Author

LoansJagat Team

Read Time

6 Minute

16 Jan 2025

NKGSB Net Banking – Convenient & Secure Online Banking Services

Imagine you are travelling to Jaipur for some work and your family needs money urgently, who lives in Haryana. You can’t come back immediately, so here comes the saviour—online transactions. You immediately send the money using net banking.

With a few clicks, you can manage all your financial transactions from within the confines of your house or office. NKGSB Bank's net banking platform is there to ease your financial life by bringing convenience, speed, and a whole suite of services available around the clock.

Here's everything you need to know about net banking at NKGSB Bank—from registration to login, password recovery, and essential banking features.

What is net banking?

Net banking is the facility wherein you can carry out all transactions with your bank via the Internet. It would encompass everything from transferring money to paying former dues and investment properties to track activities in the account, all made possible through Internet banking.

The NKGSB Bank net banking service allows you access to your account and banking anywhere, anytime.

Features of NKGSB Bank Net Banking

Feature | Description |

24/7 Accessibility | Manage your account anytime, anywhere. |

Fund Transfers | Transfer money via NEFT, RTGS, IMPS, or UPI quickly and securely. |

Account Management | Check your account balance, view transaction history, and download e-statements. |

Utility Payments | Pay electricity, water, phone, and other bills online. |

Investment Management | Open fixed deposits (FDs), recurring deposits (RDs), and manage mutual funds. |

Loan Services | Apply for loans and track EMI schedules. |

Card Management | Block/unblock debit or credit cards and set transaction limits. |

Secure Transactions | Enhanced security features to protect your financial information. |

Step-by-Step Guide to NKGSB Bank Net Banking

1. Net Banking Registration

To use NKGSB Bank’s net banking services, you need to register first. Follow these steps.

- Visit the NKGSB Bank website: Go to the official website (www.nkgsb-bank.com).

- Navigate to Internet Banking: Click on the “Digital Banking” tab and select “Internet Banking.”

- Accept Terms & Conditions: Click on “Accept and Proceed” to continue to the registration page.

- Click on Register: On the next page, select “Register for Personal Banking.”

- Choose a Registration Method: You can register using your debit card or customer ID. Select the appropriate option.

- Enter Your Details: Provide the required information to register, such as

- Customer ID (found in your passbook or account-opening documents)

- Account number

- Debit card details (card number, expiry date, CVV)

- Registered mobile number

- Customer ID (found in your passbook or account-opening documents)

- Set a Password: Create a secure password using a combination of uppercase and lowercase letters, numbers, and special characters.

- Verify with OTP: An OTP will be sent to your registered mobile number. Enter the OTP to verify your identity.

- Confirmation: After successful verification, you’ll receive a confirmation message or email.

Pro Tip: Keep all necessary documents, such as your debit card, customer ID, and mobile phone, handy to avoid interruptions.

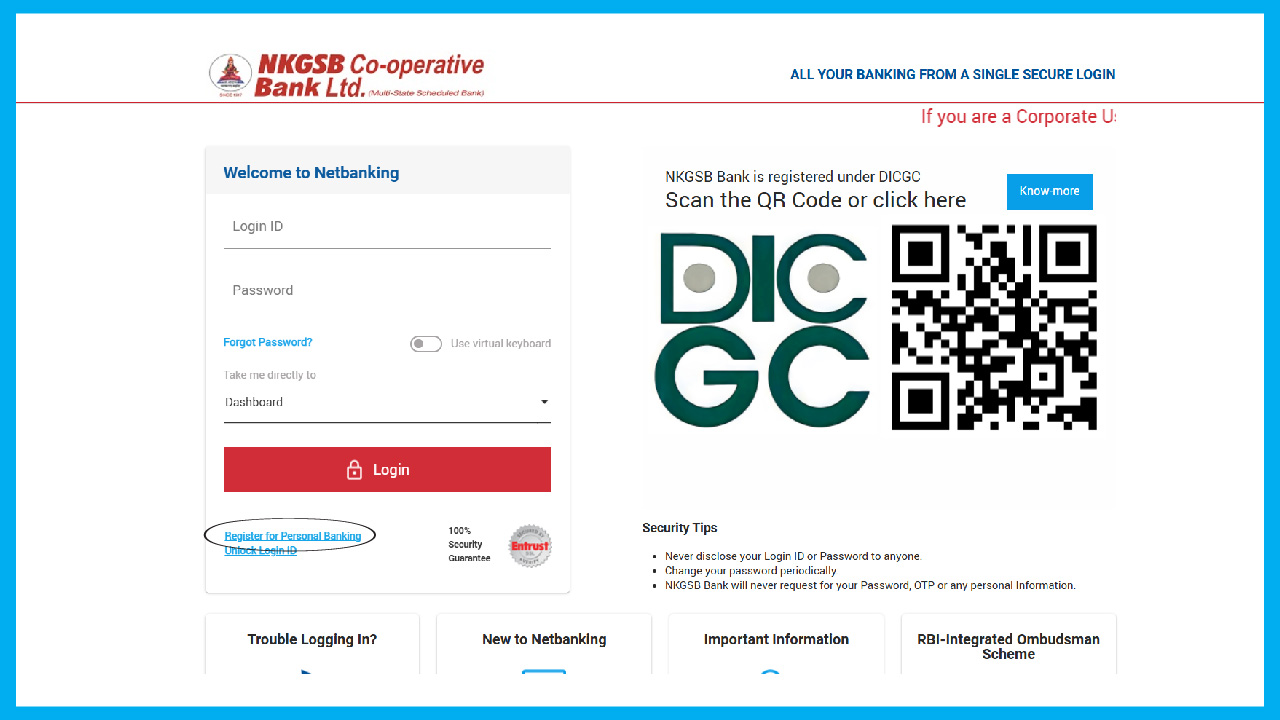

2. Net Banking Login

Once registered, logging in to your NKGSB Bank net banking account is a breeze. Here’s how:

Read More – TJSB Net Banking

- Visit the NKGSB Bank website: Open www.nkgsb-bank.com.

