How to Close Paytm Postpaid – A Complete 2025 Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

“Arjun, what is this Paytm Postpaid?” his mother asked while chopping vegetables in the kitchen.

Arjun, sipping his tea, smiled. “It’s like a credit system, Mom. Buy now, pay next month.”

His mother frowned. “Since when did borrowing money become a habit?”

Arjun was struck hard by just one question. Convenience led him to start using Paytm Postpaid, but eventually, it turned into a vicious cycle of buying now and worrying later. He continued to accrue bills and occasionally even missed deadlines, which resulted in further fees. Now was the moment to take charge.

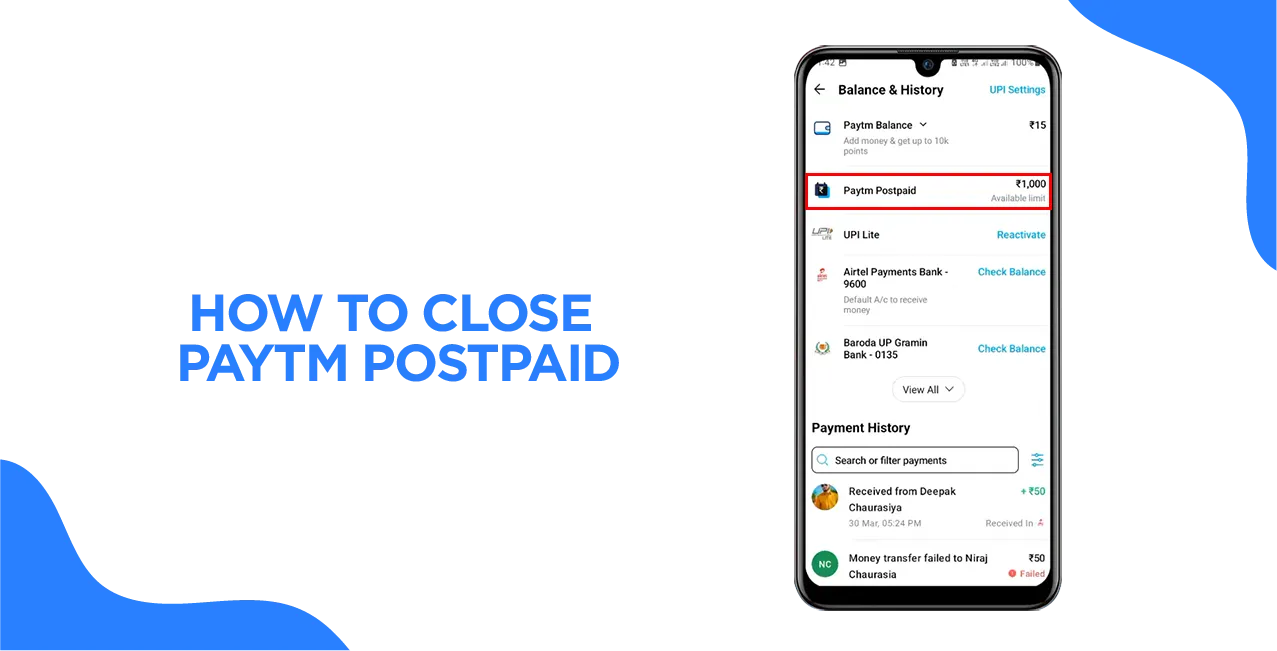

Determined, he launched the Paytm app, touched on “Help” in the upper right corner, chose “Paytm Postpaid,” and went to “Balance and History.” He selected “I want to close my Paytm Postpaid account” after scrolling down and clicking “Contact Us.”

He smiled and said to his mother, “No more needless credit, Mom,” after receiving the email confirming that his Paytm Postpaid had been deleted a month later. I will only spend what I have from now on.”

She patted his back and said, “Smart decision. True wealth is knowing how to manage your money.”

Key Points to Consider Before Closing Your Paytm Postpaid

To guarantee a seamless deactivation process, take into account the following important factors prior to terminating your Paytm Postpaid account:

Clear All Outstanding Dues: Make sure you have paid off any outstanding balances on your Paytm Postpaid account. Your account may not be closed if there are any outstanding amounts.

Avoid Using Paytm Postpaid Post-Request: Don't use the Paytm Postpaid service after completing your deactivation request. Your closure request may be revoked for any transactions performed during this time.

Read More – Paytm HDFC Credit CardUnderstand the Deactivation Timeline: Deactivation takes time to complete. Usually, on the eighth day of the month after your request, your Paytm Postpaid account will be closed. For example, the account will be terminated on February 8th if you file a closure request on January 15th.

