Top 7 Mistakes Entrepreneurs Make When Applying for a Business Loan

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Applying for a business loan is tricky. Many entrepreneurs make common mistakes that lead to rejection or extra costs. Avoid these errors to improve your chances of getting approved.

1. Weak Business Plan and Lack of Financial Planning

Many entrepreneurs fail to secure business loans due to poor planning. Banks need clear financial projections and detailed business plans. Without proper documentation, lenders cannot accurately assess risk. A weak plan shows a lack of preparation and business understanding.

Entrepreneurs often underestimate costs and overestimate revenue. They fail to include contingency funds for unexpected expenses. Poor cash flow planning leads to unrealistic projections. This creates doubt about the business's viability.

Example: Nitesh's Café Business Plan

Nitesh's unrealistic projections made banks reject his loan application immediately.

2. Ignoring Credit Score

Many entrepreneurs overlook their credit score when applying for business loans. Banks check personal credit scores to assess trustworthiness. A poor credit score signals financial irresponsibility. This leads to loan rejection or higher interest rates.

Read More – Is It Smart To Take A Business Loan For Expansion?

Entrepreneurs often have unpaid credit card bills or missed EMI payments. They assume business loans are separate from personal credit. This is a costly mistake. Banks view credit history as a predictor of future behaviour.

Example: Tushar's Credit Score Impact

Tushar's low credit score cost him ₹1,65,000 extra in interest over five years.

3. Submitting Incomplete Applications

Incomplete loan applications are a major reason for rejection. Banks need complete documentation to process loans efficiently. Missing documents delay the approval process significantly. Many entrepreneurs rush their applications without proper preparation.

Banks require specific documents like financial statements, tax returns, and business licences. Incomplete applications show a lack of seriousness and organisation. This creates negative impressions with lenders.

Example: Rahul's Application Journey

Rahul's incomplete applications cost him ₹4,500 extra and delayed his loan by two months.

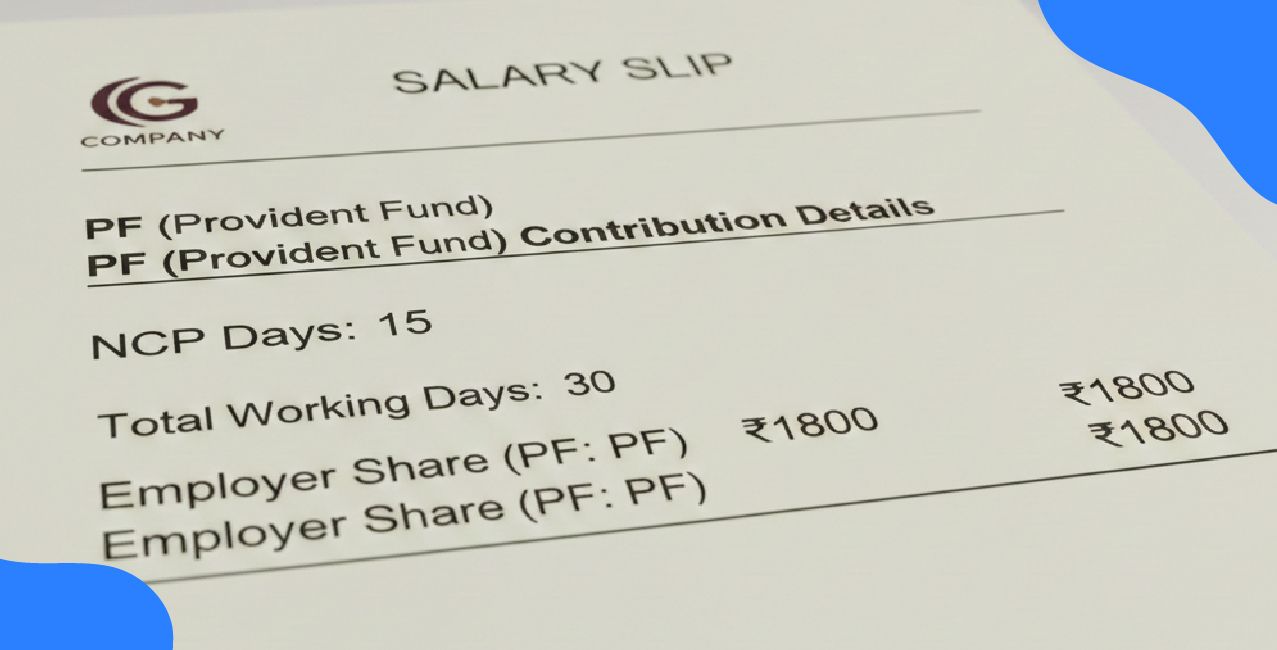

4. Choosing the Wrong Loan Type

Many entrepreneurs select inappropriate loan types for their business needs. Different loans serve different purposes and have varying terms. Choosing wrongly leads to higher costs and repayment difficulties. Banks offer term loans, working capital loans, and equipment financing options.

