How to Activate Net Banking in a Post Office – Step-by-Step Guide

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Key Insights

- You can use your net banking when you have an account in the Post Office.

- You can check your balance, transfer money, and pay bills from anywhere at any time through Net Banking.

- You can sign up for Post Office Net Banking online and offline, as mentioned below.

How to Activate Net Banking in a Post Office: Overview

If you have a Post Office Savings Bank (POSB) account, you can use India Post's internet banking services. These services let you transfer money between your own accounts or to other Post Office Savings Accounts.

Dev is a government employee who deposits money into your Public Provident Fund (PPF) and Sukanya Samriddhi Yojana (SSY) accounts, among other options.

This blog helps you understand the net banking services offered by the post office. Now, we will talk about the online and offline registration process of Post Office Net Banking.

Step-by-Step Guide to Activate Post Office Net Banking

You can sign up for India Post Payments Bank in person at your nearest post office or online through net banking.

Online Registration Method

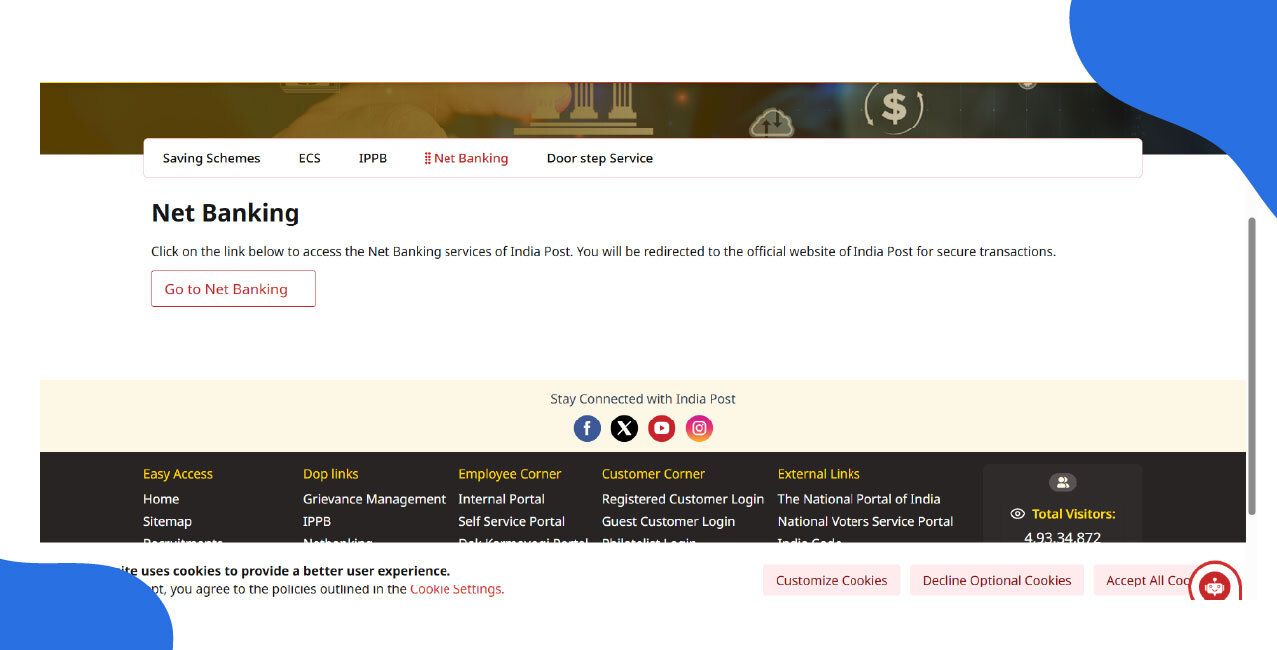

Step 1: Search on Google for Post Office Net Banking. (Click Here to Direct Link).

Step 2: Then click on the new users activation, then enter your Account ID and user ID. ( Click here to direct Link )

Step 3: Then enter your Registered phone number and enter the OTP.

