Why Online Banking Fraud Is Rising – How to Protect Yourself in 2025

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

You get a call from someone pretending to be a police officer. They claim your bank account is involved in illegal activities and demand immediate payment to avoid arrest.

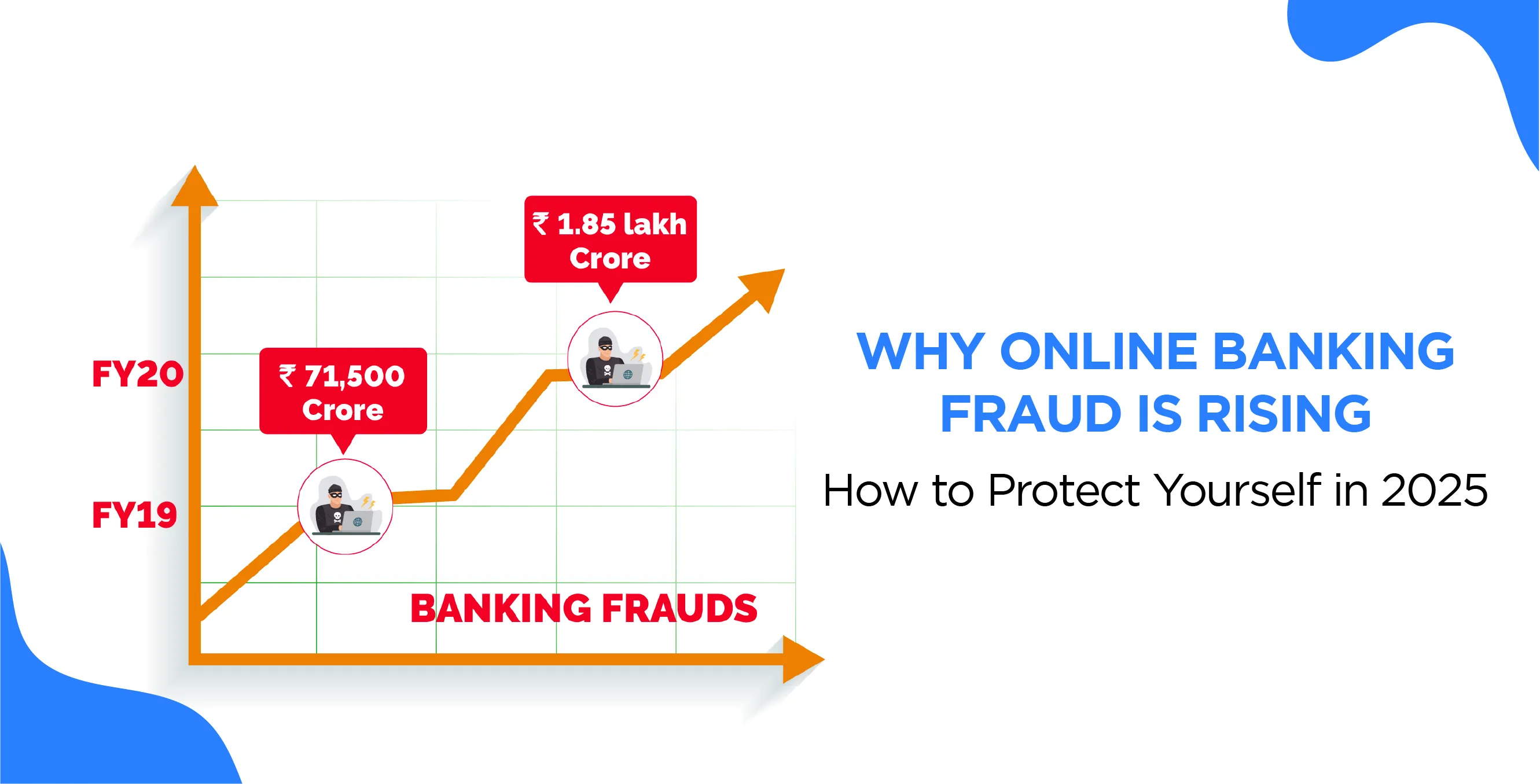

This is not a movie plot but a real scam known as a "digital arrest." In 2024, such scams and other online frauds led to a loss of ₹4,245 crore across 24 lakh cases in India, marking a 67% increase from the previous year.

With the rise of digital payments and online banking, fraudsters find new ways to exploit unsuspecting individuals. Understanding these threats is the first step towards protecting yourself in the digital age.

Why Is Online Banking Fraud on the Rise?

Online banking has become very common in India, especially after the pandemic. People enjoy the ease of transferring money, paying bills, or shopping online. But as more people use digital banking, fraud cases are rising too.

