BOB RTGS Form | Download & Updated Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- The BOB RTGS form is used for transferring large amounts securely between bank accounts.

- You can get the form online as a BOB RTGS form PDF or from any Bank of Baroda branch.

- Fill the BOB RTGS form correctly, as it ensures a quick and hassle-free fund transfer.

Have you ever needed to send a large payment urgently and wondered which method is safest? Or have you felt confused about which form to use for high-value transfers at your bank?

The BOB RTGS form is used to transfer large sums of money securely from one Bank of Baroda account to another bank account through the Real Time Gross Settlement system. It is available both in-branch and as a BOB RTGS form PDF online.

For example, my friend Riya, a small business owner, used the RTGS form to send ₹3,00,000 to her supplier’s account in another city. By filling in the beneficiary’s details and submitting the form, her transfer was completed within minutes.

This blog explains how to download, fill out, and submit the BOB RTGS form easily.

How to Download the BOB RTGS Form?

If you want to make a high-value fund transfer through RTGS at Bank of Baroda, you don’t need to visit the branch to collect the form. The bank provides the BOB RTGS form PDF on its official website, making it easy for customers to download, print, and fill it from home.

The process is simple and takes only a few minutes to complete. Follow these easy steps to complete your BOB RTGS form download:

- Visit the official website: Open your browser and go to (https://bankofbaroda.bank.in/download-forms). This is the official page where Bank of Baroda provides all its downloadable forms.

- Select the form: Scroll through the list and find the RTGS/NEFT paying slip form. This form is used to initiate both RTGS and NEFT transfers.

- Click on Download: Once you find the form, click on the Download option. You’ll be redirected to a new page where the form is available.

- On the new page, you’ll see two versions of the form: one in Hindi and another in English.

- Download your form: Click on your preferred language to download the BOB RTGS form PDF.

After downloading, print the form and fill in the required details such as sender and beneficiary information, amount, and account number. Once filled, you can submit it at your nearest Bank of Baroda branch to process your RTGS transaction. This is how you can easily complete your BOB RTGS form download online.

Bonus Tip

SBI recently strengthened its fraud-monitoring system for high-value online transfers. When you make large RTGS transactions, the bank’s system may trigger a safety check, which helps detect suspicious activity quickly and protects customers from unauthorised transfers. This additional verification layer enhances the security of your digital payments.

Read More - IndusInd Bank RTGS Form

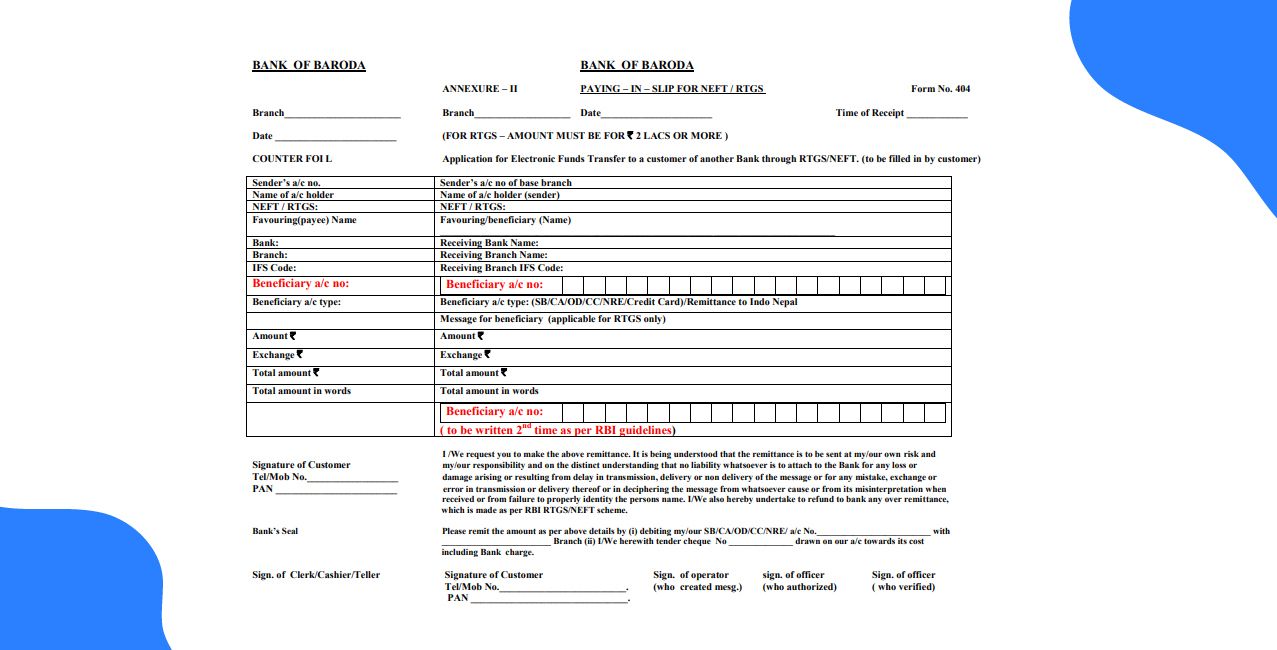

How to Fill BOB RTGS Form (Step-by-Step Guide)?