Obtain a No Dues Certificate (NOC): To verify that all outstanding balances have been paid off and the account has been formally ended, ask your lending partner for a No Dues Certificate after it has been closed.

Monitor Your Credit Report: Your credit score may be momentarily impacted if you close your Paytm Postpaid account. Furthermore, it may take two to three months for your credit record to reflect the closure. To guarantee correct changes, keep a close eye on your credit report throughout this time.

Consider Future Credit Needs: The length and variety of your credit history may be impacted if Paytm Postpaid is the sole credit account you currently have open. Before moving further, consider how this choice will affect your future credit needs.

You may guarantee a smooth and knowledgeable closure of your Paytm Postpaid account by bearing these things in mind.

Documents Required to Close Paytm Postpaid

Make sure all outstanding payments are paid before closing your Paytm Postpaid account. Usually, the deactivation procedure doesn’t involve any further paperwork. However, you can get in touch with Paytm’s customer service or your loan partner directly if you run into problems or require more help:

- Clix Finance India Pvt. Ltd. (for Paytm Postpaid Lite): Email: hello@clix.capital

Aditya Birla Finance Ltd. (for Paytm Postpaid Delite): Email: care.finance@adtiyabirlacapital.com

You can visit Paytm’s official help page for further instructions on the closure procedure.

Paytm Postpaid Closing Charges

There are no special fees associated with terminating your Paytm Postpaid account. Nonetheless, the following factors must be taken into account:

- Outstanding Dues: Before starting the closure, make sure all outstanding debts have been paid. Depending on the amount that is past due, unpaid balances may be subject to late fines that range from ₹0 to ₹750 + GST.

- Convenience Fees: Although there are no fees for closing the account, depending on the lender’s policy, a small convenience fee of 0% to 3% is applied to monthly expenditures while the account is being used regularly.

Credit Score Impact: Your credit score is positively impacted by timely repayment, while delays or defaults may have the opposite effect. Your credit score may be impacted by the length and diversity of your credit history if you close the account.

Even if terminating your Paytm Postpaid account doesn’t incur any fees, it’s important to pay off all outstanding balances to prevent penalties and take into mind the possible effects on your credit score.

How to Close Paytm Postpaid Online (Is It Possible?)

In case, you have a balance:

- Make use of the remaining funds by using any Paytm service.

- Move the remaining amount to any other Paytm phone number that is registered.

Move funds to any bank account.

Before you close your account, here are some things you should know:

When you close your account, the accompanying login ID and password are no longer active, and your phone number is unlinked. In effect, you are no longer able to use these tokens to log into Paytm.

According to RBI rules dated October 11, 2017, Paragraph 9, Point No. 9.1 (i), (g), and (k), you can only transfer your balance from one Paytm account to another Paytm account or bank account after completing KYC.

Your transaction logs must be kept for a maximum of ten years following the deletion of an account, per PMLA (Prevention of Money Laundering Act) recommendations section 12, points no. 3 & 4 (bit.ly/fiuindia) and PPI guidelines paragraph 6, point no. 6.3 (bit.ly/ppiwallet). No third party will ever have access to this data, which is kept on servers in India. This information will only be available to government authorities that are required by law to get it through a legally valid data request.

Steps to deactivate Paytm Postpaid Account:

Step 1: You will have to log in to Paytm with your old phone number.

Step 2: Click "☰" in the upper left corner of the home screen.

Step 3: Go to 24×7 Help.

Step 4: You need to go to "Profile Settings."

Step 5: Choose "I need to delete or close my account."

Step 6: Choose "This Paytm account is not used by me."

Step 7: Select "Message us" to submit a request.

Step 8: Your request will be verified by Paytm and will be closed after review.

How to Close Paytm Postpaid Offline (Step-by-Step Guide)

You must get in touch with Paytm’s customer service or the relevant lending partners directly in order to close your Paytm Postpaid account offline. Here’s how to go about it:

Contact Paytm Customer Support:

- Phone: Dial Paytm’s customer care number at 0120-4456-456.

Email: Send a detailed request to care@paytm.com, specifying your intention to close your Paytm Postpaid account.

Reach Out to Lending Partners:

Get in touch with the relevant lending partner based on your Paytm Postpaid variant:

Clix Finance India Pvt. Ltd. (for Paytm Postpaid Lite): Email: hellp@clix.capital.

Aditya Birla Finance Ltd. (for Paytm Postpaid Delite): Email: care.finance@adityabirlacapital.com

Steps to Follow:

- Settle Outstanding Dues: To prevent any issues, make sure all outstanding debts are paid before starting the closure.

- Prepare Necessary Information: Prepare your registered mobile number, account information, and any other necessary paperwork so that your identification may be confirmed.