Understanding loan features is crucial before applying. Term loans suit long-term investments, whilst working capital loans help with daily operations. Equipment loans have lower rates but restrict fund usage.

Example: Yogesh's Loan Type Comparison

Yogesh chose a working capital loan instead of an equipment loan, paying ₹59,756 extra in total cost.

5. Overlooking Loan Terms and Conditions

Many entrepreneurs focus only on loan amounts and interest rates. They ignore crucial terms and conditions in loan agreements. Hidden charges and penalties can significantly increase borrowing costs. Processing fees, prepayment charges, and late payment penalties are often overlooked.

Reading loan documents carefully prevents unpleasant surprises later. Understanding repayment schedules and default consequences is essential. Some loans have variable interest rates that change over time. Collateral requirements and personal guarantees also affect borrowers significantly.

Also Read - Business Loan or Line of Credit – Best Financing for Small Businesses

Example: Yash's Loan Cost Breakdown

Yash applied for a ₹15,00,000 business loan at an 11% interest rate for 4 years. He focused only on the monthly EMI of ₹38,926 but ignored additional costs.

Hidden Costs Yash Discovered:

- Processing fee: ₹45,000 (3% of loan amount)

- Documentation charges: ₹5,000

- Insurance premium: ₹18,000 annually

- Late payment penalty: ₹500 per day after the due date

- Prepayment charges: 2% if repaid early

Total unexpected costs: ₹1,22,000 over loan tenure

Yash's actual borrowing cost became 13.2% instead of the advertised 11%, costing him ₹1,22,000 extra.

6. Not Comparing Loan Offers

Many entrepreneurs accept the first loan offer they receive. This is a costly mistake that can lead to higher interest payments. Different banks and lenders offer varying terms and conditions. Shopping around helps find better deals and saves money significantly.

Interest rates, processing fees, and repayment terms differ between lenders. Some banks offer special schemes for new businesses. Government-backed loans often have lower rates than private lenders. Comparing at least three offers is essential before making decisions.

Example: Jay's Loan Comparison

Jay needed ₹8,00,000 for his textile business expansion.

Jay saved ₹88,464 by comparing offers instead of accepting the first one.

7. Lack of Collateral or Proper Repayment Planning

Many entrepreneurs fail to secure adequate collateral for business loans. Banks require security to minimise lending risks. Without proper collateral, loan applications face immediate rejection. Property, equipment, or fixed deposits serve as common collateral options.

Poor repayment planning is equally damaging. Entrepreneurs often overestimate their ability to repay loans. They fail to create realistic cash flow projections. Missing EMI payments damages credit scores and business reputation. Banks may seize collateral or take legal action against defaulters.

Example: Jatin's Collateral and Repayment Issue

Jatin applied for a ₹12,00,000 loan for his restaurant business. His collateral was insufficient, and repayment planning was poor.

Jatin's Situation:

- Loan amount required: ₹12,00,000

- Collateral offered: ₹8,00,000 (property value)

- Monthly revenue projected: ₹1,50,000

- Actual monthly revenue: ₹85,000

- Monthly EMI: ₹32,500

- Monthly expenses: ₹75,000

- Cash shortage: ₹22,500 per month

Result: Jatin defaulted after 6 months, losing his ₹8,00,000 property and facing legal action. His poor planning cost him his collateral and business reputation.

Conclusion

To get a business loan, avoid these mistakes: poor planning, bad credit, wrong loan type, and hidden costs. Compare offers, plan repayments, and prepare properly to succeed.

FAQs

1. Why is a good business plan important for a loan?

Banks need it to check if your business can repay the money.

2. Does my personal credit score affect my business loan?

Yes, a poor score can get your loan rejected or cost more.

3. Should I compare different loan offers before applying?

Yes, comparing helps you find cheaper and better deals.

Other Related Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article