Central Bank of India Customer Care Number — Quick Helpline & Support Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Central Bank is a well-known name in digital banking, providing innovative financial products with a focus on security and consumer convenience. Whether it's fast loans, effortless UPI transactions, or 24-hour assistance, IndusInd makes sure customers are never left stranded.

Let’s understand through Vikram how a customer executive helped him:-

Vikram, was a college lecturer, was preparing for his first international conference in Singapore. He decided to take some foreign currency from an ATM at the last minute, after booking his flights and packing his bags.

But tragedy struck: his Central Bank International Debit Card had been blocked after two failed PIN tries (due to his nervous fingers!). It was 11:30 p.m., and his flight was scheduled for 5 a.m.

He dialled his brother in a panic, and he said, *"Vikram, calm down and call Central Bank’s 24/7 helpline right now!"

Vikram called 1800 22 1911 (Central Bank's Toll-Free Customer Care).

How the Central Bank Saved the Day?

- Instant Verification

- Emergency Unblocking

- Reset his PIN remotely.

- Proactive Support.

By 1:30 AM, Vikram was back on track.

Why This Matters?

Mistake happens, but Central Bank's team responds quickly!

- 24/7 support from real customer care and not just bots.

- Zero-liability policy for fraud instances that are reported promptly.

- No lengthy process; the issue was fixed with a single phone call.

The Moral of the Story?

Note:- Always double-check your payments! Never share OTPs/CVVs—even if the caller claims to be from the bank. However, if something goes wrong, Central Bank's customer service (1800 22 1911) has your back.

That is why we at LoansJagat try to educate you as much as possible so that even if you get stuck, you know what to do next. So let’s dive into the blog to know more about the customer support of Central Bank.

Central Bank Of India Customer Care Numbers – Quick Summary Table

Detailed Central Bank Of India Customer Care Numbers by Service

a. General Customer Support

The Central Bank is one of India's most reputable financial organisations, serving millions of customers both domestically and internationally. Resolving consumer complaints promptly and effectively is of utmost importance due to the large number of customers. To ensure smooth service delivery and customer satisfaction, the Central Bank has established an efficient and responsive General Customer Support system.

The help lines address a wide range of banking demands, from basic savings account enquiries to mobile and internet banking concerns.