- Navigate to Internet Banking: Click on the “Digital Banking” tab and select “Internet Banking.”

- Proceed to Login: Click on “Accept and Proceed,” then click “Continue.”

- Enter Login Credentials: Provide your username, password, and captcha code.

- Click on Login: Access your account dashboard to start managing your finances.

Common Login Issues and Solutions

- Forgot Username: Use the “Forgot Username” option and provide details such as your debit card number and registered mobile number to retrieve it.

- Incorrect Password: Click on “Forgot Password” to reset it. Follow the instructions sent to your registered email or phone.

3. Resetting Your Net Banking Password

If you forget your password, follow these steps

- Go to the Home Page: Visit the NKGSB Bank website and navigate to the homepage.

- Navigate to Digital Banking: Locate and click on the “Digital Banking” section.

- Click on Internet Banking: Select the “Internet Banking” option.

- Proceed to Net Banking: Click on “Accept and Proceed to Net Banking.”

- Click Continue: On the next page, click on the “Continue” button.

- Forget Password: Click on the “Forget Password” option.

- Enter Login ID: Mention your login ID and choose the option to reset the password using either your customer ID or debit card details.

- Complete the Process: Follow the instructions to reset your password, and you will be able to access your account again with the new password.

4. Unlocking Your Login ID

If your login ID is locked, follow these steps

- Go to the Home Page: Visit the NKGSB Bank website and navigate to the homepage.

- Navigate to Digital Banking: Locate and click on the “Digital Banking” section.

- Click on Internet Banking: Select the “Internet Banking” option.

- Proceed to Net Banking: Click on “Accept and Proceed to Net Banking.”

- Click Continue: On the next page, click on the “Continue” button.

- Unlock Login ID: Click on the “Unlock Login ID” option.

- Enter Login ID: Enter your login ID and choose the option to unlock using either your Customer ID or Debit Card details.

- Complete the Process: Follow the instructions to unlock your login ID, and you’ll be able to log in again.

Key Services Offered by NKGSB Bank Net Banking

1. Account Management

- View account balances and transaction history.

- Download e-statements for a specific period.

2. Fund Transfers

- NEFT: Transfer large sums of money, processed in batches.

- RTGS: For high-value transactions above ₹2 lakhs.

- IMPS: Instant money transfer, available 24/7.

- UPI: Seamless transactions using UPI IDs or QR codes.

3. Bill Payments

- Pay electricity, water, gas, and other utility bills online.

4. Investment Services

- Open fixed deposits and recurring deposits.

- Invest in mutual funds or insurance policies.

5. Loan Management

- Apply for personal, home, or car loans.

- Track loan application status and EMI schedules.

6. Card Management

- Block/unblock debit or credit cards.

- Set transaction limits or request replacement cards.

7. Standing Instructions

- Automate recurring payments like EMIs, rent, or subscriptions.

Tips for Secure Net Banking

- Use Strong Passwords: Avoid using easily guessable information such as birthdays or names.

- Update Passwords Regularly: Change your password periodically for enhanced security.

- Avoid Public Wi-Fi: Use secure networks to access net banking.

- Enable Two-Factor Authentication: Add an extra layer of security to your account.

- Monitor Account Activity: Regularly review your account for unauthorized transactions.

Daily Transaction Limits and Charges

Transaction Type | Daily Limit | Charges |

NEFT | ₹1 lakh per transaction | ₹2 per transaction |

RTGS | ₹2 lakh and above | ₹5 per transaction |

IMPS | ₹50,000 per transaction | ₹1.50 per transaction |

Customer Support

For any issues or queries, contact NKGSB Bank’s customer care team

- Phone: 1800-123-4567

- Email: support@nkgsb.com

- Website: www.nkgsb-bank.com

Conclusion

Whether you transfer funds with a simple click of a mouse, pay bills, or apply for loans, net banking gives you that seamless experience at your fingertips.

Also Read - KJSB Net Banking

Follow this guide to enjoy all features and a secured banking experience. Visit the official NKGSB Bank website for more information and enter the world of effortlessly smooth banking.

FAQs Related to NKGSB Net Banking

1. Who is eligible for NKGSB net banking?

Any NKGSB account holder with a valid savings or current account can register for net banking.

2. Can I reset my password without visiting the branch?

Yes, you can reset your password online using your registered mobile number and debit card details.

3. What should I do if I forget my username?

Use the “Forgot Username” option on the login page. Enter your customer ID and other details to retrieve it.

4. Is net banking secure?

Yes, NKGSB net banking employs advanced encryption and security protocols. Ensure you use strong passwords and avoid accessing your account on public networks.

5. Are there any charges for using net banking?

Basic services like account management and fund transfers are free. However, certain services like NEFT or RTGS may have nominal fees.

6. How do I block my debit card online?

Log in to your account, go to the “Card Management” section, and select the “Block Card” option.

Other Net Banking Services | |||

About the Author

LoansJagat Team

‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Quick Apply Loan

Subscribe Now

Related Blog Post