- Submit a written Request: Write a brief and straightforward request to close your account, including your account information and the reason for the closure, if you are contacting via email.

Await Confirmation: Paytm or the loan partner will verify the closure once your request has been processed. Depending on their processing cycle, this could take until the eighth day of the following month.

Important Consideration:

Avoid Post-Request Transactions: After filling your closure request, avoid utilising Paytm Postpaid services since any further transactions may cause the closure procedure to be cancelled.

Monitor Your Credit Report: Your credit score may be impacted if you close the account. To make sure the closure is appropriately reported, check your credit report on a regular basis.

You can successfully terminate your Paytm Postpaid account via offline channels by following these procedures.

How to Check the Status of Your Paytm Postpaid Closure Request

To check the status of your Paytm Postpaid closure request, follow these steps:

- Await Confirmation Email: After submitting your closure request, Paytm typically processes it within 1-2 business days. You should receive an email confirming the deactivation of your Paytm Postpaid account.

Contact Paytm Customer Support: If you haven’t received a confirmation or wish to inquire about the status:

Via App:

- Open the Paytm app and log in.

- Navigate to '☰' (Menu) > 'Help & Support' > '24x7 Help'.

- Select “Paytm Postpaid’ and Choose ‘Issue with Paytm Postpaid account status’.

Tap on ‘Chat with us’ to connect with a support representative.

Via Email: Send an email detailing your query to care@paytm.com

- Monitor Your Credit Report: It could take two to three months for your credit record to reflect the closure of your Paytm Postpaid account.

You can verify the status of the account closure by routinely checking your credit report.

These steps can help you effectively monitor the status of your Paytm Postpaid closure request.

Common Issues Faced During Paytm Postpaid Closure & How to Resolve Them

It can be difficult to close your Paytm Postpaid account at times. The following are typical problems users run across throughout the closing process, along with solutions:

Incomplete KYC Verification:

Issue: The termination of your Paytm Postpaid account may be impeded by an insufficient Know Your Customer (KYC) verification.

Resolution: Go to your profile in the Paytm app, choose 'Complete KYC,' and then follow the instructions to send in the required paperwork to finish your KYC.

Pending Dues:

- Issue: Outstanding balances on your Paytm Postpaid account can prevent successful closure.

Resolution: Before starting the closure request, make sure all outstanding payments have been made. Use the Paytm app to view your account statement and settle any outstanding balances.

Lack of Direct Closure Option in App:

- Issue: It can be difficult for some users to identify the app's account closing option.

Resolution: To request account deactivation, email Paytm customer support at care@paytm.com or use the app's 'Help & Support' section if the option isn't easily accessible.

Delay in Closure Confirmation:

- Issue: After submitting a closure request, there might be a delay in receiving confirmation.

Resolution: Keep in mind that the deactivation procedure could take some time. If you don't receive confirmation in the anticipated time range, contact customer service for an update.

Impact on Credit Score:

- Issue: Closing your Paytm Postpaid account may affect your credit score.

Resolution: Acknowledge that your credit history may be impacted by account closure. Get a No Objection Certificate (NOC) from the lending partner to verify account closure after making sure all outstanding payments have been paid.

Continued Reporting on Credit Report:

- Issue: Even after closure, the account may still appear on your credit report.

Resolution: 'Closed' is a common record-keeping designation for closed accounts on your credit report. Usually, this has no adverse effect on your credit score.

You can successfully complete the Paytm Postpaid account closure procedure by taking proactive measures to resolve these problems and keeping lines of contact open with Paytm customer service.

Conclusion

The procedure of terminating your Paytm Postpaid account is straightforward, however, cautious measures must be taken to guarantee a seamless deactivation. To prevent delays, all outstanding debts must be paid before starting the request.

You can use the Paytm app to request closure, or you can call or email customer service at care@paytm.com or 0120-4456-456. You can also ask the relevant loan partner for help if necessary.

Also Read - SBI Paytm Credit Card

After processing the request, keep an eye on your credit report to make sure the closure appears accurately. You can successfully and trouble-free terminate your Paytm Postpaid account by following these instructions.

Frequently Asked Questions

Q. How can I deactivate my Paytm postpaid?

Deactivating your Paytm postpaid account can be done using the Paytm app or by emailing Paytm customer support. Contacting customer support, selecting the Paytm postpaid transaction issue, and selecting the delete postpaid account option are the steps in the procedure.

Q. What is the penalty for Paytm postpaid?

There may be a late payment fee if you don't pay your Paytm postpaid dues on time; the precise amount will depend on past defaults and past due amounts.

Q. Does Paytm postpaid affect credit score?

Your credit score may be impacted by Paytm postpaid, yes. When payments are not made, credit bureaus will be notified, which will lower your credit score.

Other Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article