They can steal your money without you even knowing. Even tech-savvy people fall into these traps. It's not always about lack of knowledge; sometimes it's just one wrong click or a moment of trust in the wrong person.

Increased Digital Banking Adoption

After the COVID-19 lockdown, more people started using digital banking. From small-town shopkeepers to retired pensioners, many shifted to online methods. Today, India has over 110 crore mobile phone users. Over 45 crore use digital payment apps like Google Pay, PhonePe, or Paytm.

More people online means more chances for scammers to target them. Many users are new and don’t know how fraudsters work. A woman from Jaipur lost ₹1,20,000 after clicking on a fake electricity bill payment link she got on WhatsApp. She thought it was real.

More users = More targets. It’s like more fish in the pond for scammers to catch.

Cybercriminal Techniques

Scammers now use smarter tricks. Gone are the days of simple fake emails. Now, they use AI, deep fakes, and fake websites that look just like your bank’s site. Some send SMS from numbers that look official. Others create panic, like saying your bank account will be blocked in 30 minutes.

They use:

Technique | What it Does |

Phishing | Fake emails or messages to steal your login info |

Malware | Harmful software that steals data from your device |

Social Engineering | Tricks to make you share personal info |

Spoofing | Faking phone numbers or emails to look official |

One Delhi man lost ₹2,00,000 because he clicked a link claiming to update his KYC. It looked just like his bank’s website. These attacks are not random. Scammers study your habits from social media or leaked data.

Human Error and Lack of Awareness

Most frauds happen because of small mistakes. Weak passwords like “123456” or “abcd1234” are still common. Some people use public Wi-Fi to check their bank balance, not knowing that hackers can watch their activity.

Another big issue is trusting unknown calls or messages. A 70-year-old man from Mumbai lost ₹3,50,000 after he shared his OTP with someone claiming to be a bank officer.

Here's how mistakes happen:

Mistake | Risk |

Weak Passwords | Easy to guess and break into account |

Public Wi-Fi Use | Hackers can read your login details |

Clicking Unknown Links | Can install spyware or malware |

Sharing OTPs or PINs | Scammers can take full control of your bank account |

Awareness is the only solution. If something feels urgent or scary, take a pause and double-check.

Security Gaps in Financial Institutions

While big banks invest in cybersecurity, not all banks or NBFCs (non-banking financial companies) do. Smaller financial services often don’t have strong online safety systems. If their system gets hacked, customer details can be leaked.

Also, some apps don’t use two-step verification. That means if someone gets your password, they can directly enter your account.

Banks also delay in warning customers. A woman in Hyderabad lost ₹90,000 and said her bank took 3 days to respond. By then, the money was gone.

Stronger bank systems and faster customer support can reduce damage, but not all banks offer that level of service yet.

Rise of Mobile Banking Apps

Everyone wants fast, easy banking. That’s why mobile apps are booming. But more apps mean more entry points for fraudsters. Not all apps are safe. Some fake banking apps are available in app stores. Once you install them, they can steal your bank login, contacts, and even messages.

In 2023, over 2,000 fake financial apps were found online. Many had names similar to trusted banks, and people downloaded them, thinking they were official.

A 28-year-old from Pune lost ₹1,80,000 after entering his details into a fake loan app. He never even applied for a loan.

Apps should be downloaded only from official sources and updated regularly to fix security gaps.

Common Types of Online Banking Fraud

Phishing Scams

These scams often come through email or SMS. You may receive a message saying your bank account will be blocked if you don’t update your KYC. There’s a link in the message. It looks like a real bank page, but it’s fake.

Once you enter your details, scammers get your password and OTP. A Bengaluru teacher lost ₹95,000 this way after she clicked on a message that looked like it came from her bank.

Message Type | Usual Trick |

Email | Fake bank update or payment request |

SMS | KYC update or reward points link |

WhatsApp | Urgent account block message with a link |

Fake Banking Apps

Some scammers create apps that look just like official banking apps. These apps ask for your user ID, password, and even UPI PIN. Once you enter this, your account is fully exposed. These apps are often available on third-party app stores or through links shared on social media.

App Feature | What Makes It Dangerous |

Fake Login Page | Steals your ID and password |

Access to SMS | Reads your OTP messages |

Hidden Software | Runs in background and watches your activity |

A young man from Noida lost ₹1,20,000 through a fake “loan approval” app he downloaded after seeing an ad on Instagram.

Remote Access Scams

You get a call from someone claiming to be a bank officer or technician. They ask you to install an app like AnyDesk or QuickSupport to solve a problem. Once installed, they take full control of your phone and access your banking apps. A 62-year-old man from Kolkata lost ₹2,80,000 this way.

