s user-friendly design, quick registration, and strong security features make digital banking effortless for individuals and businesses alike.

In this blog, we will explore how to register for the service, the types of mobile banking apps HDFC Bank offers, transaction limits, and key benefits to help you use HDFC Bank Mobile Banking effectively.

Types of HDFC Bank Mobile Banking Apps

HDFC Bank Mobile Banking Apps offer different tools for personal, business, and investment needs. Each app helps users manage money quickly and securely through HDFC Mobile Banking.

Each HDFC Bank Mobile Banking App is tailored to meet specific customer needs, making HDFC Mobile Banking simple, flexible, and secure for both individuals and businesses.

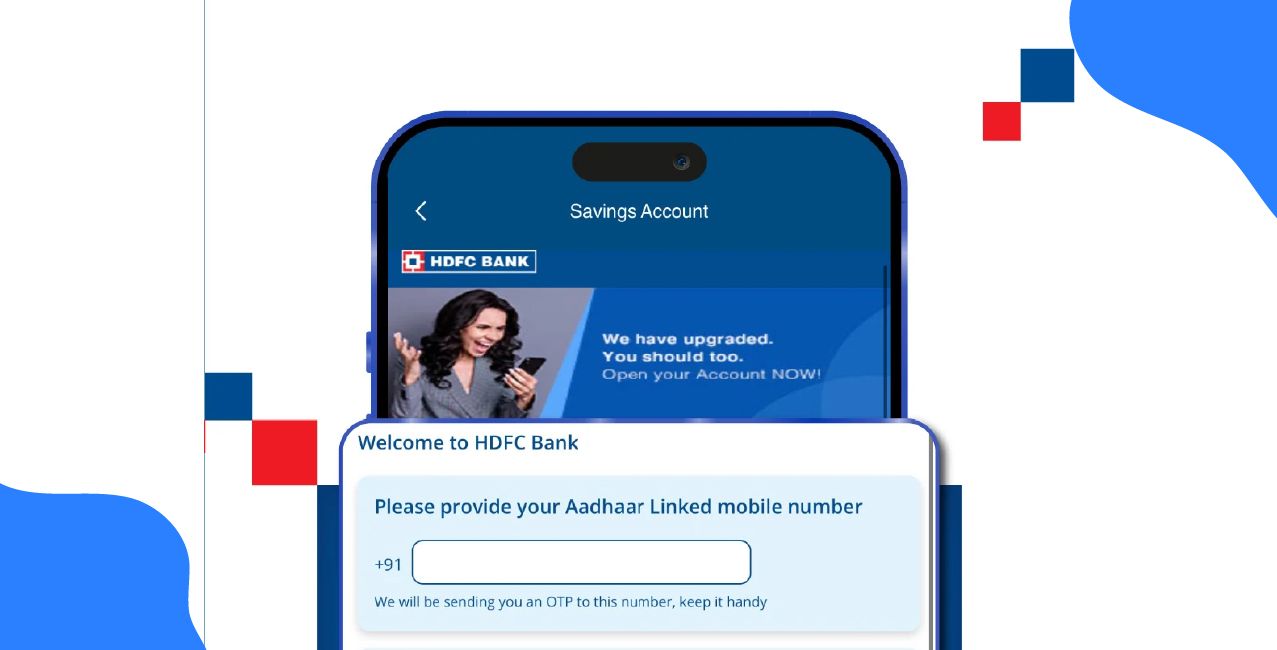

How to Register for HDFC Bank Mobile Banking?

Registering for HDFC Bank Mobile Banking is quick and easy. You can complete the process directly on your phone in just a few steps.

Read More – Bank of India Mobile Banking

Step 1: Download the App

Go to the Apple App Store or Google Play Store and download the HDFC Bank MobileBanking App. Make sure you choose the official version by HDFC Bank.

Step 2: Open the App

After installation, launch the app and tap on the “Register” option to start your registration.

Step 3: Enter Details

Enter your Customer ID and your registered mobile number as requested on the screen.

Step 4: Verify with OTP

You will receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to verify your identity.

Step 5: Complete Registration

- If you already use NetBanking, Log in using your Customer ID and NetBanking IPIN (Internet Banking Password).

- If you are a new user: Enter your debit card details to set a new IPIN for mobile banking access.

Step 6: Set Up Quick Access (Optional)

For faster logins, set up a 4-digit Quick Access PIN or enable biometric login such as fingerprint or face recognition.

By following these steps, you can easily complete your HDFC Bank Mobile Banking download and registration. Once set up, you can manage your finances, transfer money, and make payments securely from your phone anytime, anywhere.

HDFC Bank Mobile Banking Transaction Limits

When you use HDFC Bank Mobile Banking, there are specific limits on how much money you can transfer through IMPS. These limits ensure secure and smooth transactions for all customers.

Before making large transfers after your HDFC Bank Mobile Banking login, check your daily and per-transaction limits. Following these limits helps keep your transfers safe and ensures your transactions go through smoothly.

How to Login to HDFC Mobile Banking?

