City Union Bank Net Banking: How to Register, Login & Use Services

Check Your Loan Eligibility Now

By continuing, you agree to LoansJagat's Credit Report Terms of Use, Terms and Conditions, Privacy Policy, and authorize contact via Call, SMS, Email, or WhatsApp

Internet banking is becoming popular in India. Today, 295.5 million are using digital banking and every year, this figure goes up by 20%-25%. Online banking has become trusted by more and more people.

Isn't that interesting? These statistics show that Internet banking in India is fast picking up and is becoming highly integrated.

One such example is City Union Bank (CUB), which provides net banking. This facility provides online banking facilities to its customers.

Thus, the bank account can be accessed at any point in time and from any place without actually going to the bank. It's safe and easy to manage money. One can easily view his or her balance, see past transactions, and perform much more work related to banking 24/7 from home.

What is City Union Bank?

City Union Bank was started on 31st October 1904, at Kumbakonam, Tamil Nadu, under the name Kumbakonam Bank. The bank, which had a humble beginning serving the population of Thanjavur, became strong and had a keen interest in service by ensuring the safekeeping of the funds of customers, raising money for people, loans to customers, accepting remittances for others, and paying them to whomever customers desired.

City Union Bank's vision is to be a trusted partner, helping customers in their financial growth and contributing responsibly to the economy.

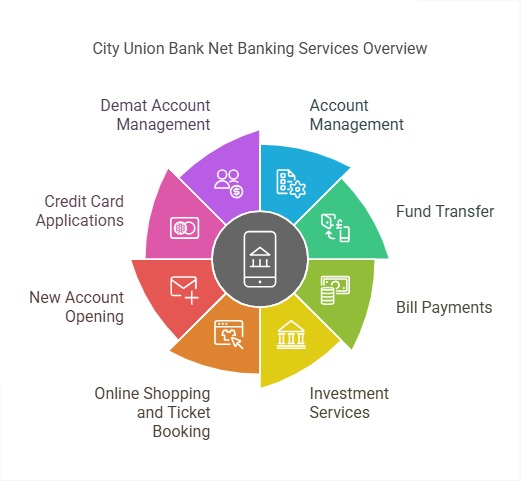

Services offered by City Union Bank Net Banking

Here’s the table of various services offered by City Union Bank Net Banking

Service | Description |

Account Management | Check balance, transaction history, and statements. Update address and phone number. Download statements. |

Fund Transfer | Transfer funds within City Union Bank and to any other Indian bank via IMPS, RTGS, NEFT, UPI. |

Bill Payments | Pay credit card bills and utility payments, and set up recurring payments. |

Investment Services | Manage fixed and recurring deposits, invest in the stock market, and open a Demat account. |

Online Shopping and Ticket Booking | Book air, bus, and rail tickets, and shop online. |