If you have already downloaded the BOB RTGS form PDF from the official website, you can easily fill it out by following a few simple steps. The BOB RTGS form is used for transferring funds of ₹2,00,000 or more from one bank account to another through the Real Time Gross Settlement (RTGS) system.

Follow the step-by-step guide below to fill it correctly:

1. Fill in the branch details

At the top of the form, write your branch name, date, and time of submission. These details help the bank staff identify when and where the transaction was initiated.

2. Enter your personal details

In the section for the remitter (sender), write your name, account number, and contact number. Make sure the name matches the one registered with your Bank of Baroda account.

3. Select the transaction type

Tick the RTGS option on the form. This ensures that your request is processed through the Real Time Gross Settlement (RTGS) mode, not NEFT.

4. Provide beneficiary details

Enter the beneficiary’s name, account number, and bank name. Write the branch name and IFSC code of the beneficiary’s bank accurately, as any mistake may cause the transfer to fail.

Select the account type of the beneficiary: Savings, Current, NRE, or others.

5. Enter the transaction amount and purpose

Write the transfer amount first in figures and then in words. If the form includes a section for “Message to beneficiary” or “Purpose of payment,” you can fill it in with details like “Invoice Payment” or “Salary Transfer.”

6. Repeat the beneficiary account number

To confirm accuracy, you may need to write the beneficiary’s account number again in the verification box provided. This helps prevent errors during processing.

7. Sign and verify your form

Enter your PAN number if the amount is large or as required. Sign the form using the same signature registered with your bank account.

8. Submit and collect acknowledgement

Submit the filled BOB RTGS form PDF at your Bank of Baroda branch. The bank staff will process your request and provide an acknowledgement slip or UTR number, which serves as proof of the transaction.

By following these simple steps, you can fill out the BOB RTGS form correctly and complete your high-value fund transfer quickly and securely.

Also Read - HDFC Bank RTGS Form

Required Documents for BOB RTGS Form

To complete the BOB RTGS form, you must provide certain details and documents that help the bank verify your identity and process your fund transfer securely.

Whether you have the printed form from a branch or the BOB RTGS form PDF downloaded online, the same information and documents are required.

1. Sender and Transaction Details

You need to provide the following details about your own account and the transaction:

- Bank of Baroda account number: The account from which the money will be debited.

- Your name: As it appears in your bank records.

- Amount to be transferred: Write the amount in both numbers and words.

- Your signature: To authorise the transaction.

- Mobile or telephone number: For communication or confirmation.

- PAN number: Needed for identification and verification.

- Date: Mention the date of the transaction clearly.

2. Beneficiary Details

You must also provide complete details about the person receiving the funds:

- Beneficiary’s name: As registered with their bank account.

- Beneficiary’s bank name and branch: The exact bank and branch details.

- IFSC code: The 11-digit code that identifies the beneficiary’s bank branch.

- Beneficiary’s account number: The account into which the money will be transferred.

3. Supporting Documents

Along with the form, you may need to provide a few supporting documents:

- Cheque leaf: The bank may ask for a cheque leaf from your account to confirm account ownership.

- Identification document: Such as your PAN card or Aadhaar card for ID verification.

By keeping these details and documents ready, you can fill and submit your BOB RTGS form smoothly and ensure that your high-value transfer is processed without any delay.

Conclusion

BOB RTGS form filling is a simple process when you have all the necessary details and documents ready. The form helps you transfer large amounts safely and quickly through the Real Time Gross Settlement system.

Whether you use the printed version or the BOB RTGS form PDF, make sure all information, such as account numbers, IFSC code, and amount, is accurate. Once submitted, the bank processes your request securely, ensuring your funds reach the beneficiary without delay.

FAQs

What are the RTGS timings in Bank of Baroda?

The RTGS service in Bank of Baroda is available 24x7, including weekends and public holidays. You can make RTGS transfers anytime through internet banking, the mobile app, or at branches that support RTGS.

Is there any charge for using RTGS in the Bank of Baroda?

Bank of Baroda follows RBI-approved charges for RTGS transactions. Online RTGS transfers made through the internet or mobile banking are usually free of cost, while branch transactions may have a small fee. It’s best to check the latest charge list on the official Bank of Baroda website or at your nearest branch.

What should I write on the cheque for an RTGS transaction in Bank of Baroda?

You should write the cheque in your own name. When you apply for an RTGS remittance, the bank sends the money on your behalf, so you must issue a cheque payable to yourself. This lets the bank debit your account and process the RTGS request correctly.

Other Related Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article