How to Build a Strong Credit Score from Scratch – Complete Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Priya, a young professional from Mumbai, is excited about purchasing her first car. She approaches a bank for a loan, only to learn that her lack of a credit history makes her ineligible. Priya's situation is not unique; over 160 million Indians had limited access to credit due to insufficient credit histories.

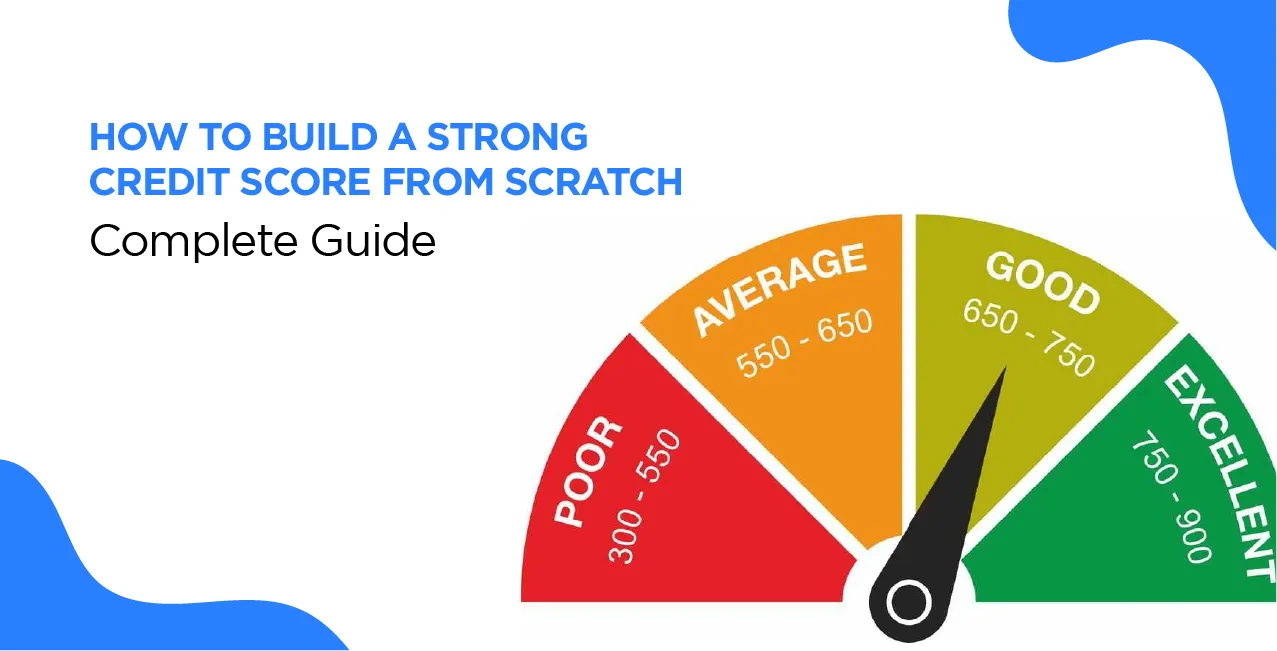

Building a strong credit score from scratch can seem daunting, but it's a crucial step toward financial empowerment. A good credit score opens doors to loans and credit cards and secures better interest rates, saving you thousands of rupees.

For instance, individuals with credit scores above 800 often receive more favourable loan terms, yet only 36% of users have achieved this score.

This guide will explore practical steps to establish and enhance your credit score in 2025, ensuring you're well-prepared to meet your financial goals.

Open a Credit Card Designed for Beginners

Ravi, a recent graduate from Bengaluru, wanted to improve his credit score but didn’t know where to start. He applied for a standard credit card but was rejected due to a lack of credit history. This is a common issue for many beginners. The best way to build credit from scratch is to get a beginner-friendly credit card.

Banks and fintech companies in India offer secured and student credit cards, specifically for those without a credit history.

A secured credit card requires a fixed deposit as collateral, typically starting from ₹10,000. For example, if you deposit ₹25,000 in a fixed deposit, the bank may offer a credit limit of ₹20,000.

On the other hand, student credit cards don’t need a credit history but have lower limits (₹10,000 - ₹20,000). You can build a solid credit history by using the card for small expenses and paying the bill on time.

