What Is a UPI ID? Meaning, Format & How To Create Or Find It

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

A UPI ID is a virtual address used tobbbbbbbbbbbbbb send or receive money via UPI apps without sharing your bank details. It is a fast, secure, and convenient way to transfer money using your smartphone. The UPI ID is also known as a VPA (Virtual Payment Address). It plays a crucial role in this process.

Imagine you are at a roadside shop buying groceries worth ₹370. You left your wallet home, but your phone's with you. The shopkeeper asks if you can pay online to his UPI address 98765xxxx@okhdfcbank.

You enter his UPI address in your UPI app, confirm the amount (₹370), and the payment is done in seconds. This is the ease a UPI ID brings.

In this blog, we will understand what UPI means, how it works, and how you can create or find it.

What Is A UPI ID?

A UPI ID (Unified Payments Interface ID) is a unique identifier linked to your bank account. It allows you to make digital transactions without needing to share sensitive information, such as your account number or IFSC code.

You no longer need to fill in lengthy bank details. UPI ID is like a short and easy-to-remember email address. For example: rahul123@oksbi.

According to The Hindu, UPI has helped transform the payment ecosystem of India by offering a seamless blend of identity, access, and data cost efficiency. This virtual ID plays a crucial role in that digital evolution.

Why Is UPI ID Important?

UPI ID helps you simplify digital transactions in your daily life. The following table gives a quick look at where a UPI ID is useful:

From the above-mentioned table, you can see the importance of the UPI ID. You might think that UPI is for adults only, but you are wrong.

The new UPI Circle feature allows children under 18 to perform transactions within set limits. This brings younger users into the digital economy with the help of supervised UPI IDs.

Read More – Soon You Can Use UPI to Withdraw Loans Against Gold, FDs, Shares & Property

Format Of A UPI ID

A UPI ID is typically in the format of (username or mobile number)@(bank or app name). For example, sana123@okaxis or 1234567890@paytm.

- In the UPI ID, the part before the @ sign shows the unique identifier selected by you or assigned by the app.

- The part after the @ symbol shows the payment app or bank used to create the UPI ID.

The format of your UPI ID is quite straightforward. Let’s understand it better through this table:

From the above-mentioned table, you can clearly understand the format of the UPI ID. The following table highlights some examples of UPI ID from popular banks:

From the table mentioned above you can see that format remains the same, only the bank or app handle after @ changes.

Read More – How to Change UPI PIN?

How To Create A UPI ID?

If your mobile number is linked to your bank account, then you can create a UPI ID within a few minutes. You can create your UPI ID by completing the steps below:

By following the above-mentioned steps, you can easily create a UPI ID. If in case you face any issue, then you can contact the customer care of the app you are using.

For example, if you face an issue using Google Pay, then you can contact customer care by dialling their toll-free number 18004190157.

Also Read - My UPI Transaction Failed, But Money Was Debited!"

Where To Find Your UPI ID?

You can find your UPI ID by following the steps:

- Open your UPI App.

- Go to Profile or Settings.

- Find your UPI ID in the listed details.

Most apps also allow you to view, copy, or even delete old UPI IDs. The following table tells you where you can find your UPI ID in commonly used apps:

The above-mentioned table can help you locate your UPI ID in the 4 commonly used apps.

Can You Customise Your UPI ID?

Nowadays, most of us like customisations because they give us a personal touch. You can now easily customise the first half of your UPI ID (before the @ symbol).

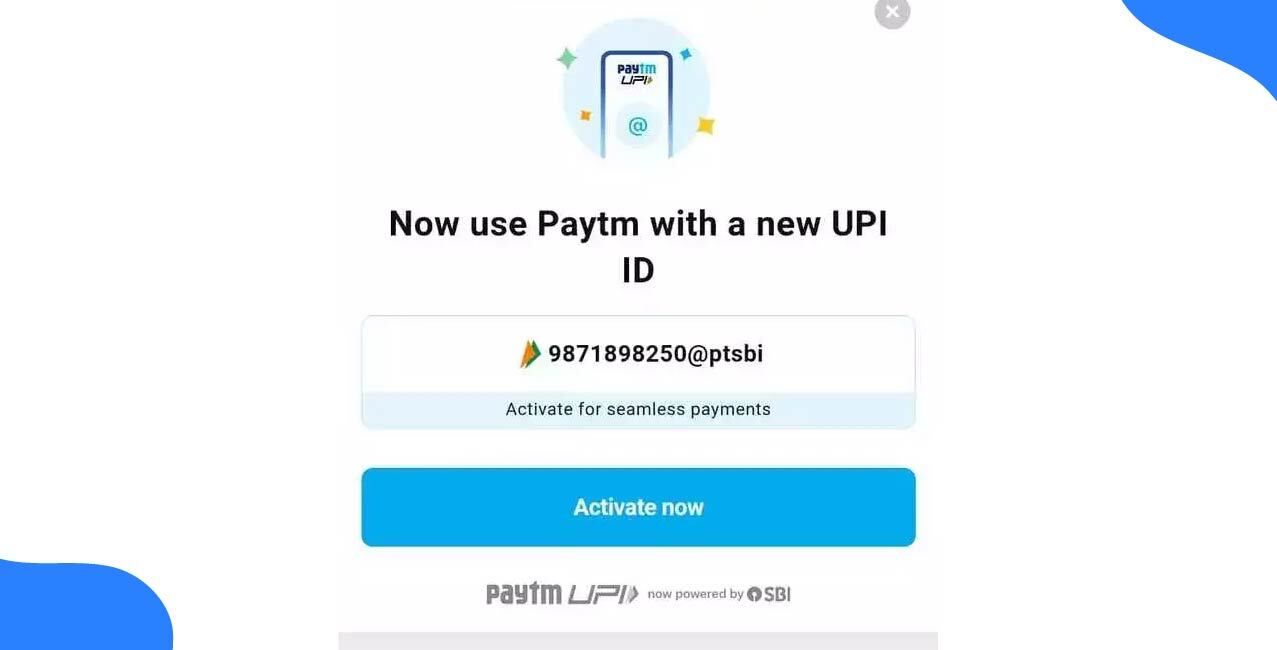

For instance, Paytm has introduced the feature of personalised UPI ID. Its objective is to enhance your privacy by allowing payments without revealing your contact number.

For example, your UPI ID is 0987654321@oksbi. But you want to customise it with your name. So you can easily customise it at natasha@oksbi.

Conclusion

UPI ID has transformed the way we handle money by offering a simple, secure, and fast way to send or receive payments. Whether you are shopping online, paying bills, or transferring funds to a friend, your UPI ID acts like a virtual address that protects your actual bank details.

You can easily create, manage, and use a UPI ID across different apps and banks. As digital payments grow, understanding your UPI ID helps you stay in control of your finances and avoid common mistakes.

FAQs

1. Can a UPI ID reveal my bank account number?

No, your UPI ID masks your actual account details completely.

2. Can I use UPI without internet access?

Yes, UPI can work offline using UPI 123PAY, UPI Lite X, or the 99# USSD service, even on basic phones.

3. Can I delete a UPI ID permanently?

Yes, most apps allow you to deactivate or unlink a UPI ID.

4. What happens if I send money to the wrong UPI ID?

If the UPI ID exists, the money will be transferred. If not, the payment will fail. You can contact your bank or UPI app to raise a complaint.

Other Informative Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Salaried vs. Self-Employed: Who Gets a Personal Loan Faster in 2025?

Too Many EMIs? What to Do When Monthly Payments Become Unmanageable

Post Office Customer Care Number: Helpline & Support

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article