ICICI Bank Mobile Banking | Features & Updated Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Takeaways

- ICICI Bank mobile banking offers three apps for different needs.

- Registration of ICICI Bank mobile banking takes minutes at any ATM or branch with ID.

- Transaction limits of ICICI Bank mobile banking vary by payment type for your account security.

Have you ever managed your finances from your phone? ICICI Bank mobile banking makes this dream a reality today.

Mobile banking means accessing bank services through your smartphone application. It is like carrying your bank branch in your pocket. You can check balances, transfer money, and pay bills instantly. ICICI Bank mobile banking eliminates the need for physical branch visits.

I needed to pay my electricity bill of ₹3,200 last Sunday urgently. All bank branches were closed, so I felt worried initially. I opened the ICICI Bank mobile banking app on my phone. The ICICI Bank mobile banking login process took just a few seconds.

I paid my bill within two minutes from my home. This saved my time and gave me complete peace instantly.

Types of ICICI Bank Mobile Banking Apps

Did you know? Over 58% of banking customers now prefer mobile apps. They choose convenience over traditional branch visits every single day.

ICICI Bank offers different powerful mobile solutions for different customer needs. Each app serves a unique purpose in your financial journey. Let's explore the types of ICICI Bank mobile banking options available.

ICICI Bank mobile banking makes your financial life incredibly simple and efficient. You can choose the app that fits your lifestyle perfectly. The ICICI Bank mobile banking app suite covers all your banking needs..

How to Register for ICICI Bank Mobile Banking?

ICICI Bank mobile banking registration is simple for everyone. Indian resident customers have multiple convenient options to get started. The bank ensures a smooth onboarding process for all users.

Registration Options Available

You can register for ICICI Bank mobile banking through two main methods. The first option is to visit any ICICI Bank ATM nearby. The second option is to visit your nearest ICICI Bank branch.

Register at the ICICI Bank ATM

ATM registration is the quickest way to activate mobile banking services. You just need your debit card and registered mobile number. Visit any ICICI Bank ATM and insert your debit card.

Select the mobile banking registration option from the main menu. Follow the on-screen instructions to complete the registration process. Your ICICI Bank mobile banking login credentials arrive via SMS instantly.

Register at the ICICI Bank Branch

Branch registration offers personalised assistance from bank staff for new customers. You need to carry valid identity proofs along with you. The bank accepts various documents for identity verification purposes.

Required Identity Documents

ICICI Bank accepts the following documents for mobile banking registration:

- Original letter of introduction from your existing bank

- Driving licence (book type or laminated and embossed)

- Employee identity card issued by your organisation

- PAN card

- Ex-service man card

- Bar Council or Indian Medical Association, or Senior Citizen card

- PIO booklet for returning NRIs

- Photo identity card issued by PSU to retired employees

- MAPIN card

- Valid passport

- Voter ID card

Visit your nearest branch with any one valid document mentioned above. Bank staff will verify your documents and process your registration. You receive your ICICI net banking login details immediately after verification. The entire process takes only a few minutes to complete.

ICICI Bank mobile banking makes banking accessible anytime and anywhere today.

ICICI Bank Mobile Banking Transaction Limits

Transaction limits protect your money every day. They ensure safe and secure banking for all ICICI customers.

ICICI Bank mobile banking has specific transaction limits for different services. These limits help maintain security and comply with regulatory guidelines. You should know these limits before you make any transactions.

Transaction Limits Overview

The bank sets different limits based on transaction types and timing. ICICI Bank mobile banking offers various payment methods to customers. Each method has its own daily and per-transaction limits.

UPI transactions have a cumulative daily limit of ₹1,00,000. You can make only 20 UPI transactions per day, maximum. NEFT limits vary based on your customer segment at ICICI Bank. RTGS requires a minimum transfer amount of ₹2,00,000. IMPS offers quick transfers with different limits for different methods.

Planning Your Transactions

You should plan large transfers, keeping these limits in mind. Transaction limits may vary for different account types sometimes. ICICI net banking login also follows similar transaction limit guidelines. Contact ICICI Bank directly to know your specific account limits. The bank may adjust limits based on your banking relationship.

ICICI Bank mobile banking ensures your money stays safe always.

Conclusion

ICICI Bank mobile banking transforms how you manage your finances daily. The platform always offers secure, convenient, and efficient banking solutions. You can access multiple services anytime, anywhere, with complete peace of mind.

