All About GSTR 3: Who Should File, Format & Filing Instructions

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

“Rajeev ne Lucknow mein laddoo beche ₹4,80,000 ke, aur kharida ghee ₹2,00,000 ka. Ab Rajeev ko sirf mithaas nahi, GSTR 3 ka hisaab bhi chukana padega!”

For business owners navigating the Indian tax system, staying compliant with monthly returns can sometimes feel like solving a puzzle with ever-shifting pieces. Among these, GSTR-3 plays a critical role in ensuring that tax liabilities are correctly assessed and credits are appropriately claimed.

But what exactly is GSTR-3, who needs to file it, and how do you go about doing it correctly?

This blog breaks down the essentials of GSTR-3 filing—from understanding who’s required to submit this monthly return, to interpreting the form’s structure and mastering the filing process. Using clear explanations and practical numerical examples, we’ll make sense of this once-mandatory filing mechanism that forms the backbone of accurate Goods and Services Tax (GST) compliance in India.

Let us begin by exploring what GSTR-3 is and how it fits into the wider GST return ecosystem.

What Is GSTR 3?

“Nakhra nahin, yeh tax ka asar hai boss!”

GSTR-3 is like a monthly report card for your business. It shows what your business sold (that’s called outward supply) and what it bought (that’s inward supply). If you run a business and have signed up for GST, you usually need to fill out this form every month; unless you are using a special shortcut tax method or are part of a group that shares services.

It is the government’s way of checking how much tax you collected and how much you already paid, so it can figure out if you need to pay more or get some money back. Simple, right?

This return contains three key data points:

- Details of sales and purchases

- Tax liability and credits

- Net tax payable

Rajeev’s laddoos earned him ₹4,80,000 in sales, and he claimed ₹36,000 as input tax credit on ghee purchases. So, how much tax does he pay?

Here’s a basic table that shows how it works:

Boom! Rajeev must pay ₹50,400 to the government through GSTR 3. Masti bhi, hisaab bhi!

Who Should File GSTR 3?

“Sabko nahi, sirf kuch logon ko milta hai yeh filing ka sukh-dukh!”

Every regular registered taxpayer under the Goods and Services Tax in India must file GSTR 3. But wait, not everyone is in this bandwagon. Check this out:

For example, Meena runs a boutique in Delhi and earns ₹1,50,000 a month. She opted for the composition scheme, so she does not need to file GSTR 3. But her brother Rohit, who runs a mobile store, must file it because he is a regular taxpayer.

Format of GSTR 3: Decoding the Layers

“Form bharo, tension chhodo. Yeh format hai full on jhakaas!”

GSTR 3 has multiple sections, but we will slice it down like a hot samosa.

Part A includes:

- Turnover summary

- Inward and outward supplies

- Input tax credit details

- Tax liability

Part B includes:

- Tax paid

- Interest and late fee

- Refunds claimed

Take the case of Shruti, a stationery seller from Pune. Her outward supply is ₹2,40,000, and she has claimed credit of ₹30,000. Her final tax liability is shown in Part B and paid via online challan.

How to File GSTR 3: Complete Step-by-Step Guide

“Tech ka tadka, filing mein dhamaaka!”

Here’s how you can file GSTR 3 online in true desi style. Visit the Goods and Services Tax Portal.

Step-by-step process:

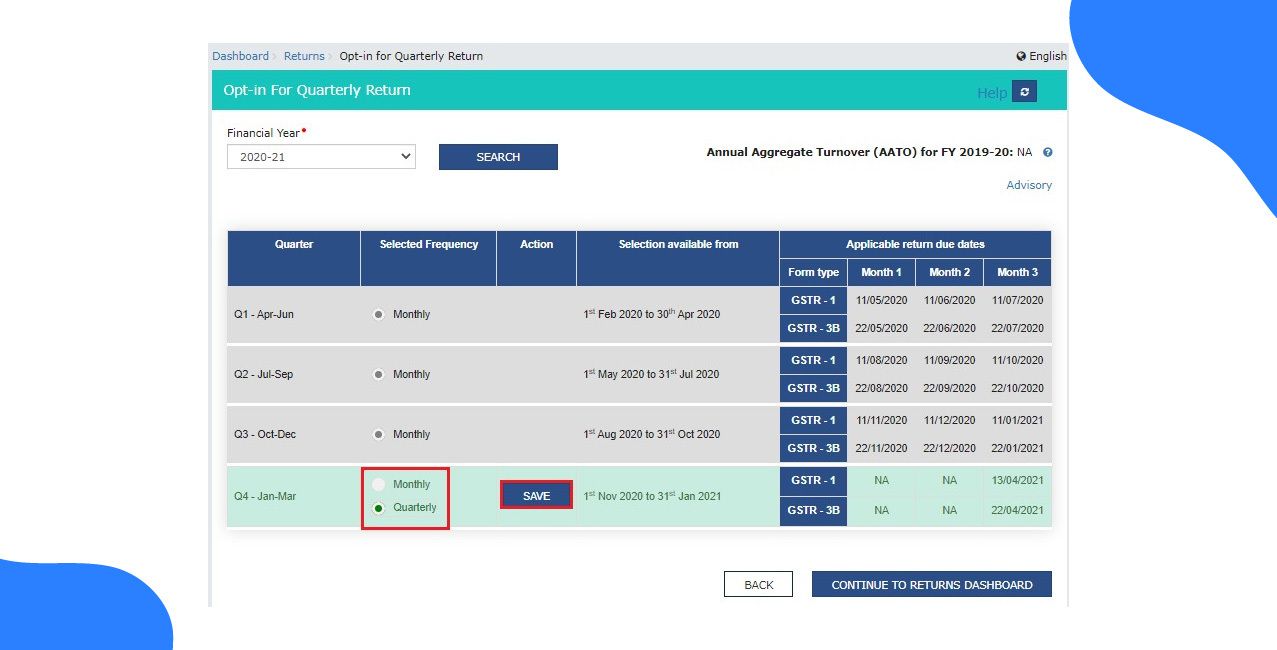

- Log in with your credentials on the GST Portal.

- Navigate to “Services” section and from there you can find the ‘Returns Dashboard’ from the main menu.

- Select the financial year and return filing period.

- Click on Prepare Online under GSTR 3.

- Review the auto-filled data from GSTR 1 and GSTR 2.

- Reconcile mismatches, if any, and modify manually where allowed.

- Add details for tax payment and interest (if applicable).

- Validate, confirm, and Submit.

- Click File Return using your Digital Signature Certificate or Electronic Verification Code.

- Download the acknowledgement with reference number.

Numerical Example:

Suppose Jignesh, who runs an electronics shop in Ahmedabad, made the following transactions:

Total GST Payable = ₹54,000 - ₹27,000 = ₹27,000

After submitting this data online, Jignesh can pay ₹27,000 via a challan and complete his GSTR 3 filing. Mazaa aa gaya!

Due Date and Penalties: Deadline ka Darr

“Miss mat karna bhai, warna lag jaayegi paise ki chhati pe chot!”

The due date for filing GSTR 3 is the twentieth of the next month. However, GSTR 3 filing has been suspended temporarily due to changes in the filing system and replaced by GSTR 3B, but understanding GSTR 3 remains important for foundational knowledge and audits.

If Rani delayed her filing by ten days, her total penalty = ₹100 x 10 = ₹1,000. Ouch!

Why GSTR 3 Is Still Relevant Today

“Old is gold, aur GST ka knowledge toh bilkul platinum hai!”

Though GSTR 3 is currently inactive, it is the skeleton behind the current system. Its format teaches reconciliation, accuracy, and transparency. Chartered accountants and tax professionals still train newbies using GSTR 3 format.

Important Link: Track the latest updates on GSTN Official Portal

Even government audits may refer back to historical GSTR 3 filings for FY 2017–18 and FY 2018–19. So, samajhna zaroori hai boss!

Mobile Apps and Support

“Pocket mein tax world, haath mein pura control!”

Here are some funky apps and tools to make filing and calculations easier:

Use the GST Portal or download these apps for support and live help.

Bonus: Tip of the Day

“Tally aur Excel dono ka kamaal, par tax filing mein na chale jugaad ka khel!”

Always reconcile your sales and purchases before the twentieth of every month. Keep a printed copy of invoices. Use the offline tool for data import to avoid portal overload during peak hours.

Conclusion

“Paka hua hisaab, tayyar return aur zero stress!”

Knowing GSTR 3: Who Should File, Format & Filing Instructions is like learning the ultimate dhamaaka recipe of Indian tax curry. Once you get the masala proportions right, the rest is flavour and flair.

Whether you are a chaiwala, doodhwala, or tech startup guru, knowing how GSTR 3 works gives you a superpower in the GST world.

Form bharna hai, toh number aane do. GSTR 3 is your stage; shine like a tax superstar!

Chalo ab ek baat yaad rakhna – paisa aayega, tax bhi bharna padega. GSTR 3 is not boring anymore, kyunki number ka game hai zabardast!

FAQs on GSTR 3: Who Should File, Format & Filing Instructions

1. Who is required to file GSTR 3 in India?

Only regular registered taxpayers need to file GSTR 3. Composition scheme participants and non-resident taxpayers do not need to file this form.

2. Is GSTR 3 still active or has it been replaced?

GSTR 3 filing has been suspended and replaced by GSTR 3B, but understanding GSTR 3 is crucial for foundational learning and historical audits.

3. What happens if I miss the due date for GSTR 3?

Late filing can attract a penalty of ₹100 per day (₹50 Central + ₹50 State), capped at ₹10,000 per return.

4. Can I file GSTR 3 using a mobile app?

Yes, you can use official apps like the GSTN App or software like ClearTax and Zoho Books for return filing support.

Other Related Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article