How to Activate Net Banking in Canara Bank: Step-by-Step Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Insights

- You can use Canara Bank Net Banking for easy banking. You just need your account details to register in a few minutes.

- Visit your Canara Bank branch to set up Net Banking, present your account details, and complete the necessary form for Canara Bank Net Banking. They will then set up a simple process for you.

- You will get a User ID and password. You can use your net banking for such things as anytime for payments, transfers and checking your balance.

How to Activate Net Banking in Canara Bank: Overview

Canara Bank's net banking service allows customers like Ramesh to manage accounts online anytime, anywhere.

He can check balances, transfer funds, and view statements, ensuring 24/7 banking from his home or office with a secure Canara Bank Net Banking portal.

By selecting the "New User" link on the bank's website and providing his account number and debit card information, Ramesh can start the online process. He only needs his Customer ID and password to log in and access all of the services after registering.

This blog helps you understand how to activate Net Banking in Canara Bank. Now we talk about how to activate net banking online and the Offline Process.

Step-by-Step Guide to Activate Canara Bank Net Banking

Canara Bank's net banking can be activated immediately online or offline, providing safe access to accounts, money transfers, and other features.

Online Registration Method

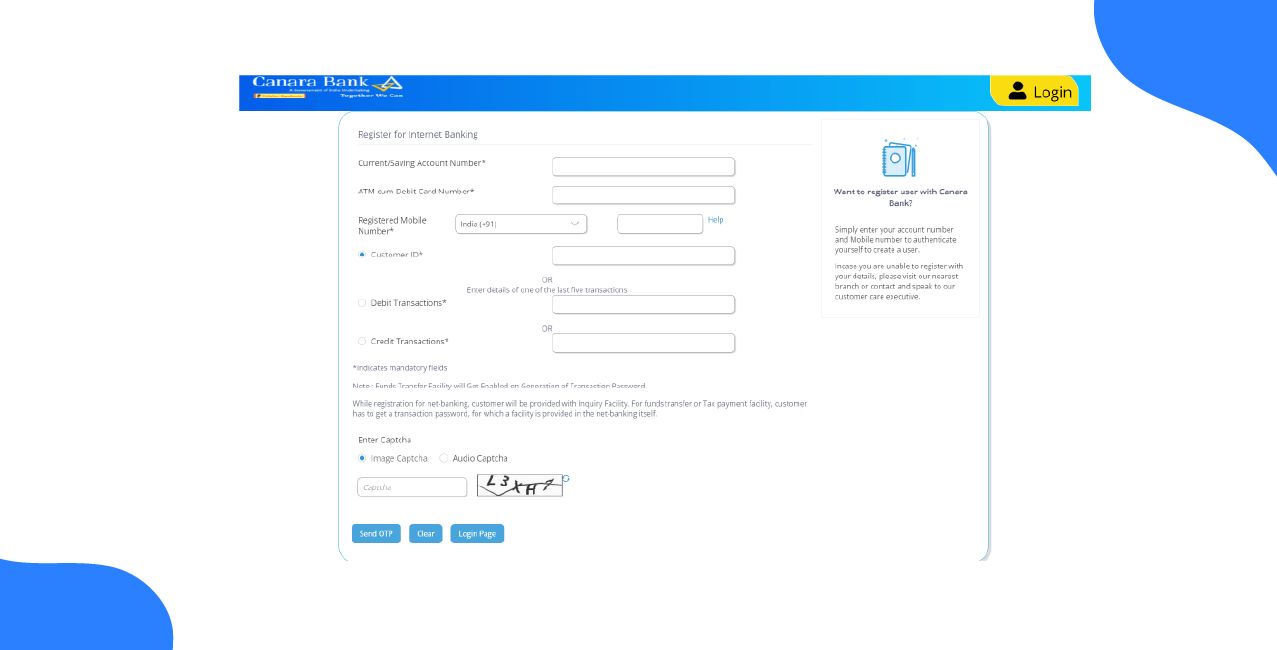

To successfully activate your Canara Bank online net banking service, follow these steps:

Step 1: Go to the Canara Bank website and find the net banking page.

Step 2: Click on the "Net Banking - Login (Retail & Corporate)" option.

Step 3: Click on "New User Registration" to continue.

Step 4: Read the 'Terms and Conditions' and click 'I Agree' to move forward.

Step 5: Fill in the correct information ( account number, debit card number, etc) and click on "Send OTP".

Step 6: You received OTP on your registered mobile number and click on "Submit".

Step 7: Set your password and click 'Submit'.

