Author

LoansJagat Team

Read Time

5 Minute

27 Dec 2024

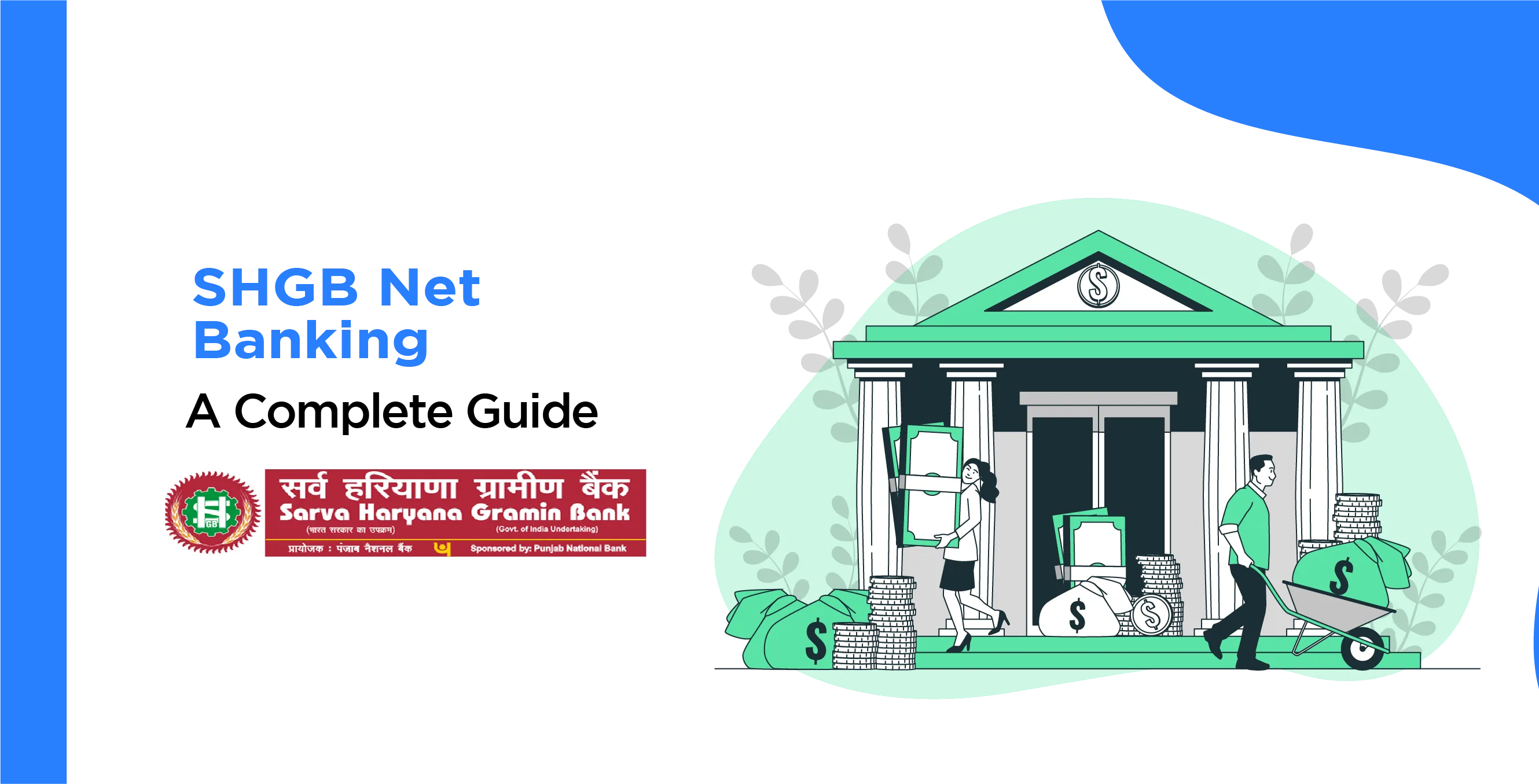

SHGB Net Banking - Complete Guide to Online Banking Services

The Reserve Bank of India's FI Index states that digital financial services have been major enablers of improving financial inclusion.

Among the services offered, credit, insurance, and investment have had lesser impacts on the financial inclusion process compared to the greater effect of digital payments. Thus, it can be noted that digital payment systems have become more important for facilitating access to financial services for many more people.

Sarva Haryana Gramin Bank (SHGB) offers net banking to make financial services accessible in rural regions. The main focus of the bank is offering safe savings options and loan options for homes, automobiles, and small-scale enterprises. This is done through self-help groups and ensuring complete financial inclusion in all the villages being served.

What is Sarva Haryana Gramin Bank?

Sarva Haryana Gramin Bank, also known as Haryana's Apna Bank, was created on 29 November 2013, when two banks—Haryana Gramin Bank and Gurgaon Gramin Bank—merged.

The bank’s goal is to provide easy and affordable banking services for everyone, especially farmers, workers, small business owners, women, and children. They aim to ensure no one is left without access to banking services, focusing on helping those who need it the most.

Features of SHGB Net Banking

Here are the features provided by SHGB Net Banking:

Feature | Description |

Secure Online Transactions | Perform all your online transactions safely and easily. |

Fund Transfer | Transfer funds using NEFT or RTGS. |

Balance Checking | Check your account balance anytime, from anywhere, 24/7. |

Opening Fixed/Recurring Deposit | Open fixed or recurring deposit accounts online. |

Utility Payments | Pay utility bills conveniently from the comfort of your home. |

How to Register for SHGB Net Banking

- Visit the official website of the SHGB.

- Locate ‘Net Banking’ on the right of the page in the white bar and click on it.