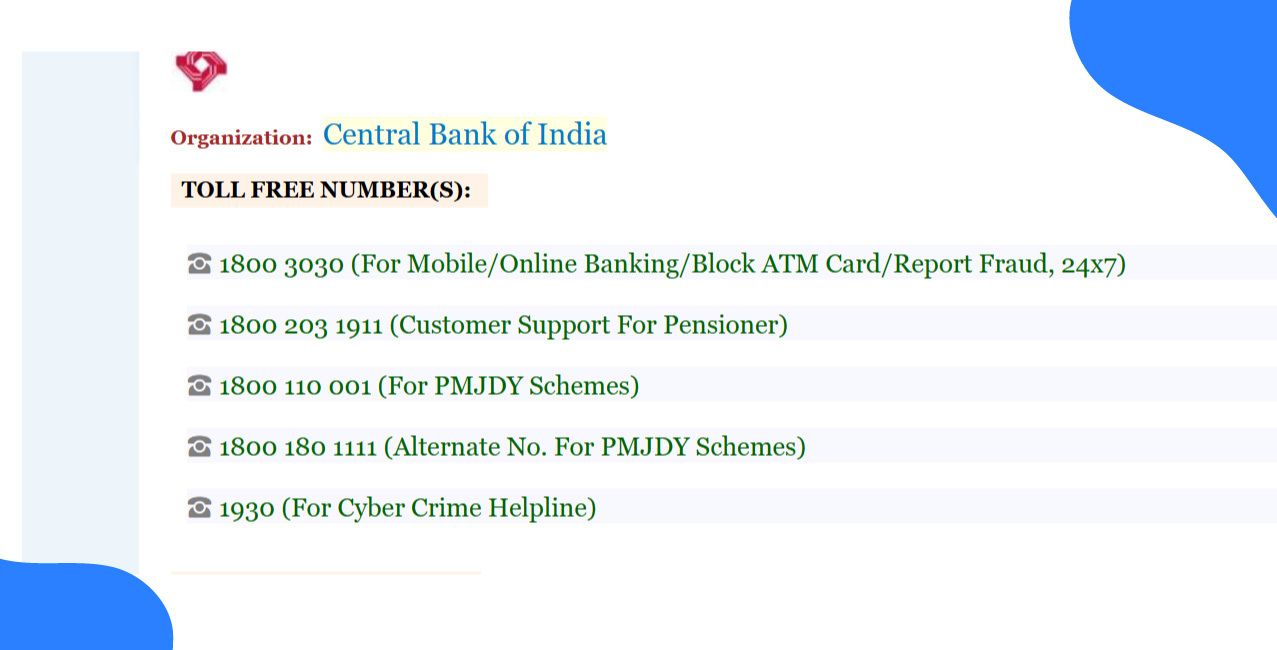

Toll-Free Central Bank Customer Care Numbers (Available 24x7)

Central Bank offers dedicated toll-free numbers to ensure that customers can access help anytime and from anywhere in India:

- 1800 3030

This number can be dialled from any mobile phone or landline across India without incurring any charges. Whether it’s a weekday or a public holiday, these lines are open 24x7, ensuring uninterrupted support.

When Should You Use These Numbers?

The general customer support numbers are meant to address an extensive number of customer issues and services. Here are some frequent scenarios in which you might need to reach out:

- Account Enquiries: If you want to check your balance, view recent transactions, or receive account statements.

- ATM Issues: If you need to block a debit card, request a PIN reissue, or report unsuccessful ATM transactions.

- Cheque Book Requests: If you want to request a new cheque book or enquire about an existing one.

- Digital Banking Help: If you need help with the Cent Mobile, online banking login issues, UPI-related questions, and more.

- Loan enquiries: Request information on personal loans, home loans, education loans, or auto loans.

- Service Status Updates: To follow up on previously reported complaints or service requests.

- Product Information: If you want to learn more about Central Bank's new services, fixed deposits, recurring deposits, and insurance solutions.

Even if you're not sure which department you require, the general support staff can help you immediately or direct you to the proper specialised support channel.

b. Central Bank Credit Card Customer Care

- 1800 3030

This number is available 24x7, including weekends and holidays. You can dial this number for assistance with your existing card or to get information on a new credit card application.

Card Activation, Billing Disputes & Limit Management.

Once you receive your new Central Bank credit card, it needs to be activated before use. You can call the customer care number to activate your card quickly, or use the mobile app or website.

For billing disputes, such as being charged for a transaction you didn’t authorise or a merchant charging twice, customer care will guide you through the dispute process. You may be asked to submit a dispute form, after which your case is investigated.

Customers can also request a credit limit increase — either temporary or permanent — by calling the helpline or submitting an online request. Eligibility is based on usage history, payment behaviour, and overall credit profile.

Lost Card Reporting & Replacement

If your credit card is lost or stolen, you must immediately report it to Central Bank to prevent misuse. The helpline team will instantly block the card and initiate the replacement process. The new card is typically delivered within 7 working days.

For urgent cases, you can also send an SMS typing BLOCK XXXX (last 4 digits of your card) to +91 99675 33228 from your registered mobile number.

c. Personal Loan & Home Loan Customer Care

The Central Bank is committed to providing seamless and customer-friendly support for all your loan-related needs. Whether you are applying for a personal loan or a home loan, our dedicated customer care team is here to assist you every step of the way.

Loan Application Tracking

Once you’ve applied for a personal or home loan, you can easily track the status of your application through our online portal or mobile app. Just log in using your registered credentials and navigate to the loan section. You can also contact our 24x7 customer care number for real-time updates on your application status.