Bonus Tip: Activate iSafe authentication within your iMobile application for enhanced security. It alerts you instantly for each transaction you make daily. This feature adds strong protection against fraud and unauthorised access.

FAQs

Q: How do I activate the ICICI Bank mobile banking login?

A: Visit any ICICI Bank ATM or branch with a valid ID proof. Complete the registration process and receive login credentials via SMS.

Q: How can I generate a QR code from the ICICI Bank mobile app?

You need to have a Virtual Payment Address on the ICICI mobile app. Log in to your app and go to the BHIM ICICI UPI option. Navigate to Manage and then My Profile to access your VPA. Touch three dots and select ‘Share QR code’ to generate it.

Q: Why is the ICICI Bank mobile app not registering my account?

The mobile app may have technical bugs that affect account registration. Some customers report issues that remain unresolved for extended periods of time. You should contact customer service or visit your nearest branch directly. Alternative solutions include trying registration through internet banking or phone banking.

Q: What are the positive experiences with ICICI Bank’s iMobile app?

Users praise ICICI Bank for being technologically advanced and context-dependent. The iMobile app offers a user-friendly interface with minimal issues reported. Many customers have used it reliably for NRI banking for years. The app’s reliability is generally good with rare login issues.

Q: What negative experiences do users report with the iMobile app?

The app can be heavy and slow to load sometimes. Some users experience failed transactions, though money gets credited back eventually. Customer support responses may not always resolve issues satisfactorily for everyone. Users advise contacting customer service immediately if problems occur with transactions.

Other Related Pages | ||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

What is Retail Banking: Services Offered & Role in Personal Finance

What is AEPS in Banking? The Thumb‑Powered Financial Revolution

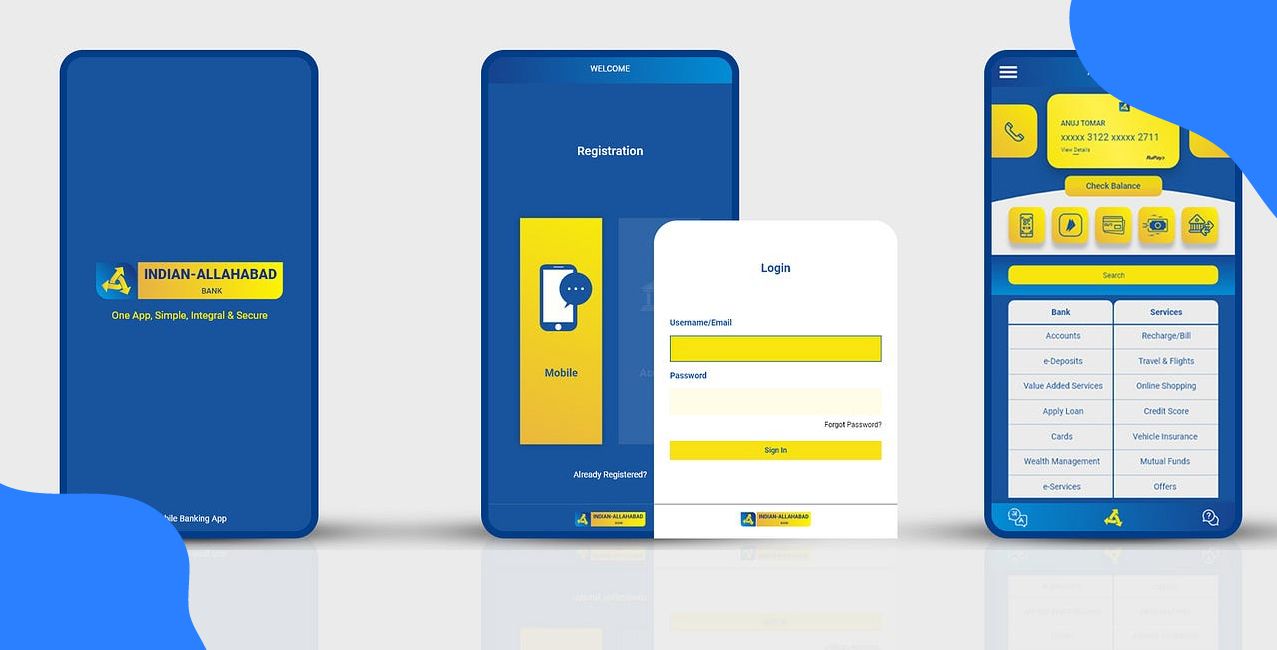

Indian Bank Mobile Banking: Features, App & Services

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article