New Account Opening | Open savings, loan, PF, or pension accounts. |

Credit Card Applications | Apply for a credit card online. |

Demat Account Management | Manage your Demat account for securities trading. |

Tax Payments | Pay taxes, file income tax e-filing, and view Form 26 AS. |

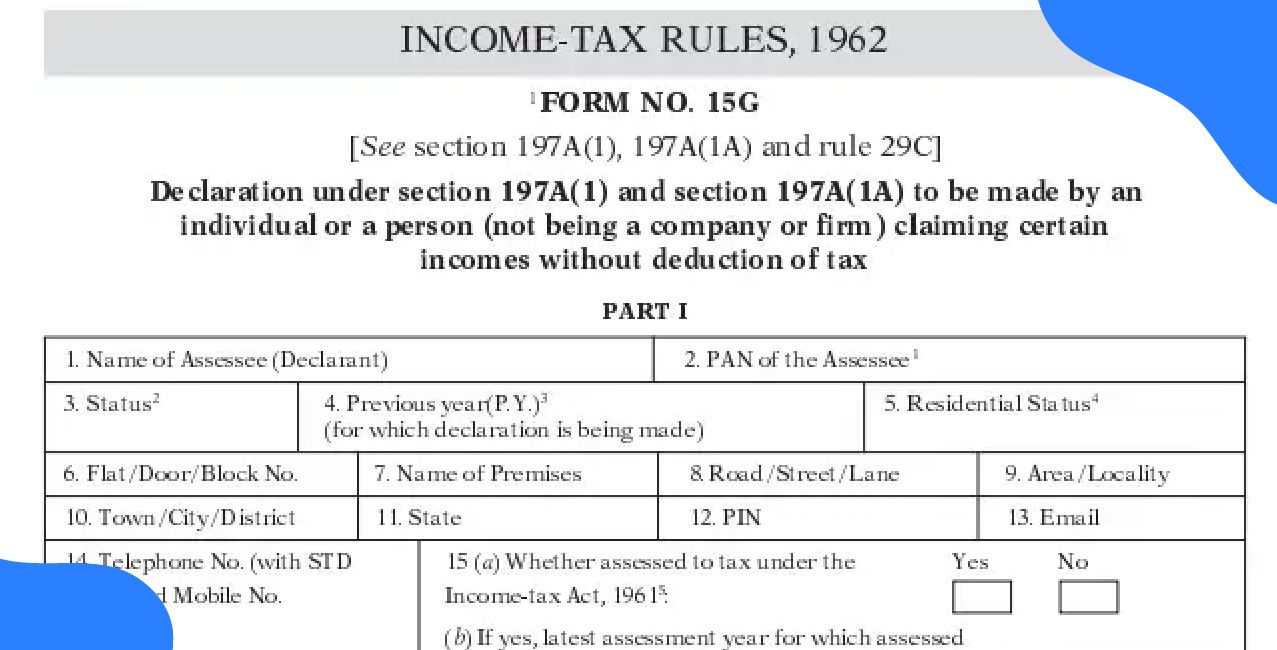

Form 15G/H | Fill up and submit Form 15G/H. |

Deposits and Loan Against Deposits (LAD) | Deposit money and avail loans against them. |

How to register in City Union Bank Net Banking

City Union Bank allows customers to register either offline or via the mobile app for their net banking services.

How to register for City Union Bank Net Banking via Branch:

Step 1: Visit your nearest branch.

Read More – City Union Bank Balance Check Number

Step 2: Fill in the Application Form carefully, Enter your valid phone number, Email ID, & Address.

Step 3: Submit the application form along with all the required documents.

Step 4: You’ll receive your ‘Login ID’ on your registered mobile number, & ‘Transaction Password’ will be sent to your address.

How to register for City Union Bank Net Banking via App

Step 1: Download City Union Bank’s app ‘CUB All in One Mobile App’ from Google Play Store or Apple Play Store.

Step 2: Locate ‘Set/Reset MPIN’ and click on it.

Step 3: Click on ‘I don’t have ATM Card’ and enter your details (like Customer ID, Branch, DOB, PAN No).

Step 4: Under Facilities Required tick on all 3 options (Login Password, Transaction Password, & MPIN).

.jpeg)

Step 5: Click on Submit.

Step 6: Enter OTP received on your registered mobile no & registered Email Id. Now click on Submit.

Step 7: Set MPIN & click on Submit.

Once you are registered on city union bank’s app, here’s how you can log into the app.

- Download City Union Bank’s app ‘CUB All in One Mobile App, from the Google Play Store or Apple Play Store.

- In the next step, enter your Customer ID & MPIN, and click on Login.

How to log into your City Union Bank Net Banking

Step 1: Visit the official website of the City Union Bank.

Step 2: Locate ‘Login’ on the top right corner of the page & click on it.

Step 3: Once you click on the ‘Login’ button, a menu will pop up under it. Click on ‘Personal Banking’ for Personal or ‘Corporate Banking’ for corporate net banking.

Step 4: On the login page, enter your ‘User ID’ & click on Continue.

Step 5: Now enter your ‘Login Password’ & click on ‘Login’.

You are now logged into your City Bank Net Banking.

Disclaimer: If you don't remember your USER ID, then call the customer care of City Union Bank (04471225000). Or, you can find the message when you register your account in the City Union Bank. That message will contain your USER ID and password for login.