- On the next page, scroll down a bit and click on ‘Login Now’ in the red bar.

- On the login page, locate ‘New User?’ under User ID and click on it.

- On the next page, click on ‘Register with Debit Card’ on the top left of the page.

- Fill in the details (like Account Number, DOB, PAN Card Number, and Registration Type) and click on ‘Verify’.

- Enter the OTP received on your registered mobile number and click on ‘Continue’.

- Enter your Debit Card Number and ATM PIN, then click on ‘Continue’.

- Accept the terms and conditions, and click on ‘Complete Registration’.

Now, you have been registered for Sarva Haryana Gramin Bank Net Banking.

How to Log into SHGB Net Banking

- Visit the official website of the SHGB.

- Locate ‘Net Banking’ on the right of the page in the white bar and click on it.

- On the next page, scroll down a bit and click on ‘Login Now’ in the red bar.

- On the login page, enter your User ID, Password, and Captcha, then click on ‘Login’ located in the yellow bar.

Now, you’re logged into your Sarva Haryana Gramin Bank Net Banking.

How to Register for SHGB Mobile Banking

- Download SHGB’s app ‘SHGB mBanking’ from the Google Play Store or Apple Play Store.

- Install the application on your device.

- Read the terms and conditions, and click on ‘I Agree’.

- Click on ‘New User’ located in the white bar.

- Enter your Account Number, select both ‘Transaction & View’ under Facility, and click on ‘Continue’.

- Enter the OTP received on your registered mobile number and click on ‘Continue’.

- Enter your debit card details (16-digit card number, PIN) and click on ‘Continue’.

Create your ‘Sign In Password’ and ‘Transaction Password’, then click on ‘Submit’.

Note: Create your passwords according to the guidelines provided in the app.- On the next page, click on ‘Sign In’.

Now, you’re successfully registered for Sarva Haryana Gramin Bank Mobile Banking.

How to Log into SHGB Mobile Banking

- Download SHGB’s app ‘SHGB mBanking’ from the Google Play Store or Apple Play Store.

- Install the application on your device.

- Read the terms and conditions, and click on ‘I Agree’.

- Enter your ‘User ID’ and ‘Password’, then click on ‘Sign In’ located in the orange bar.

Now, you’ve successfully logged into Sarva Haryana Gramin Bank Mobile Banking.

How to Transfer Funds via SHGB Net Banking

- Visit the official website of the SHGB.

- Log into your SHGB’s net banking account (refer to the step-by-step process mentioned above).

- Select ‘Fund Transfer’.

- Choose ‘NEFT’ for transferring funds.

- Enter the recipient’s bank account details (including the account number, name, and IFSC Code).

- Submit the request.

How to Add Payee via SHGB Mobile Banking

- Download SHGB’s app ‘SHGB mBanking’ from the Google Play Store or Apple Play Store.

- Log into the app (refer to the step-by-step process mentioned above).

- Click on ‘My Payee’ at the top of the page and click on it.

- Click on ‘+ Add new payee’ on the top right corner of the page.

- Click on ‘Same Bank’ if adding an account within the same bank, or ‘Other Bank’ for accounts in different banks.

- Fill in the payee’s details (e.g., name, nickname, account number, transaction type, IFSC code) and click on ‘Add Payee’.

- Enter your ‘Transaction Password’ and click on ‘Confirm’.

This is how you can add a beneficiary. You’ll receive a reference number for your payee.

How to Transfer Funds via SHGB Mobile Banking

- Download SHGB’s app ‘SHGB mBanking’ from the Google Play Store or Apple Play Store.

- Log into the app (refer to the step-by-step process mentioned above).

- Click on ‘Transaction’ at the top of the page.

- Click on ‘New Transfer’ at the top of the page.

- Fill in the details (e.g., transaction type, account numbers for both sender and recipient, amount, and remarks).

- Enter your Transaction Password and click on ‘Pay’.

Limits on Transferring Funds via SHGB Mobile Banking

Here’s the information about limits on transferring funds via SHGB mobile banking:

Mode | Transaction Limit |

IMPS | ₹5 lakh per day |

NEFT | ₹5 lakh per day |

Intra-Bank | ₹5 lakh per day |

Self - Linked Accounts | ₹5 lakh per day |

Quick Pay (without payee) | ₹10,000 per transaction, Max 3 transactions/day |

Conclusion

SHGB offers convenient and secure digital banking services through both net banking and mobile banking. These services come with features such as fund transfers, balance checking, and utility bill payments. Moreover, the bank's mobile and net banking platforms offer transaction limits, ensuring safe and controlled usage. SHGB's focus on access supports financial inclusion, especially in rural areas.

FAQs related to SHGB Net Banking

Q1: How much is the minimum balance requirement for the SHGB savings account?

There is no minimum balance requirement for opening and maintaining an SHGB savings account. You may even open it with zero balance.

Q2: Is bank transfer and net banking the same?

Net banking is the whole lot of online banking, offering a long list of services including checking of balances and other transaction services. A bank transfer, on the other hand, refers to a certain type of transaction under net banking.

Q3: How long does it take to transfer through net banking?

In a normal NEFT payment, it takes nearly two hours for the amount to get credited to the account of the beneficiary. It may sometimes take more than the normal time.

Other Net Banking Services | |||

About the Author

LoansJagat Team

‘Simplify Finance for Everyone.’ This is the common goal of our team, as we try to explain any topic with relatable examples. From personal to business finance, managing EMIs to becoming debt-free, we do extensive research on each and every parameter, so you don’t have to. Scroll up and have a look at what 15+ years of experience in the BFSI sector looks like.

Quick Apply Loan

Subscribe Now

Related Blog Post