Step 8: A message will appear on the screen confirming your registration and showing your User ID.

Step 9: Write down your User ID. You will need it to log in to Canara Bank's net banking.

Remember to keep your User ID handy when you log in to your online banking account.

Offline Registration Method

To sign up for Canara Bank's net banking service, bring your KYC documents to your branch.

- Go to your nearest Canara Bank branch. Click here to search for your nearest branch.

- Request the internet banking service form from the bank.

- Fill out the form with all required details.

- Please submit the completed form and your KYC documents, including identity and address proof, at the branch.

- After the bank verifies your form, your User ID and password will be sent to you by SMS, email, or mail to your registered address within 2-3 days.

After verification, your login credentials will be sent to you via email or SMS.

Bonus Tip: Your Customer Information File (CIF) number is a unique 11-digit number that links all your accounts with the bank. You can find it in your passbook, account statement, or cheque book.

How to Log in for the First Time?

To start a safe online money transfer via the net banking portal, log in to your account.

Step 1: Access the Canara Net Banking platform by entering the designated User ID and password credentials.

Step 2: On the homepage, select the Funds Transfer function.

Step 3: Specify the required transfer type, such as National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), or Immediate Payment Service (IMPS).

Step 4: Provide the recipient’s bank account number, Indian Financial System Code (IFSC), and the transfer amount.

Step 5: Verify all entered details and confirm the transaction.

Step 6: Enter the transaction password and select Submit.

Step 7: Upon successful processing of the transfer, a confirmation message is generated.

To indicate that the transaction was successful, a confirmation message will show up on the screen. Now that you know the steps of Canara Bank Net Banking, we will discuss common issues during activation and their solutions.

Common Issues During Activation & Solutions

During self-activation, customers often encounter issues such as invalid details or OTP delivery failures. These can typically be resolved by re-entering information carefully or verifying mobile numbers.

How Dev solved his Canara Bank Net Banking-related problem:

Dev is activating his net banking but faces some common problems. This table lists the issues and their solutions to help him:

Dev can swiftly fix the issues and finish his net banking activation by using these fixes.

Bonus Tip: You cannot update your mobile number online for security reasons. You must visit your home branch with your KYC documents to update your mobile number first, then proceed with activation.

Canara Bank Net Banking Services You Can Use

Canara Bank net banking provides easy fund transfers, convenient bill payment services, and thorough online account management.

Easily access and manage your finances with our full range of digital banking services.

- Account Management:

- Check account balances and view transaction history.

- Download e-statements and manage e-statements.

- Update personal information and manage accounts.

- Check account balances and view transaction history.

- Fund Transfers:

- Transfer funds instantly using IMPS, NEFT, RTGS, and UPI.

- Add and manage beneficiaries.

- Transfer funds instantly using IMPS, NEFT, RTGS, and UPI.

- Bill Payments & Recharges:

- Pay utility bills (electricity, gas, water, and phone) and internet bills.

- Make credit card bill payments and mobile recharges.

- Pay utility bills (electricity, gas, water, and phone) and internet bills.

- Investments:

- Open and manage Fixed Deposits (FD) and Recurring Deposits (RD).

- Invest in Mutual Funds and insurance policies.

- Access and manage other investment schemes like PPF.

- Open and manage Fixed Deposits (FD) and Recurring Deposits (RD).

- Online Shopping:

- Shop online and make secure payments through various merchants.

This portal serves as a secure, one-stop shop for all your regular financial and banking needs.

Conclusion

For all your financial needs, this comprehensive guide provides the steps and solutions necessary to quickly activate and utilise Canara Bank's secure and convenient online banking services. Take care of your finances quickly and securely with our easy-to-use online banking tools.

FAQS

Is there any fee or charge for activating or using Canara Bank net banking?

No, both the activation process and the basic use of net banking services are free of charge for customers.

Can I activate net banking for a joint account?

Yes, but only the primary account holder can activate and operate the net banking services for a joint account.

I have a savings account but no debit card. Can I still activate net banking?

No, a debit card is mandatory for online self-registration. You must visit your branch to apply for net banking without a debit card.

Is there a daily limit for fund transfer through net banking?

Yes, transaction limits are set for security. You can view and modify these limits in the 'Profile' or 'Settings' section after logging in.

Other Related Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Canara Bank Net Banking: Unlock Seamless Digital Banking at Your Fingertips

J&K Bank Net Banking: A Smarter Way to Bank from Anywhere

Axis Bank Net Banking: How to Register, Login & Use Services

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article

.png)