Logging in to HDFC Mobile Banking is quick and secure.

- First, download the HDFC MobileBanking app from the Play Store or App Store.

- Open the app and enter your registered mobile number.

- You will receive an OTP to verify your identity.

- After verification, create a four-digit Quick Access PIN or use your existing Customer ID and password to log in.

- Once set up, you can access your account, check balances, make payments and manage services with ease.

The app lets you log in instantly on future visits using your PIN, fingerprint or Face ID.

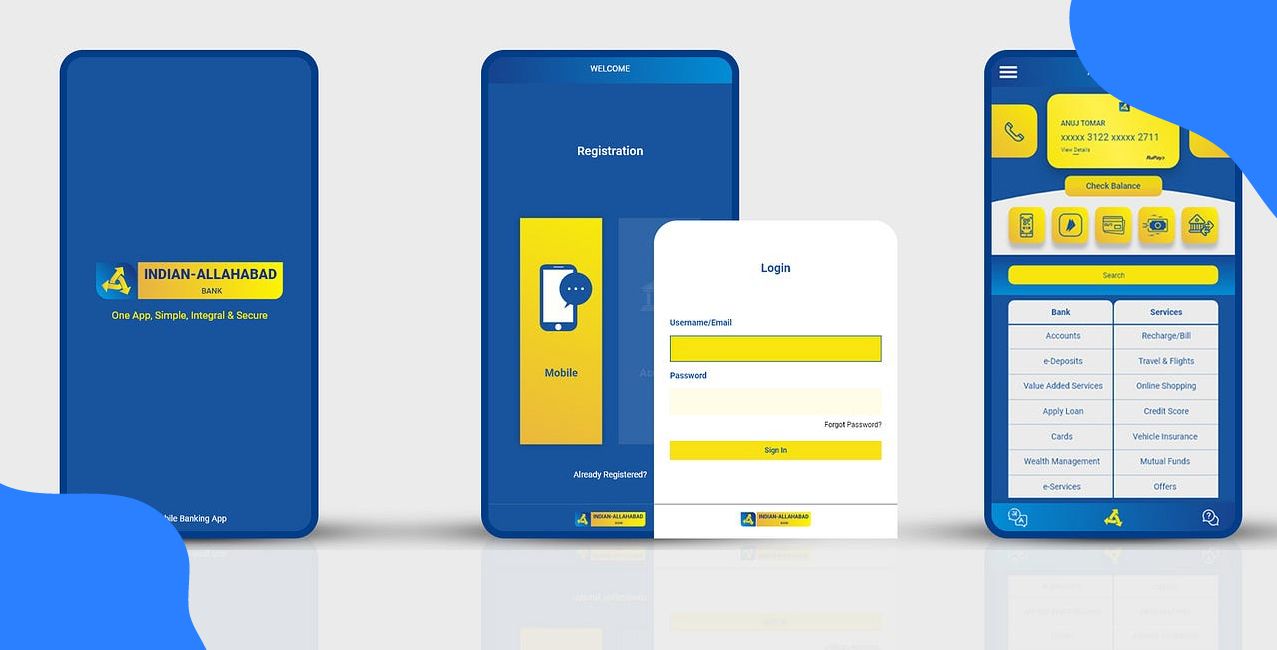

Also Read – Indian Bank Mobile Banking

HDFC Mobile Banking Customer Care

If you need any sort of assistance, you can easily connect with HDFC customer care by calling 18001600 / 18002600. These numbers are accessible from all over India.

Conclusion

HDFC Bank Mobile Banking makes everyday banking simple, fast, and secure. It allows you to check balances, transfer money, pay bills, and manage investments from your phone at any time. With easy registration, clear transaction limits, and reliable security features, HDFC Bank Mobile Banking helps you stay in control of your finances wherever you are.

Bonus Tip: Do you know? Rishabh Pant is leading HDFC Life’s new protection campaign.

FAQs

Q: Is HDFC mobile banking safe?

A: Yes, HDFC mobile banking is safe if you use it carefully. The app uses PIN/MPIN, biometrics, OTP for transactions, encryption, and fraud monitoring. Always keep your device secure and update the app regularly.

Q: How can I remove a device from my HDFC mobile banking app?

A: Open the HDFC app, then go to Settings, then Security & Devices, select the device, then tap Remove/Log out and confirm with MPIN/OTP. You can also remove devices via NetBanking or by contacting HDFC customer care. After removal, the device cannot access your account.

Q: What should I do if the HDFC mobile banking app is not working?

A: Restart your phone, check your internet, update or reinstall the app, then contact HDFC customer care if it still doesn’t work.

Q: Can I use HDFC mobile banking on multiple devices?

A: Yes, you can register multiple devices, but each device must be authorised via MPIN/OTP. You can manage or remove devices anytime from the app or NetBanking for security.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

What is Retail Banking: Services Offered & Role in Personal Finance

What is AEPS in Banking? The Thumb‑Powered Financial Revolution

Indian Bank Mobile Banking: Features, App & Services

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article