Keep your credit utilisation ratio below 30%—meaning if your card limit is ₹50,000, don’t spend more than ₹15,000 in a month.

Become an Authorised User on a Trusted Account

Amit’s older sister had a credit card for five years with a ₹2,00,000 limit and always paid her bills on time. When Amit needed to build his credit score, she added him as an authorised user on her card. Within six months, his credit score improved.

If you have a trusted family member with a good credit score, ask them to add you as an authorised user on their credit card. This will give you access to their card benefits, and their positive payment history will help boost your score.

However, you must choose the right person because their late payments can also affect your score.

Here’s how an authorised user arrangement works:

Factor | Primary Cardholder | Authorised User |

Credit Limit | ₹1,50,000 | Shares the same limit |

Credit Score Impact | Affects both users | Gets the same benefits |

Responsibility | Full liability | No legal liability |

Spending Power | Can control spending | Can spend within limits |

Removal Process | Can remove anytime | Credit score may drop |

Read More - My CIBIL Score Was 540

Steps to Make the Most of This Strategy

- Choose the Right Cardholder: Ensure the person adding you has a high credit score (750+), makes timely payments, and has a low credit utilisation ratio.

- Set Usage Rules: Clarify who will use the card and how much can be spent. Some primary cardholders allow the authorised user to pay only for emergencies.

- Monitor the Account: Check monthly statements and confirm payments are made on time. If the primary cardholder defaults, it can hurt your credit score.

- Use It for Small Transactions: Even though you are not liable for payments, use the card responsibly and only for essential purchases.

- Ask for Removal When Ready: Once your score improves, apply for your credit card and ask to be removed from the authorised user list.

Use a Credit Builder Loan to Establish a History

Neha, a young entrepreneur in Pune, wanted to take a business loan but had no credit score. She started with a credit builder loan, which helped her qualify for a bigger loan within a year.

A credit builder loan is a unique loan where you borrow money, but instead of receiving it upfront, the bank holds the amount in a fixed deposit.

You make small monthly payments, and once the loan is fully repaid, you can access the funds. This method builds a repayment history and boosts your score.

Here’s how to make the most of a credit builder loan:

- Start with a Small Loan: Many banks offer loans from ₹5,000 to ₹50,000. Choose an amount you can quickly repay.

- Make Timely Payments: Your credit score improves only if you pay on time. Even one missed payment can lower your score.

- Avoid Prepayment: While it may seem wise to close the loan early, it’s better to complete the entire tenure to maximise credit history benefits.

- Choose a Shorter Tenure: Opt for a 6-month to 12-month loan instead of longer terms. This speeds up your credit score growth.

- Monitor Your Credit Score: Monitor your monthly score through platforms like CIBIL or Experian to track improvements.

- Combine with a Credit Card: A beginner-friendly credit card and a credit builder loan can increase your credit score faster.

- Don’t Apply for Too Many Loans: Applying for multiple loans quickly can hurt your score—space out your applications.

Building a strong credit score takes patience, but with the right strategies, you can establish financial credibility within months. Stay consistent, manage credit wisely, and unlock better economic opportunities in 2025.

Also Read – High CIBIL Score Doesn’t Guarantee Loan

Pay All Bills on Time, Every Time

Rahul, a 28-year-old IT professional in Hyderabad, was shocked when his home loan application was rejected despite having a credit card for three years.

The reason? He had missed a few payments on his phone and electricity bills, which affected his credit score. Many people don’t realise that late payments—even on small bills—can hurt their creditworthiness.

Every bill matters, whether it's your credit card bill, EMI, electricity, rent, or mobile recharge. A single missed payment can lower your score by 50 to 100 points.

For example, if you forget to pay a ₹1,000 credit card bill, your bank may report it to CIBIL after 30 days, marking it as a default. The longer you delay, the lower your score will be.

The easiest way to avoid this is to set up auto-pay for all your bills and ensure your bank account has enough balance to cover them. If you ever forget a payment, clear it within 30 days to minimise the impact.

Keep Your Credit Utilisation Below 30%

Meera, a young marketing executive in Delhi, had a credit card with a ₹1,00,000 limit. She frequently used ₹70,000 to ₹80,000 every month, thinking it would improve her credit history. Instead, her credit score dropped because she used more than 30% of her available credit.

Credit utilisation is how much credit you use compared to your limit. Keeping it low shows lenders that you are financially responsible.