EMI Queries:

Have questions about your EMI schedule, due dates, or interest rates? Our customer care executives are well-equipped to provide detailed information regarding your EMI structure, payment methods, and how to set up auto-debit options. You can also receive EMI statements via email or SMS upon request.

Foreclosure Requests

Planning to foreclose your loan? Central Bank offers a hassle-free foreclosure process. Reach out to our customer care team to understand the documentation required, outstanding balance, and any applicable charges. We aim to make the process quick and transparent for your convenience.

- For any queries, call our toll-free number 1800 22 1911 or visit your nearest Central Bank branch. Central Bank – with you all the way.

d. Central Bank NRI Customer Care

Central Bank understands the unique banking needs of its Non-Resident Indian (NRI) customers. To ensure a smooth and convenient banking experience, Central Bank offers dedicated NRI customer care services available across multiple channels and time zones.

International Helpline Numbers

The Central Bank has exclusive helpline numbers for NRIs living in key countries such as the USA, UK, Canada, Australia, UAE, and Singapore. These toll-free or local numbers connect you directly with NRI banking specialists who can assist with account queries, fund transfers, internet banking issues, and more. Global helpline: 1800 3030 (charges apply).

Email Support

NRI customers can reach out via email at General Queries: customercare@cboi.in and for NRI Services: helpdesknricell@centralbank.co.in for quick resolutions. Whether it's an inquiry about NRE/NRO accounts, remittance services, or fixed deposits, our team ensures prompt and personalised responses.

Callback Support

Prefer to talk at a convenient time? Central Bank offers a callback facility—just submit a request through the official Central Bank NRI Services website. Our representatives will get in touch with you as per your preferred time zone.

e. Emergency Services (Lost/Stolen Card, Fraud Report)

Central Bank prioritises your financial security. In case of a lost or stolen debit/credit card or suspected fraud, immediate action is crucial to prevent unauthorised transactions. Central Bank provides 24/7 emergency support to help you secure your accounts quickly.

Immediate Actions to Take

If your card is lost, stolen, or you notice suspicious activity, act immediately. Call Central Bank’s 24x7 helpline at 1800 22 1911 (toll-free) to report the issue. You can also use the Central Bank Cent Mobile or internet banking to block the card instantly.

Once you report the loss, the bank will promptly block the card to prevent further misuse. You will receive a confirmation email after your hotlisting has been successful.

Card Replacement:

After hotlisting, you can request a replacement card using one of the following methods:

- Cent Mobile Application

- Net Banking

- Visit the Nearest Branch.

Please be aware that the bank needs a written application from the cardholder to reissue the card. The replacement card will be the same version as the one that was reported missing.

Cyberfraud Reporting:

If you suspect malicious activity on your computer, please contact the National Cyber Crime Helpline at 1930 for immediate assistance.

Other Ways to Contact Central Bank Of India Customer Support

- WhatsApp Banking: Steps to activate and use

- Save the official Central Bank of India WhatsApp number: +91 63648 61866

- Send "Hi” to start the conversation.

- Save the official Central Bank of India WhatsApp number: +91 63648 61866

Follow the menu prompts to access services like:

- Account balance check

- Mini statement

- Cheque book request

- Card blocking

- Available 24/7 for registered mobile numbers

Email Support: Priority and general queries

- General banking queries: customerservice@centralbank.co.in

- Debit card issues: debitcard@centralbank.co.in

- Internet banking problems: netbanking@centralbank.co.in

- Loan-related queries: loans@centralbank.co.in

- NRI banking: nri@centralbank.co.in

SMS Banking: Common commands for quick tasks

Send SMS from your registered mobile number to 9967533228:

- BAL - Check account balance

- MINI - Get a mini statement

- LOST - Block your debit card

- CHEQUE - Check cheque status

- LOAN - Get loan details

(Standard SMS charges apply)

Chatbot/Live Chat via Central Bank of India website/app

Available through:

Official website: www.centralbankofindia.co.in (click 'Chat with Us')

- Cent Mobile App: Under the 'Help' section

- Services include:

- Instant account information

- Transaction dispute resolution

- Product details

- Complaint status

- Operational hours: 8 AM to 8 PM daily

Social Media: Twitter, Facebook handles

Twitter: @centralbank_in (Response time: 2-4 hours during business days)

Facebook: facebook.com/centralbankofindia (Response via Messenger within 6-8 hours)

Important: Never share account details on social media - only general queries are addressed here

Note: All digital banking services require your mobile number to be registered with the bank. For security reasons, always use official channels mentioned on the bank's website (www.centralbankofindia.co.in).