Step 4: Set up the password. Users usually have to set security questions and sometimes set transaction limits.

Offline Registration Method

Step 1: Go to your local post office and bring your passbook, Aadhaar, and the mobile number you registered.

Step 2: Ask for the IPPB mobile banking activation form and fill it in.

Step 3: Give the filled form and your ID proof to the staff.

Step 4: After your request is processed, you will get a confirmation SMS.

Step 5: Download the IPPB app and set it up with your mobile number and OTP, as described before.

Complete the registration process to conveniently manage your digital post office savings account.

Read More - How To Reset SBI ATM PIN

How to Log in for the First Time?

Access your Post Office net banking account or reset your password easily online.

Step 1: Search on Google for Post Office Net Banking. (Click Here to Direct Link).

Step 2: Then Enter your Customer ID and Password. Click on Submit.

Step 3: Then OPT will be received on your Registered phone number, and enter the OTP and log in.

If you want to reset your password in Post Office Net banking, then follow these steps:

Step 1: Access the Post Office's net banking website and log in.

Step 2: Select 'Forgot Password'.

Step 3: Type in your user or customer ID.

Step 4: Press the "Submit" button. Answer the hint question.

Step 5: Click 'Submit' after logging in with the OTP that was sent to your registered email address.

Step 6: Create a new password.

Successfully log in or reset your password to manage your account securely. Next, we talk about common issues and activation.

Bonus Tip: If you want to add or change a nominee, you must submit a physical form (Form 2) at the post office branch where your account is held.

Common Issues During Activation & Solutions of Post Office Net Banking

You might run into problems like entering incorrect information or having trouble with OTPs when setting up Post Office net banking. Taking the right steps can help you solve these common issues and complete the setup.

Post Office Net Banking Services You Can Use

Learn More - How to Change UPI PIN?

If you follow the same steps that Akash used, you can quickly solve any activation issues and start using your net banking services.

With net banking, you can access your accounts at any time and handle important transactions easily and securely, no matter where you are.

- You can pay bills and transfer money with just a few clicks.

- Banking services are available around the clock, every day of the week.

- This gives you the convenience and flexibility to manage your finances on your own schedule.

- Reliable technology ensures your transactions are processed quickly and safely.

- You can enjoy banking without the usual hassles.

Customers now have total control over their banking at any time and from any location, thanks to this safe and effective technology.

Bonus Tip: Your User ID is typically your CIF ID or Customer ID, which is printed on your passbook. If you cannot find it, please visit your local post office branch to retrieve it.

Conclusion

This blog gives you comprehensive instructions on how to set up and use Post Office Net Banking, giving you safe, round-the-clock access to conveniently manage your transactions and savings account from any location.

FAQs

1. What is the difference between India Post Payments Bank (IPPB) and Post Office Savings Bank (POSB) net banking?

IPPB net banking is for IPPB accounts, while POSB net banking is for traditional savings accounts (like PPF, SSY, NSC). They have different websites and registration processes.

2. What is the daily transaction limit for fund transfers?

Transaction limits are set for security. For POSB net banking, the default limit is often ₹10,000 per day for third-party transfers, but this can be increased by submitting a form at the post office.

3. I have both POSB and IPPB accounts. Do I need separate logins for Net Banking in a Post Office?

Yes, POSB and IPPB are distinct systems. You will need separate user credentials to access Net Banking for a Post Office Savings Account and an IPPB account.

4. How can I change the mobile number registered with Net Banking in a Post Office?

To update your mobile number, you must physically visit your home post office branch with your passbook and proof of your new number (like Aadhaar). This cannot be done online.

Other Related Pages | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Canara Bank Net Banking: Unlock Seamless Digital Banking at Your Fingertips

J&K Bank Net Banking: A Smarter Way to Bank from Anywhere

Axis Bank Net Banking: How to Register, Login & Use Services

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article