Steps to reset your Login Password for City Union Bank Net Banking

Step 1: Visit the official website of the city union bank.

Step 2: Locate ‘Login’ on the top right corner of the page & click on it.

Step 3: Once you click on ‘Login’ button, a menu will pop-up under it, click on ‘Personal Banking’

Step 4: On the login page click on ‘Set/Reset Password’ under the Forgot User ID.

Step 5: On the next page, fill in the details (like customer ID, Branch).

Step 6: Select ‘I don’t have a debit card’ , if you don’t have a Debit card, and enter your DBO & PAN Number.

Step 7: Locate Facilities Required & tick on all three options under it ‘Login Password’, ‘Transaction Password’, & ‘MPIN’, and click on Continue.

Step 8: Enter the OVD ID received on your registered mobile number & registered Email ID, and click on ‘Continue’.

How to transfer funds via City Union Bank Net Banking

You can transfer funds through NEFT, RTGS, or IMPS via City bank net banking.

Here’s a step-by-step process on how to transfer funds.

Step 1: Visit the official website of City Union Bank Net Banking.

Step 2: Log into your City Union Bank net banking account (the step-by-step login process is mentioned above in the blog; you can go there and check it).

Step 3: Click on the ‘Fund Transfer’ button & select the account from which you want to transfer the money.

Step 4: If you haven’t added a beneficiary, then click on ‘Add Beneficiary’ located under Manage Beneficiary.

Step 5: Enter the beneficiary’s details carefully.

Also Read - City Union Bank Current Account

Step 6: Now select the mode of transfer (such as NEFT/RTGS/IMPS).

Step 7: Enter the amount you need to transfer & add a remark.

Step 8: Enter your ‘Transaction Password’ to complete the transaction.

Charges on transferring funds via City Union Bank

Here is the information about charges for transferring funds via City Union Bank net banking in a table format:

Payment Method | Maximum Transaction Value | Maximum Number of Transactions per Day |

UPI (City Union Bank) | Rs. 1,00,000 | 10 transactions |

NEFT | Rs. 99,999 | No specific limit (depends on the bank) |

This table presents the details for both UPI and NEFT methods.

How to check City Union Bank’s account balance

- Give a missed call on (9278177444) from your registered mobile number.

Conclusion

City Union Bank has been in the business since 1904 and has offered several services to its customers. The bank has offered several services to its customers over the years. Net banking, mobile banking, and easy transfers of funds make managing your finances hassle-free. Check your balance, pay bills, or transfer money. Transactions are accessible through the City Union Bank website. It offers easy enrollment and use of passwords, so it also has a mobile application available, too. So if one needs an honest bank with many e-wallet services, perhaps one would consider opening an account with City Union Bank.

FAQs related to City Union Bank Net Banking

Q1: What is the Union Bank Net Banking app, and what does VYOM give?

VYOM provides facilities to its customers to see account balances and mini statements, transfer money through NEFT, IMPS, UPI, cheque stop, check cheque status, and find branches/ATMs. It is accessible 24/7.

Q2: Does City bank offer online banking?

Yes, Citibank provides both online and mobile banking with checking products and account services.

Q3. What is mobile phone banking?

Mobile banking is, in fact, the process of performing any financial transaction through a mobile device, like a cell phone or tablet.

Other Net Banking Services | |||

About the author

LoansJagat Team

Contributor‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Subscribe Now

Related Blog Post

Canara Bank Net Banking: Unlock Seamless Digital Banking at Your Fingertips

J&K Bank Net Banking: A Smarter Way to Bank from Anywhere

Axis Bank Net Banking: How to Register, Login & Use Services

Recent Blogs

All Topics

Contents

Quick Apply Loan

Consolidate your debts into one easy EMI.

Takes less than 2 minutes. No paperwork.

10 Lakhs+

Trusted Customers

2000 Cr+

Loans Disbursed

4.7/5

Google Reviews

20+

Banks & NBFCs Offers

Other services mentioned in this article