Central Bank Of India Grievance Redressal Process

The Central Bank Of India uses a three-tiered grievance redressal method to address consumer complaints in an effective, fair, and punctual way. Whether the problem is with loan repayment, disbursement, technical issues, or account access, the Central Bank Of India advises consumers to follow this procedure to ensure a successful resolution.

Level 1: Customer Support Team

If customers have any questions or concerns, they should first contact the Central Bank Of India customer service employees. Toll-free numbers are General Banking: 1800 22 1911, Credit Card Support: 1800 222 368, and NRI Banking: 1800 209 0061.

This is accessible for a variety of concerns, including loan application issues, repayment difficulties, delayed disbursement, KYC verification issues, and more. For a rapid resolution, please include your registered mobile number, a brief description of the problem, and any screenshots (if applicable).

Level 2: Nodal Officer details

Customers can escalate their issues to the Central Bank Of India's Nodal Officer if the response offered by the customer service representative is inadequate or if they have not answered within an acceptable time frame.

- Nodal Officer: Mr. Amitabh Gupta (Asst. General Manager)

- Email address:customercare@centralbank.co.in

- Response time: Within 5 business days.

When escalating, include the ticket ID or previous communication details as a reference.

Level 3: Banking Ombudsman escalation process

If your issue remains unsolved after 30 days of escalation to the Nodal Officer, you may file a complaint with the Reserve Bank of India's Integrated Ombudsman Scheme.

- Website address: https://cms.rbi.org.in.

- Category: NBFC Loan Complaints

- Supporting Documents: Include any email communication and ticket numbers.

This tiered approach ensures equitable treatment and adherence to the RBI's grievance redressal criteria.

Response timelines as per RBI guidelines

Response Timelines (as per RBI guidelines)

- Initial response: Within 7 working days

- Resolution timeline: Within 30 days of complaint registration.

The Central Bank Of India encourages customers to follow the escalation matrix to ensure fair and timely resolution.

Conclusion

Have a problem with the Central Bank? Don't worry, assistance is only a message away!

They can help you with any issue, whether it's a payment issue or a login issue.

For safety, only use platforms that have been confirmed. Fast action leads to fast results.

Want more assistance with smart money? Visit LoansJagat now.

FAQs on Central Bank Of India Customer Care

Does the Central Bank of India provide WhatsApp support for client complaints?

Yes, clients can use WhatsApp to file complaints or get assistance by messaging +91 63648 61866. This service provides quick communication for addressing complaints and gathering information.

Where can I obtain information about the bank's customer service policies?

The official website of the Central Bank of India contains information about its customer service policies, such as the Citizens Charter and the Code of Banks' Commitments to Customers. These documents describe the bank's commitment to providing fair and transparent services to its customers.

How do I report a failed transaction in an ATM, POS, UPI/IMPS, or online if my account was debited but the transaction did not proceed?

If you had a failed transaction in which your account was debited without a completed transaction, you can file a complaint using the Integrated Complaint Management System (ICMS) at https://icc.centralbank.co.in/cucms_cboi/docket/srbooking/srbooking/. In addition, you can email the facts to smatmreversal@centralbank.co.in or atmbo@centralbank.co.in for resolution.

Other Related Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Salaried vs. Self-Employed: Who Gets a Personal Loan Faster in 2025?

Too Many EMIs? What to Do When Monthly Payments Become Unmanageable

Post Office Customer Care Number: Helpline & Support

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article