How to Keep Credit Utilisation Low

- Spend Within Limits: If your credit card has a ₹50,000 limit, don’t spend more than ₹15,000 to maintain a good score.

- Increase Your Credit Limit: Request a higher limit from your bank, but don’t increase your spending. For example, if your limit rises to ₹1,50,000, keeping expenses at ₹30,000 will lower utilisation.

- Use Multiple Cards: Instead of using one card excessively, spread expenses across two or three cards. If you have two cards with ₹50,000 limits, use each for ₹10,000 rather than spending ₹20,000 on one.

- Make Multiple Payments: Instead of waiting for the billing cycle to end, pay your balance twice a month to reduce your reported utilisation.

- Check Your Utilisation Before Loan Applications: If you plan to apply for a loan, ensure your utilisation rate is below 30% for at least three months to improve your chances of approval.

Credit Utilisation and Impact on Credit Score

Credit Utilisation Ratio | Impact on Credit Score |

Below 10% | Excellent |

10% - 30% | Good |

30% - 50% | Average |

Above 50% | High Risk: Score Drops |

Diversify Your Credit Mix Over Time

Nitin, a small business owner in Mumbai, relied only on his credit card for transactions. When he applied for a car loan, he was surprised that his credit score was lower than expected. The reason? His credit profile lacked diversity.

A credit mix refers to having different types of credit, such as credit cards, loans, and overdraft facilities. Lenders prefer individuals who can responsibly handle multiple forms of credit.

Here’s how you can diversify your credit mix:

- Start with a Credit Card: If you only use debit cards, get a beginner-friendly credit card to build your credit history.

- Take a Small Personal Loan: A loan of ₹50,000 with timely repayments can improve your creditworthiness.

- Use a Consumer Durable Loan: Buying a laptop, mobile, or appliance on EMI (₹10,000 - ₹20,000) and paying on time can help.

- Apply for a Car or Two-Wheeler Loan: Even a ₹1,00,000 vehicle loan repaid properly shows responsible credit use.

- Avoid Taking Too Many Loans at Once: Taking multiple loans in a short period can make you look credit-hungry and lower your score.

- Maintain a Good Mix for At Least a Year: If you add loans, maintain them for 12-18 months before closing them.

- Regularly Check Your CIBIL Report: Monitoring your credit mix and fixing errors will help maintain a stable score.

A balanced mix of secured loans (home, car) and unsecured loans (credit card, personal loan) can increase your score by 50 to 100 points over time. This approach makes it easier to get bigger loans at lower interest rates in the future.

By following these strategies, you can steadily build a strong credit score and open doors to better financial opportunities in 2025. Stay disciplined, spend wisely, and watch your creditworthiness grow!

Conclusion

Building a strong credit score from scratch in 2025 requires patience, smart financial habits, and consistency. Whether you start with a beginner-friendly credit card, become an authorised user, or take a credit builder loan, every step counts.

Paying bills on time, keeping credit utilisation low, and maintaining a diverse credit mix will ensure steady growth in your creditworthiness. A good credit score doesn’t just help in securing loans—it also leads to better interest rates and financial freedom.

Stay disciplined, review your credit report regularly, and make informed financial decisions to secure your future. With the right approach, you can build a solid credit profile within months and unlock new financial opportunities.

FAQs

1. How long does it take to build a strong credit score from scratch?

It usually takes 3 to 6 months of consistent credit activity to generate a credit score. However, to reach a 750+ score, you may need at least 12-18 months of responsible credit use.

2. Can I build my credit score without a credit card?

Yes, you can. Credit builder loans, EMI purchases, and timely bill payments can help establish a credit history. However, having a credit card can speed up the process.

3. Does checking my credit score frequently lower it?

No, checking your own credit score (soft inquiry) has no impact. However, multiple loan applications (hard inquiries) within a short time can lower your score.

4. What is the fastest way to improve a low credit score?

The quickest ways include paying all bills on time, keeping credit utilisation below 30%, clearing outstanding dues, and diversifying your credit mix with responsible loan usage.

5. What is the ideal credit score to get a loan in India?

A score of 750 or above is considered excellent and increases your chances of getting a loan with low interest rates. Scores below 650 may lead to higher interest rates or loan rejections.

Other Informative Pages | |||

Should You Close Old Credit Cards to Improve Your Credit Score | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article