Indian Overseas Bank NEFT Form – Complete Guide & How to Fill

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Insights

- Branch-based IOB NEFT transfers have minimal charges ranging from ₹1.50 to ₹24 + GST. Online NEFT transfers are completely free, which helps you save even more on everyday transactions.

- The amount is credited within 2 hours if you transfer money before the bank's daily NEFT cut-off time, which is 6:30 PM. It's processed in the following batch if you miss the cut-off time.

- Indian Overseas Bank enables online NEFT transfers 24/7. You can transfer the money anytime using the IOB Net Banking or Mobile App, even at midnight for bills or an emergency.

Priyansh was in Chennai. His sister urgently required ₹50,000 for hostel fees, who was studying in Delhi. He chose to use the Indian Overseas Bank NEFT Form rather than get stressed out. He downloaded the form from the internet, carefully filled it out, and submitted it at the closest branch. The money was securely credited to her account in a matter of hours.

You can safely move money from your IOB account to any other bank account that uses the NEFT system by using the Indian Overseas Bank NEFT Form. Let’s walk through every step of Priyansh's journey, from downloading the form to completing the transaction.

How to download the Indian Overseas Bank NEFT Form?

Priyansh sits at his laptop and downloads the Indian Overseas Bank NEFT form from the bank’s website. Here are the steps he followed:

- Visit https://www.iob.bank.in/Upload/Tender/IOB419201761705PM_iob-neft-form.pdf to download the Indian Overseas Bank NEFT form Application.

- Open the PDF and download it.

Print or fill, sign it, and submit the Indian Overseas Bank NEFT Form at your nearest branch.

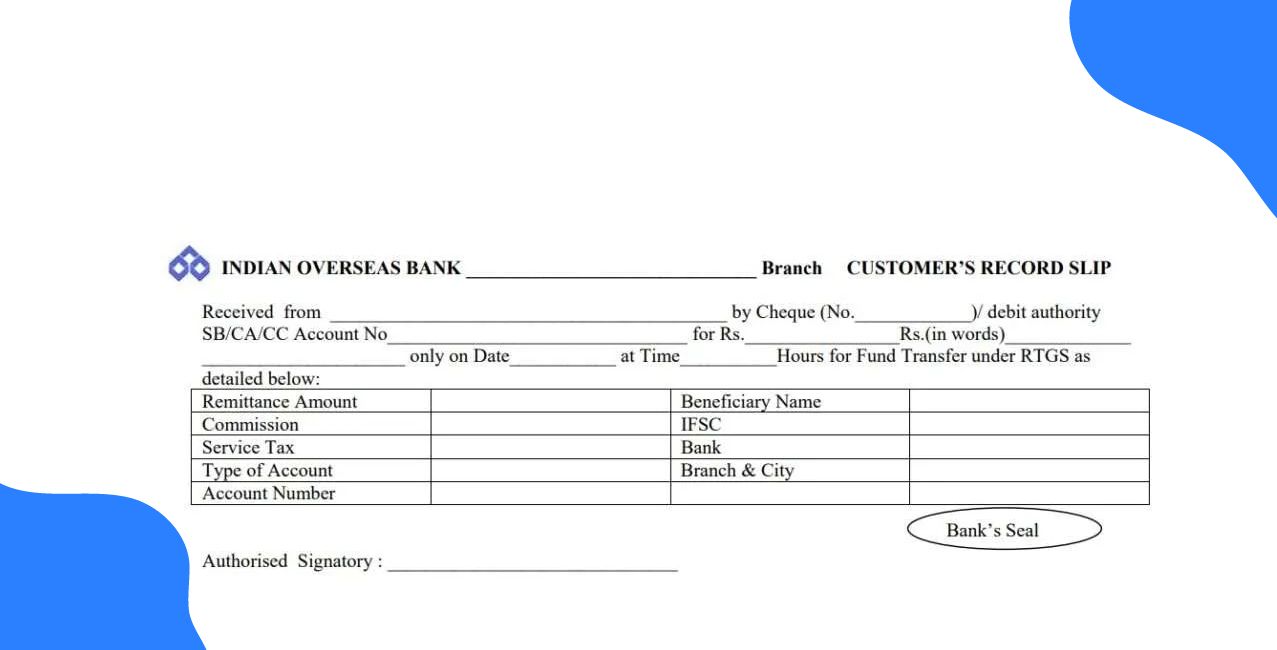

How to fill the Indian Overseas Bank NEFT Form?

Priyansh starts filling IOB NEFT application form and checking every detail after downloading the form from the website. Here are the sections you need to fill out carefully:

Fill every detail in capital letters for clarity and understanding. Verify the IFSC code and account numbers. Keep the acknowledgment slip at the end of the form to be kept with the remitter.

Required Documents for the Indian Overseas Bank NEFT Form

Here are the documents you need to check for filling the Indian Overseas Bank NEFT Form:

- A valid ID proof (Aadhar card/PAN card/Driving License) for verification.

- Indian Overseas Bank account details for debit authorization.

- Beneficiary bank details (Name, IFSC code, Account Number)

Priyansh ensured that he carried all the documents along with the form to his nearest Indian Overseas Bank branch.

Indian Overseas Bank NEFT Charges

Priyansh looked at the NEFT charges at the bank before submitting his Indian Overseas Bank NEFT form. These are the charges you need to pay:

Priyansh also got to know that online transfers are completely free and have no charges.

Indian Overseas Bank NEFT Timings

Priyansh was submitting his form at 11 AM. His timing was absolutely correct as the branch processes NEFT throughout the working days.

Branch NEFT form acceptance and cut-off time may vary by location. Customers should confirm the exact NEFT submission time with their local Indian Overseas Bank branch. Online NEFT is available 24×7 as per RBI guidelines.

Conclusion

Priyansh gets a call from his sister in the same afternoon and confirms the amount has been credited. A simple NEFT transfer by visiting the bank solved a problem within a few hours.

You can also complete your NEFT transfer through the Indian Overseas Bank by following the simple steps. The transfers made by NEFT remain a secure fund transfer option for keeping the official record of the payments.

FAQs on Indian Overseas Bank NEFT Form

How can I track my NEFT transaction status in the Indian Overseas Bank?

You can check the transaction status through net banking or the mobile App. You can also visit the branch with your acknowledgment slip.

Can I cancel an NEFT transfer after submitting the Indian Overseas Bank NEFT form?

No. The transfer cannot be cancelled or reversed after the NEFT request is processed.

What happens if I enter the wrong IFSC code in the Indian Overseas Bank NEFT Form?

The transaction will fail, and the amount will be refunded to your account within 2 working days.

Can I do NEFT from an IOB Current Account?

Yes. Indian Overseas Bank allows NEFT transfers from current accounts, subject to the account’s operating limits and branch verification rules.

Is NEFT transfer through the Indian Overseas Bank secure?

NEFT transactions are processed under the RBI’s regulated payment framework, which follows strict security and monitoring standards to protect customer funds.

Other Related Pages | ||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article