These fraudsters talk very calmly and sound professional. Many people trust them because they use banking terms and seem helpful.

Card Skimming

This mostly happens at ATMs or shops. A small device is fixed near the card slot, which copies your card details when you swipe. Some also use hidden cameras to record your PIN. Later, they clone your card and withdraw money. A Mumbai woman lost ₹60,000 after her card was skimmed at a petrol pump.

It’s hard to notice skimming devices as they look just like part of the machine. Always cover the keypad when entering your PIN.

Fake Customer Care Numbers

Many people search for bank helpline numbers on Google. Scammers post fake numbers online. When you call, they pretend to help but slowly ask for your personal and bank details. A retired officer from Pune lost ₹1,75,000 this way. He called a fake SBI number while trying to block his card.

Never trust numbers from random websites. Always check your bank's official app or website for contact details.

How to Protect Yourself from Online Banking Fraud?

You don’t need to be a tech expert to stay safe. Simple steps can keep your money protected:

- Never click on links from unknown SMS, email, or WhatsApp messages.

- Don’t share your OTP, UPI PIN, or password with anyone, not even people claiming to be from your bank.

- Always install banking apps from official apps like Google Play Store or Apple App Store.

- Use strong passwords like “MyBank@2024” instead of “123456” or your name.

- Check the URL before logging into any banking site. Real bank websites start with “https://” and show a lock symbol.

- Avoid using public Wi-Fi for banking. Use mobile data or a private connection.

- Call your bank directly through the number listed on its official website or app. Do not trust numbers you find through a quick Google search.

Online frauds are increasing daily. But you can protect your hard-earned money by being careful and taking small safety steps. Always think twice before clicking, sharing, or downloading anything related to your bank.

What to Do If You Suspect Fraud?

Online fraud can happen to anyone. Many people feel scared or ashamed when they realise they’ve been cheated, but staying silent makes things worse. Every minute counts once you spot something wrong in your bank account.

Act fast, whether it’s an unknown transaction or someone asking for your OTP. If reported early, banks can often stop the transfer or recover the money.

For example, a man from Chennai lost ₹70,000 in a UPI scam but managed to get it back because he reported it within 30 minutes. Don’t wait, and don’t feel embarrassed; fraudsters are clever, and you are not alone.

- First, call your bank’s official helpline number immediately. Ask them to block your card or freeze your account to stop any more money from going out.

- Next, file a complaint on the National Cybercrime Portal – www.cybercrime.gov.in or dial the Cyber Helpline number, 1930. This number is open 24x7. If you report quickly, the police can track the transaction or block the fraud account.

- Note down all the details, when it happened, what messages or emails you received, and how much money was taken. Take screenshots if possible.

- Lodge an FIR at your nearest police station. Some police stations also have cyber cells that deal with digital fraud.

- Change your passwords immediately, not just your bank account, but also your email and mobile wallet logins.

- Keep checking your bank statement and SMS alerts. If more unauthorised transactions happen, report them right away.

- Alert your family members and friends too, especially older people. Share your story so they don’t fall into similar traps.

Many people have recovered their money by acting quickly. Even if you don’t get all the money back, stopping further damage is possible. Do not delay or ignore the signs, speak up and report it.

Conclusion

Online banking has made life easier, but it has also opened new ways for fraudsters to cheat people. With over ₹4,245 crore lost in 2024 alone, this is not something we can ignore.

But you can stay safe by following simple steps, be alert, don’t share your personal information, use strong passwords, and always double-check before clicking on any link. If something feels odd, act fast.

Call your bank, block your card, and report it to the cybercrime portal. Awareness is your strongest shield. Share what you know with your family and friends, especially the elderly, and help them stay safe too.

FAQs

1. What should I do if I click on a suspicious link?

Clear your browser history, run a full scan on your device, and do not enter any personal details. If you think your account might be affected, inform your bank.

2. Can I get my money back after online fraud?

Yes, in some cases. If you report it quickly to your bank and the cybercrime helpline (1930), they can stop or reverse the transaction.

3. Is it safe to use public Wi-Fi for online banking?

No. Avoid using public Wi-Fi. It is not secure, and hackers can easily steal your banking details.

4. Are all banking apps safe?

Only apps downloaded from the official app stores (like Google Play Store or Apple App Store) are safe. Do not download banking apps from third-party links or unknown sources.

5. Can someone hack my account just by knowing my phone number?

No, but if they trick you into sharing an OTP or password using your number, they can access your account. Never share these details with anyone.

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article